The project's true value is evolving beyond simple profit and loss. The creator is now developing a dedicated benchmarking tool, noting its new direction is "far more important and less explored in the LLM trading ecosystem." This suggests the primary output is not alpha, but rather foundational tooling and infrastructure for the emerging field of AI-driven finance.

After the initial experiment with a broad set of micro-cap stocks failed, the project is pivoting to a more defined universe: new IPOs from the last five years. This change, based on viewer feedback, aims to better encapsulate a high-risk, high-reward strategy without being a pure "game of chance," indicating a more mature approach to experimental design.

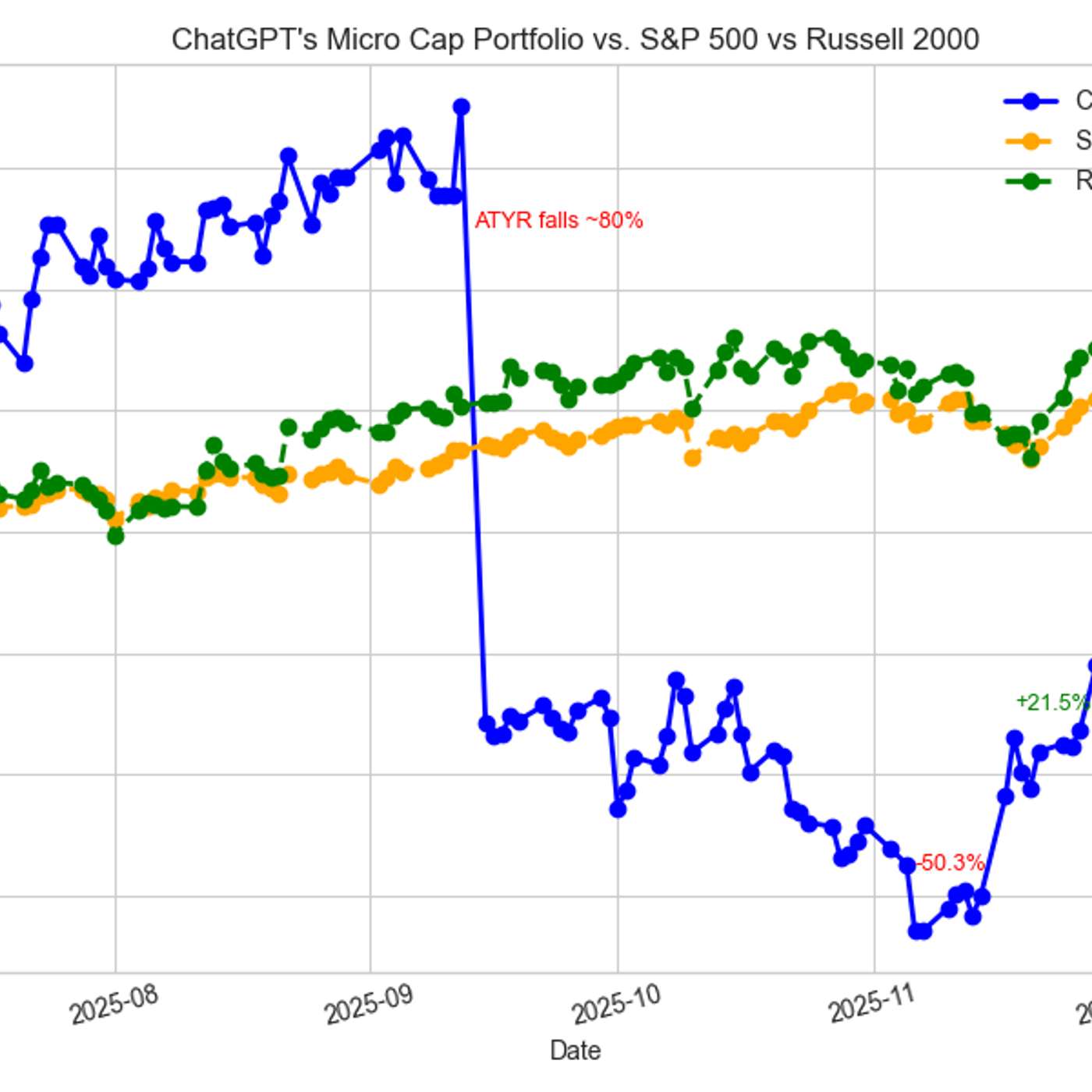

A six-month experiment concluded with a ChatGPT-managed portfolio valued at $82.88, a significant loss. This contrasts sharply with a benchmark S&P 500 investment, which would have grown to $111.68 in the same period. The AI's strategy resulted in a -50.33% max drawdown and negative alpha, highlighting its current inability to generate returns in volatile micro-cap stocks.