After the initial experiment with a broad set of micro-cap stocks failed, the project is pivoting to a more defined universe: new IPOs from the last five years. This change, based on viewer feedback, aims to better encapsulate a high-risk, high-reward strategy without being a pure "game of chance," indicating a more mature approach to experimental design.

Related Insights

Unlike the 2020-2022 bubble, the expected wave of biotech IPOs features mid-to-late-stage companies with de-risked assets. The market's recent discipline, forced by a tough funding environment, has created a backlog of high-quality private companies that are better prepared for public markets than their predecessors.

The current AI boom isn't just another tech bubble; it's a "bubble with bigger variance." The potential for massive upswings is matched by the risk of equally significant downswings. Investors and founders must have an unusually high tolerance for risk and volatility to succeed.

The project's true value is evolving beyond simple profit and loss. The creator is now developing a dedicated benchmarking tool, noting its new direction is "far more important and less explored in the LLM trading ecosystem." This suggests the primary output is not alpha, but rather foundational tooling and infrastructure for the emerging field of AI-driven finance.

AI tools drastically reduce the time and expertise needed to enter new domains. This allows startups to pivot their entire company quickly to capitalize on shifting investor sentiment and market narratives, making them more agile in a hype-driven environment where narrative alignment attracts capital.

Investing in the world's top AI research teams carries a unique risk profile. While the business outcome has high variance, the capital risk is asymmetric. The founders are so valuable that an acqui-hire is a highly probable outcome, creating a floor on the investment's value.

In a new technological wave like AI, a high project failure rate is desirable. It indicates that a company is aggressively experimenting and pushing boundaries to discover what provides real value, rather than being too conservative.

With 65% of today's winning companies being less than three years old, VCs are focusing their attention on these newer, high-growth AI startups. Older, non-rocketship portfolio companies are being ignored, a stark shift from previous cycles where investors would try to fix them.

The increased volatility and shorter defensibility windows in the AI era challenge traditional VC portfolio construction. The logical response to this heightened risk is greater diversification. This implies that early-stage funds may need to be larger to support more investments or write smaller checks into more companies.

