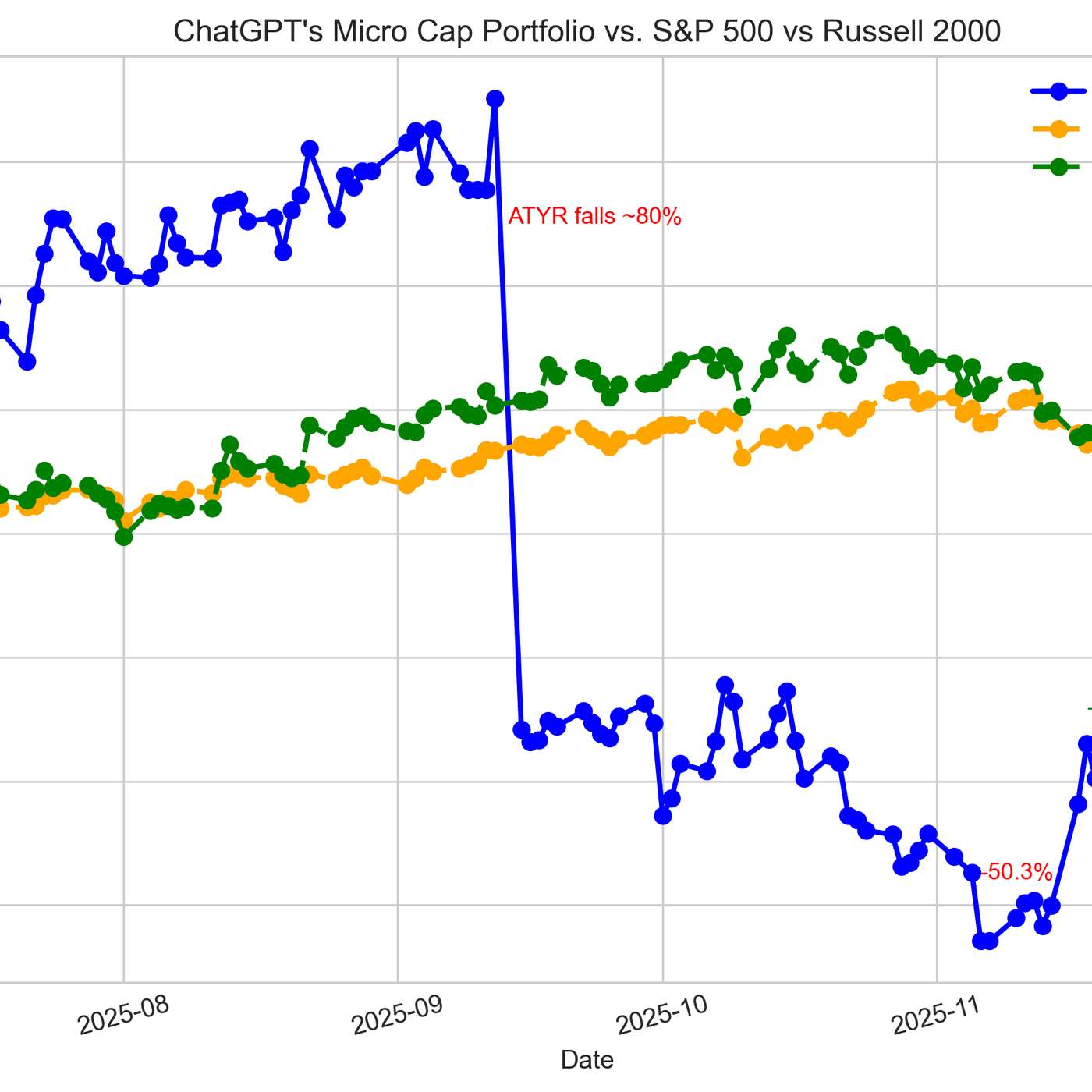

Nearing the end of a six-month experiment, the ChatGPT-managed portfolio pivoted from high-risk, single-catalyst bets to a balanced, risk-controlled setup. The primary goal is now to preserve gains and limit downside, demonstrating a dynamic strategy that adapts to the experiment's timeline.

Related Insights

To balance AI hype with reality, leaders should create two distinct teams. One focuses on generating measurable ROI this quarter using current AI capabilities. A separate "tiger team" incubates high-risk, experimental projects that operate at startup speed to prevent long-term disruption.

Unlike typical investors who chase performance, sophisticated institutions often rebalance into managed futures when the strategy is in a drawdown. They take profits after strong years (like 2022) and re-allocate capital during weak periods to maintain strategic exposure.

Compounding is a fragile process. Every portfolio adjustment, like trimming or panic selling, is like opening a door and letting heat escape. Treating your portfolio as a contained machine that works best when untouched reframes "doing nothing" as a strategic, structural advantage.

The key to long-term wealth isn't picking the single best investment, but building a portfolio that can survive a wide range of possible futures. Avoiding catastrophic losses is the most critical element for allowing wealth to compound over time, making risk management paramount.

Investors should establish a baseline risk level on a 0-100 scale based on personal factors like age and wealth. This becomes their default posture. The more advanced skill is then to tactically deviate from this baseline—becoming more or less aggressive—based on whether the prevailing market environment is offering generous or precarious opportunities.

The increased volatility and shorter defensibility windows in the AI era challenge traditional VC portfolio construction. The logical response to this heightened risk is greater diversification. This implies that early-stage funds may need to be larger to support more investments or write smaller checks into more companies.

The AI's portfolio construction goes beyond simple asset diversification by intentionally balancing three distinct investment theses: a de-risked 'anchor' (Mist), an asymmetric 'moonshot' (SLS), and a valuation-driven 'rebound' (JSPR). This strategy diversifies risk across different potential paths to success.

The goal of classifying the market into regimes like "slowdown" or "risk-on" is not to predict exact outcomes. Instead, it's a risk management tool to determine when it's appropriate to apply significant leverage (only during clear tailwinds) versus staying defensive in uncertain conditions.

To survive long-term, systematic trading models should be designed to be more sensitive when exiting a trade than when entering. Avoiding a leveraged liquidity cascade by selling near the top is far more critical for capital preservation than buying the exact bottom.

To manage a highly binary stock ahead of trial results, the AI trimmed its position by 62%, leaving shares with a near-zero cost basis. This tactic, known as playing with 'house money,' preserves exposure to massive potential upside while making a negative outcome manageable and non-existential to the portfolio.