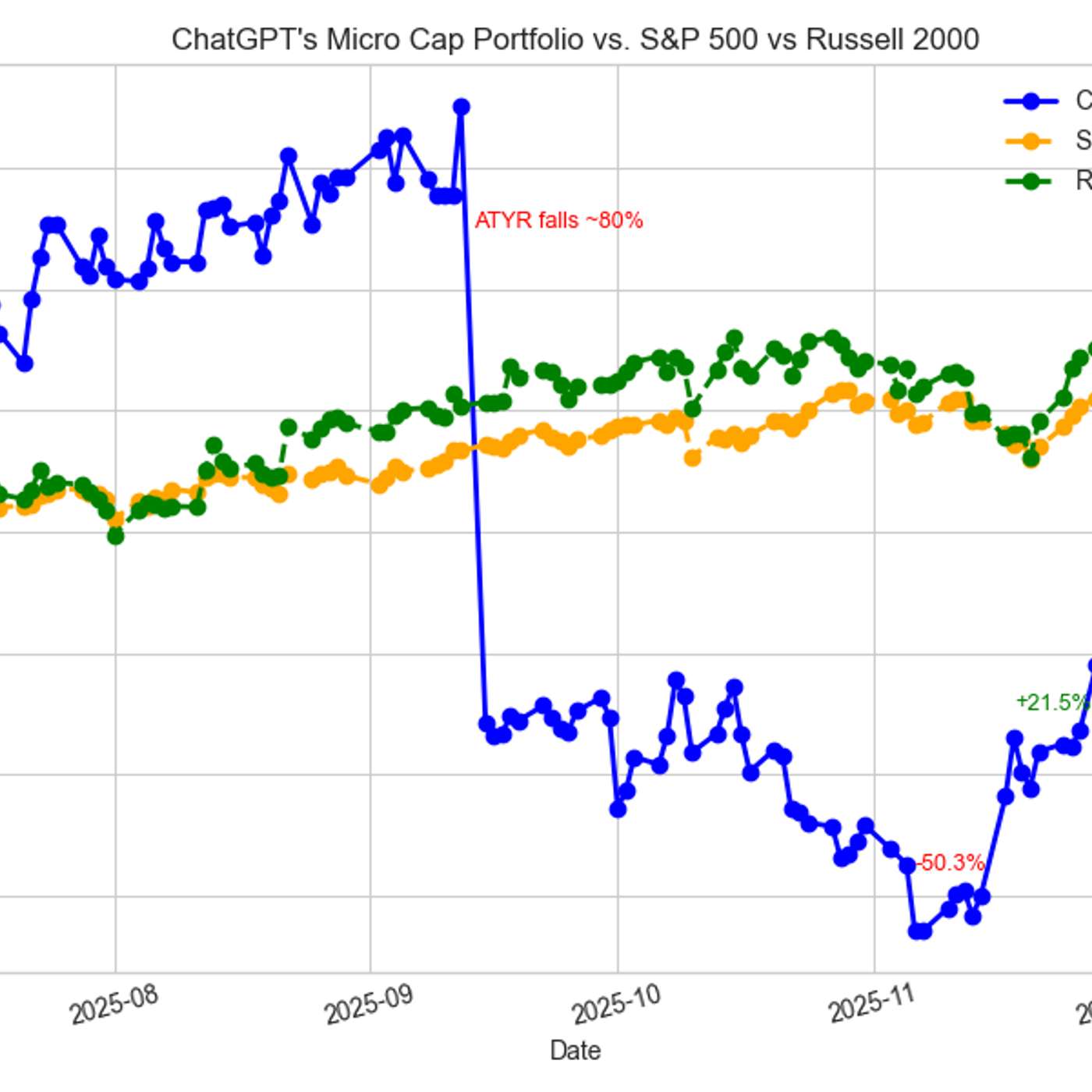

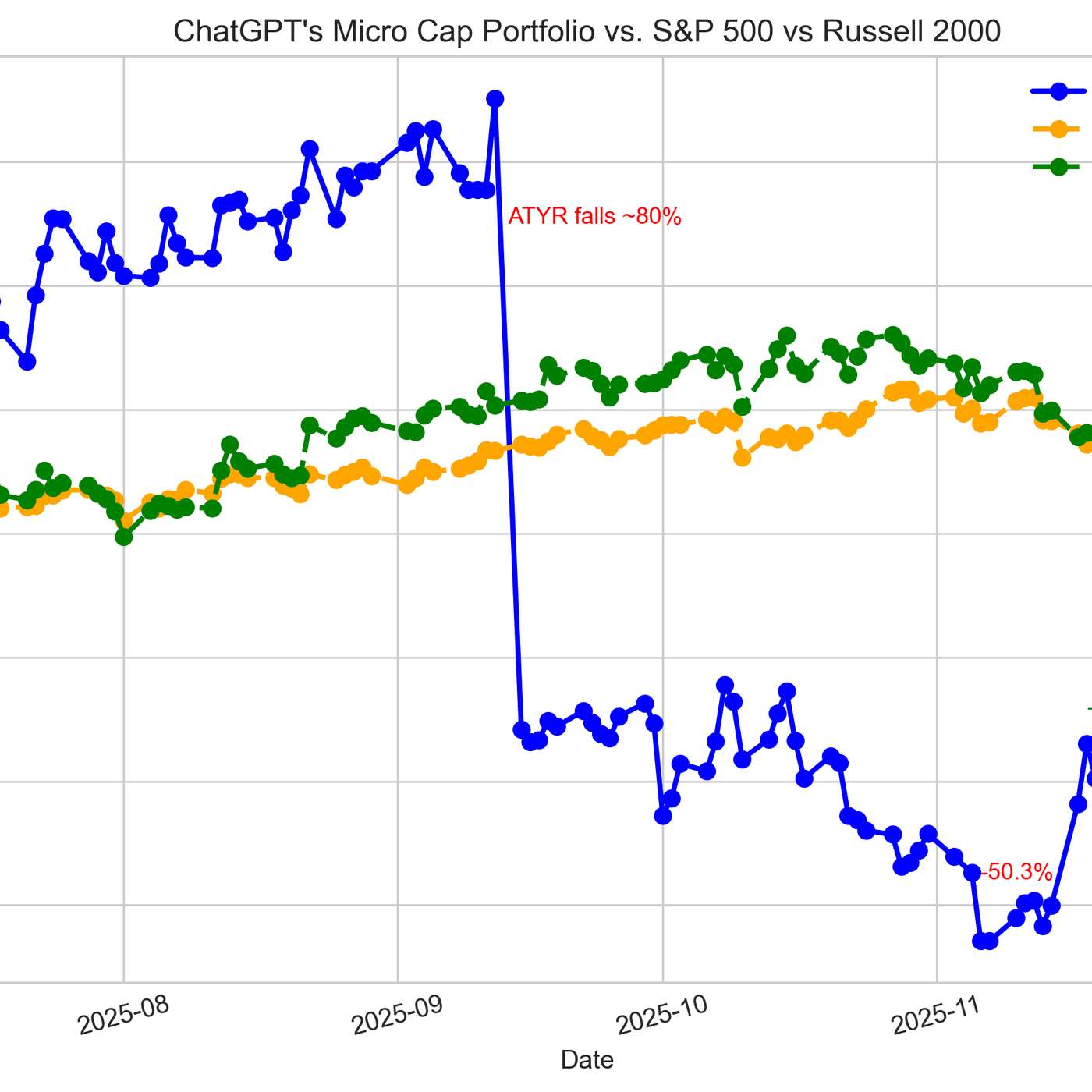

A six-month experiment concluded with a ChatGPT-managed portfolio valued at $82.88, a significant loss. This contrasts sharply with a benchmark S&P 500 investment, which would have grown to $111.68 in the same period. The AI's strategy resulted in a -50.33% max drawdown and negative alpha, highlighting its current inability to generate returns in volatile micro-cap stocks.

Related Insights

Many macro funds, especially quantitative ones, are facing headwinds because their models are optimized for trending markets. The current choppy, volatile environment lacks the long, clean trends seen in previous years, leading to performance dispersion across the industry.

Active managers are struggling against the S&P 500 not just from bad picks, but because the market is dominated by a few AI stocks they can't fully concentrate in. Many also became too defensive during April's volatility, causing them to miss the subsequent sharp market rebound.

Ken Griffin is skeptical of AI's role in long-term investing. He argues that since AI models are trained on historical data, they excel at static problems. However, investing requires predicting a future that may not resemble the past—a dynamic, forward-looking task where these models inherently struggle.

Despite a long-standing data-science-driven investment thesis, Foresight Capital's founder Jim Tananbaum states that AI tools have not yet objectively led to increased investment returns. The technology is still maturing, highlighting a reality gap between the hype around AI in VC and its current practical impact.

