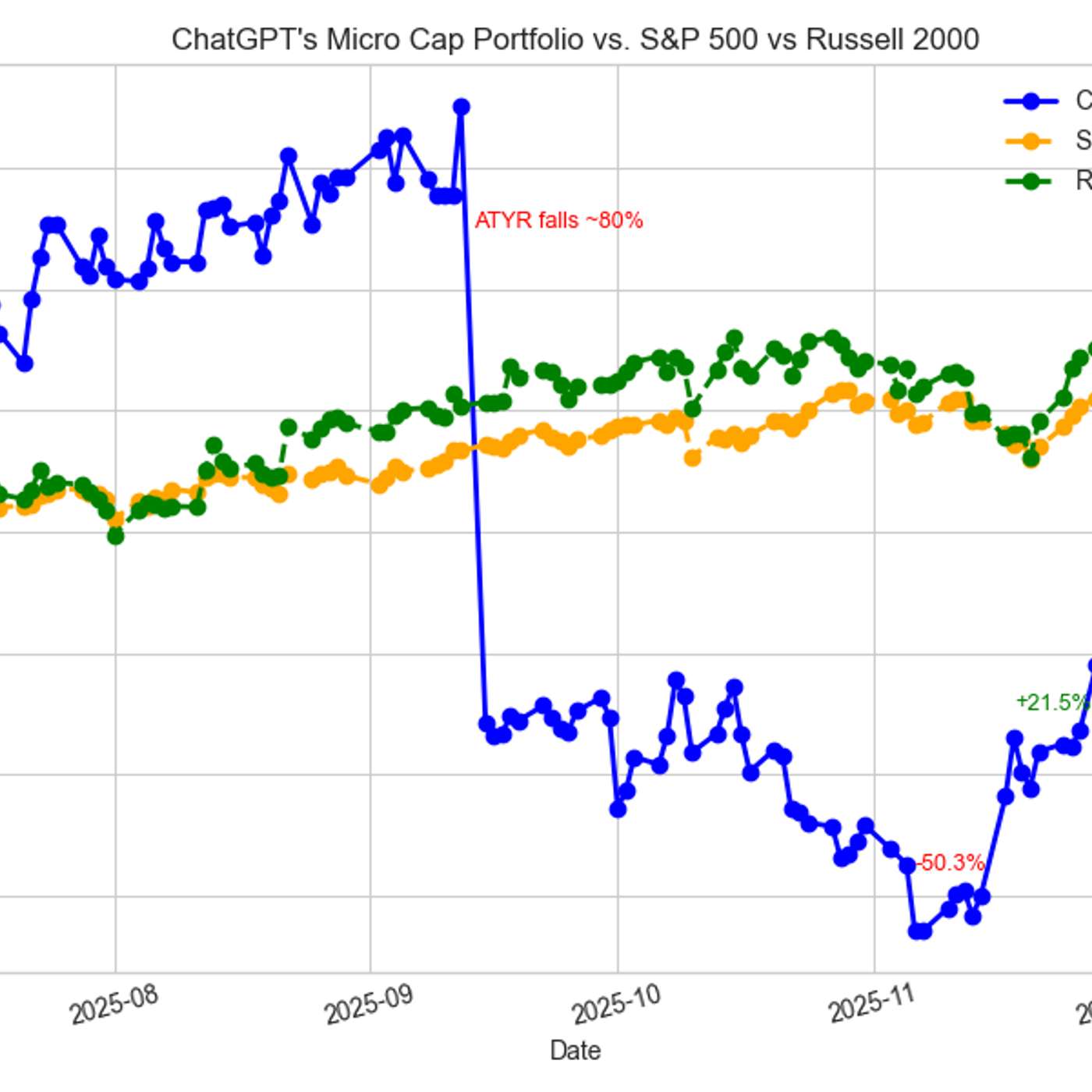

The project's true value is evolving beyond simple profit and loss. The creator is now developing a dedicated benchmarking tool, noting its new direction is "far more important and less explored in the LLM trading ecosystem." This suggests the primary output is not alpha, but rather foundational tooling and infrastructure for the emerging field of AI-driven finance.

Related Insights

Simply offering the latest model is no longer a competitive advantage. True value is created in the system built around the model—the system prompts, tools, and overall scaffolding. This 'harness' is what optimizes a model's performance for specific tasks and delivers a superior user experience.

Historically, investment tech focused on speed. Modern AI, like AlphaGo, offers something new: inhuman intelligence that reveals novel insights and strategies humans miss. For investors, this means moving beyond automation to using AI as a tool for generating genuine alpha through superior inference.

While building a legal AI tool, the founders discovered that optimizing each component was a complex benchmarking challenge involving trade-offs between accuracy, speed, and cost. They built an internal tool that quickly gained public traction as the number of models exploded.

As benchmarks become standard, AI labs optimize models to excel at them, leading to score inflation without necessarily improving generalized intelligence. The solution isn't a single perfect test, but continuously creating new evals that measure capabilities relevant to real-world user needs.

Traditional AI benchmarks are seen as increasingly incremental and less interesting. The new frontier for evaluating a model's true capability lies in applied, complex tasks that mimic real-world interaction, such as building in Minecraft (MC Bench) or managing a simulated business (VendingBench), which are more revealing of raw intelligence.

Traditional, static benchmarks for AI models go stale almost immediately. The superior approach is creating dynamic benchmarks that update constantly based on real-world usage and user preferences, which can then be turned into products themselves, like an auto-routing API.

Founders can get objective performance feedback without waiting for a fundraising cycle. AI benchmarking tools can analyze routine documents like monthly investor updates or board packs, providing continuous, low-effort insight into how the company truly stacks up against the market.

The future of AI in finance is not just about suggesting trades, but creating interacting systems of specialized agents. For instance, multiple AI "analyst" agents could research a stock, while separate "risk-taking" agents would interact with them to formulate and execute a cohesive trading strategy.

OpenAI's new GDP-val benchmark evaluates models on complex, real-world knowledge work tasks, not abstract IQ tests. This pivot signifies that the true measure of AI progress is now its ability to perform economically valuable human jobs, making performance metrics directly comparable to professional output.

The founders built the tool because they needed independent, comparative data on LLM performance vs. cost for their own legal AI startup. It only became a full-time company after its utility grew with the explosion of new models, demonstrating how solving a personal niche problem can address a wider market need.