The current conception of the defense industrial base focuses on large primes like L3 and General Atomics. However, 98% of US manufacturing is done by small businesses that are not integrated into the defense supply chain. A key investment would be creating a pathway to bring these smaller, agile companies into the fold.

Related Insights

Major US tech-industrial companies like SpaceX are forced to vertically integrate not as a strategic choice, but out of necessity. This reveals a critical national infrastructure gap: the absence of a multi-tiered ecosystem of specialized component suppliers that thrives in places like China.

The push to build defense systems in America reveals that critical sub-components, like rocket motors or high-powered amplifiers, are no longer manufactured domestically at scale. This forces new defense companies to vertically integrate and build their own factories, essentially rebuilding parts of the industrial base themselves.

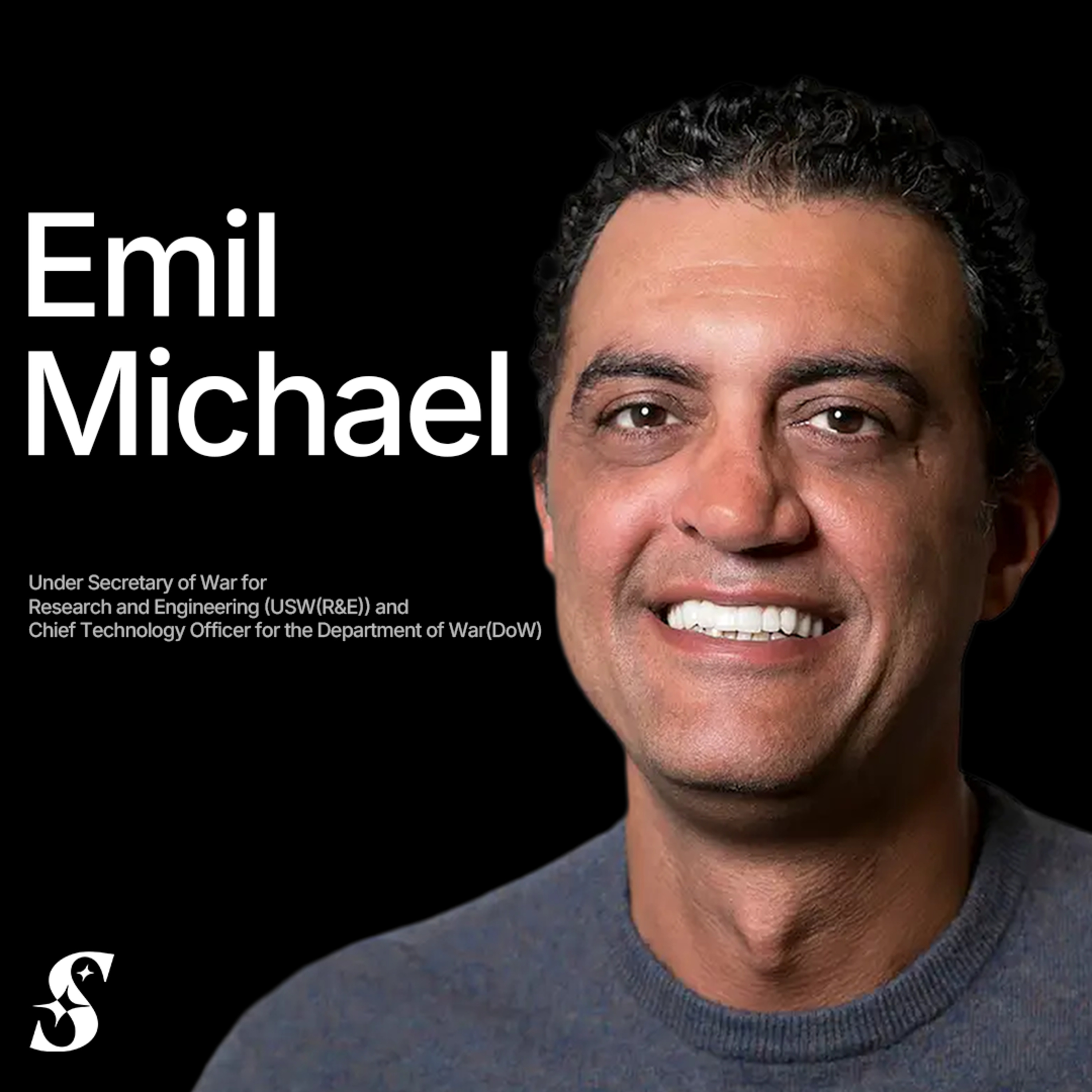

The Under Secretary of War's primary job is not just to fund technology, but to actively cultivate an ecosystem of new defense contractors. The stated goal is to create five more major companies capable of challenging established primes like Lockheed Martin, fostering competition and bringing new capabilities into the defense sector.

The US defense industry's error was creating a separate, "exquisite" industrial base. The solution is designing weapons that can be built using existing, scalable commercial manufacturing techniques, mirroring the successful approach used during World War II.

Building hardware compliant with US defense standards (NDAA) presents a major cost hurdle. Marine robotics company CSATS notes that switching from a mass-produced Chinese component to a US-made alternative can increase the price by 8x to 15x, a significant economic challenge for re-shoring manufacturing.

Valinor operates as a holding company, acquiring and running defense tech firms that address niche but critical government needs. This model services the vast market of smaller-TAM opportunities often ignored by traditional VCs seeking billion-dollar "moonshot" outcomes.

The decisive advantage in future conflicts will not be just technological superiority, but the ability to mass-produce weapons efficiently. After decades of offshoring manufacturing, re-industrializing the US to produce hardware at scale is Anduril's core strategic focus, viewing the factory itself as the ultimate weapon.

Traditional defense primes are coupled to customer requirements and won't self-fund speculative projects. "Neo primes" like Epirus operate like product companies, investing their own capital to address military capability gaps, proving out new technologies, and then selling the finished solution.

The go-to-market strategy for defense startups has evolved. While the first wave (e.g., Anduril) had to compete directly with incumbents, the 'Defense 2.0' cohort can grow much faster. They act as suppliers and partners to legacy prime contractors, who are now actively seeking to integrate their advanced technology.

Anduril's co-founder argues America's atrophied manufacturing base is a critical national security vulnerability. The ultimate strategic advantage isn't a single advanced weapon, but the ability to mass-produce "tens of thousands of things" efficiently. Re-industrializing is therefore a core pillar of modern defense strategy.