Data over the last decade shows that 97% of professional stock pickers, despite their resources, fail to beat a basic market index. Ambitious individuals often fall into the trap of thinking they're the exception. The most reliable path to market wealth is patient, consistent investing in low-cost index funds.

A key challenge of adopting ML in investing is its lack of explainability. When a traditional value strategy underperforms, you can point to a valuation bubble. An ML model can't offer a similar narrative, making it extremely difficult to manage client relationships during drawdowns because the 'why' is missing.

After the initial experiment with a broad set of micro-cap stocks failed, the project is pivoting to a more defined universe: new IPOs from the last five years. This change, based on viewer feedback, aims to better encapsulate a high-risk, high-reward strategy without being a pure "game of chance," indicating a more mature approach to experimental design.

AI models can predict short-term stock prices, defying the efficient market hypothesis. However, the predictions are only marginally better than random, with an accuracy akin to "50.1%". The profitability comes not from magic, but from executing this tiny statistical edge millions of times across the market.

Advanced AIs, like those in Starcraft, can dominate human experts in controlled scenarios but collapse when faced with a minor surprise. This reveals a critical vulnerability. Human investors can generate alpha by focusing on situations where unforeseen events or "thick tail" risks are likely, as these are the blind spots for purely algorithmic strategies.

Nearing the end of a six-month experiment, the ChatGPT-managed portfolio pivoted from high-risk, single-catalyst bets to a balanced, risk-controlled setup. The primary goal is now to preserve gains and limit downside, demonstrating a dynamic strategy that adapts to the experiment's timeline.