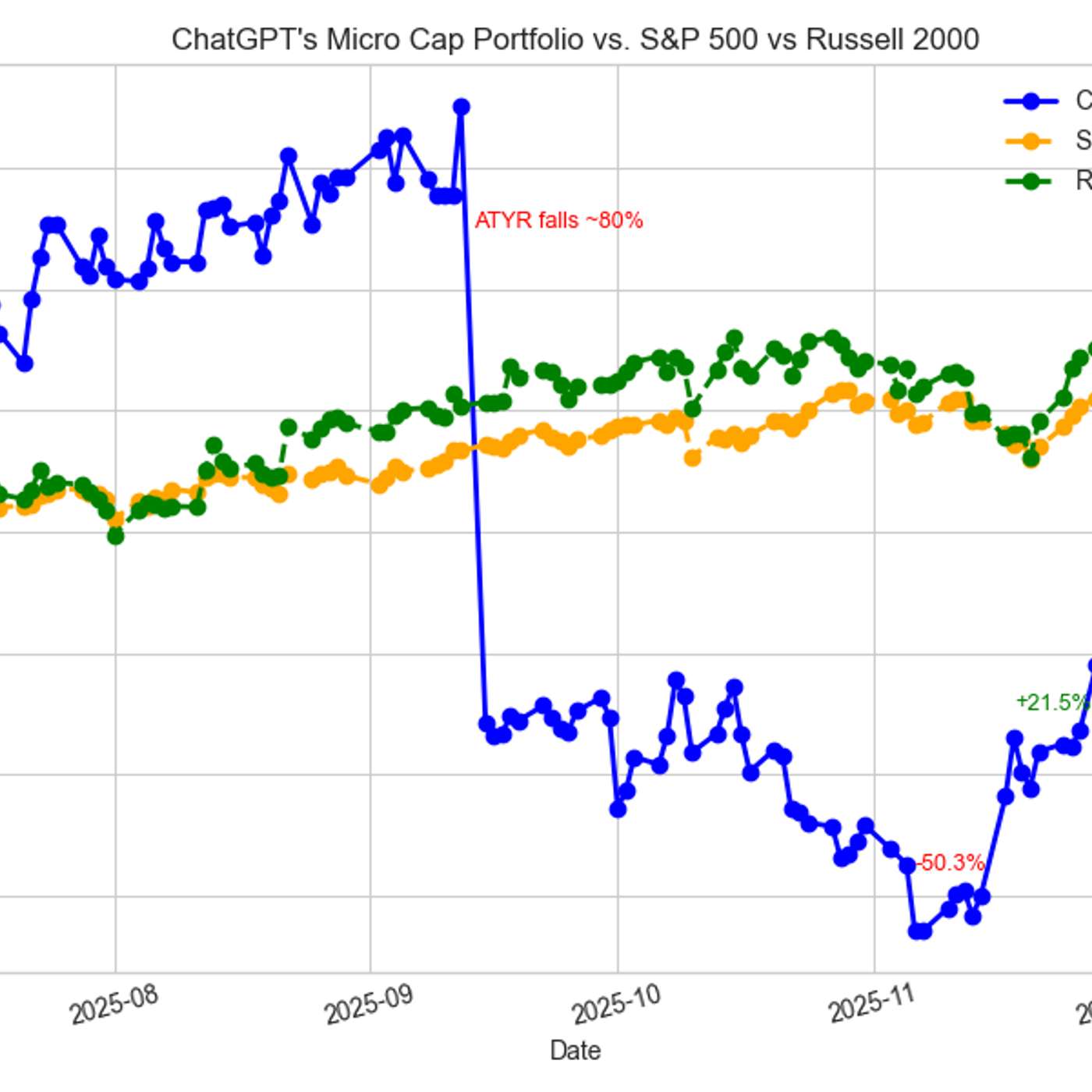

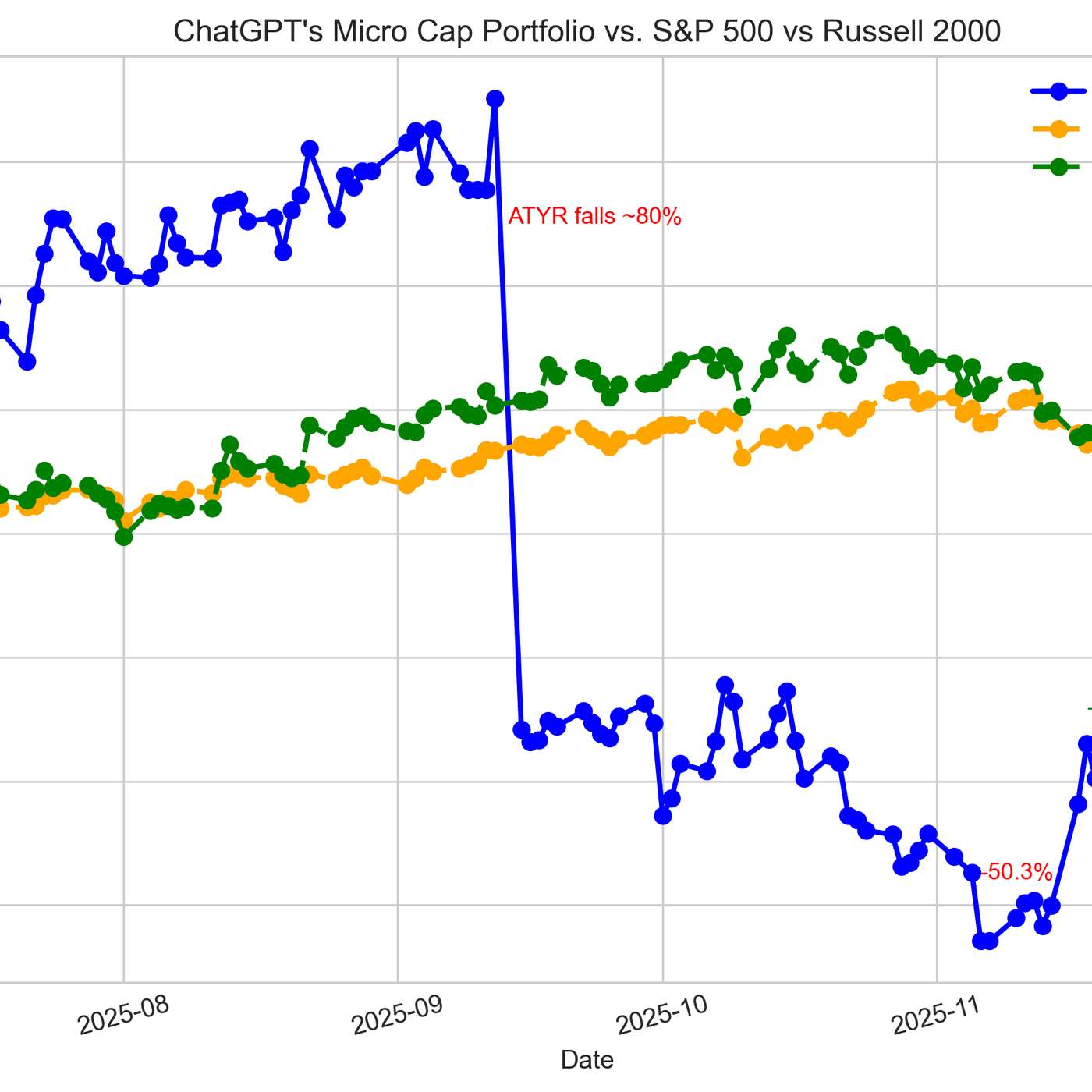

Nearing the end of a six-month experiment, the ChatGPT-managed portfolio pivoted from high-risk, single-catalyst bets to a balanced, risk-controlled setup. The primary goal is now to preserve gains and limit downside, demonstrating a dynamic strategy that adapts to the experiment's timeline.

Unlike the US market which favors billion-dollar revenues, the Hong Kong stock exchange allows smaller AI companies to IPO with just $60-80M in revenue. This offers public investors high-risk, high-reward access to fast-growing tech companies, similar to late-stage venture capital.