Unlike consumer or enterprise software, the defense industry has a single major customer per country. This structure favors consolidation. The path to success is not to be a niche SaaS tool but to build a platform that becomes a "national champion," deeply integrated with the nation's defense strategy.

Related Insights

Startups often fail to displace incumbents because they become successful 'point solutions' and get acquired. The harder path to a much larger outcome is to build the entire integrated stack from the start, but initially serve a simpler, down-market customer segment before moving up.

Luckey reveals that Anduril prioritized institutional engagement over engineering in its early days, initially hiring more lawyers and lobbyists. The biggest challenge wasn't building the technology, but convincing the Department of Defense and political stakeholders to believe in a new procurement model, proving that shaping the system is a prerequisite for success.

The government's procurement process often defaults to bidding out projects to established players like Lockheed Martin, even if a startup presents a breakthrough. Success requires navigating this bureaucratic reality, not just superior engineering.

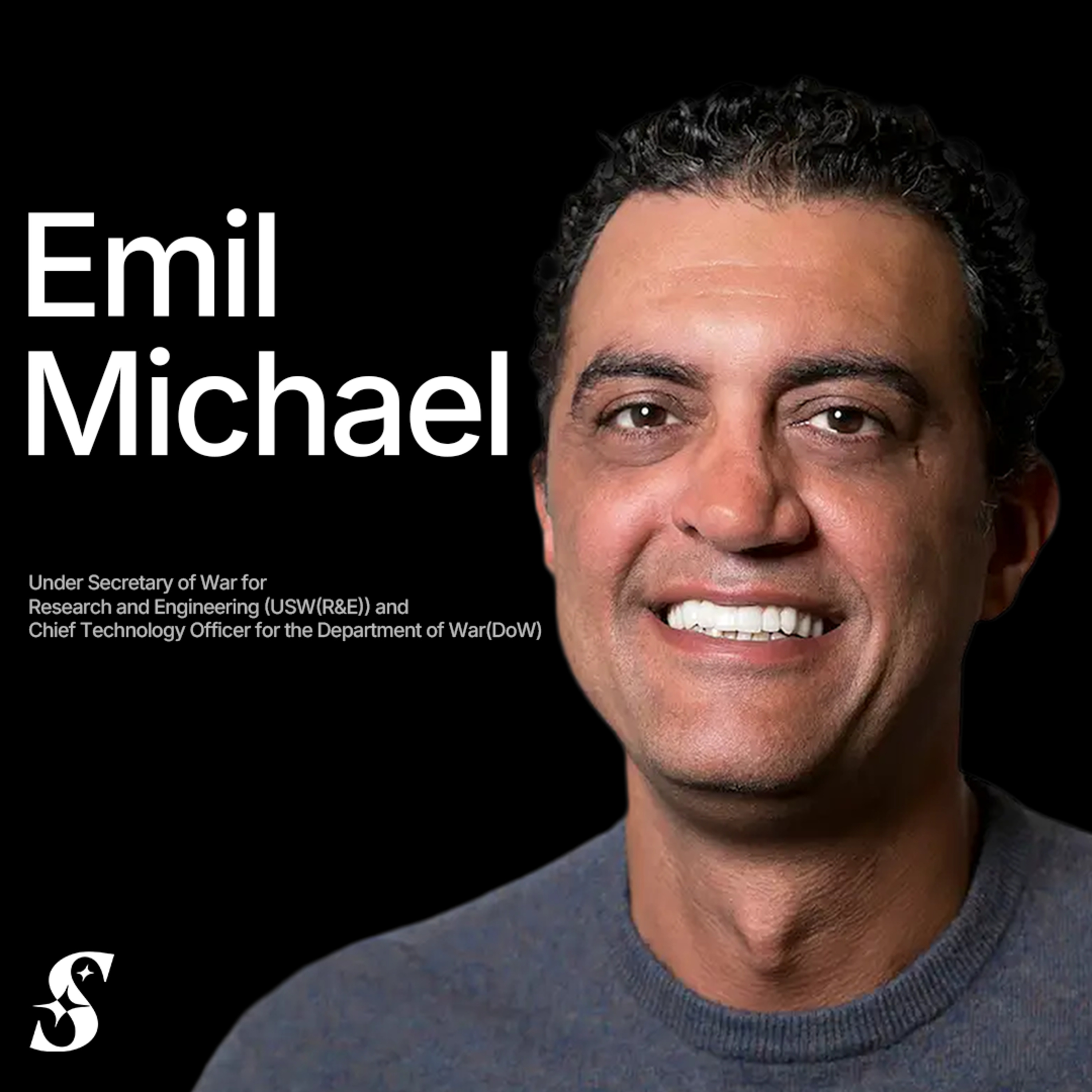

The Under Secretary of War's primary job is not just to fund technology, but to actively cultivate an ecosystem of new defense contractors. The stated goal is to create five more major companies capable of challenging established primes like Lockheed Martin, fostering competition and bringing new capabilities into the defense sector.

Large enterprises don't buy point solutions; they invest in a long-term platform vision. To succeed, build an extensible platform from day one, but lead with a specific, high-value use case as the entry point. This foundational architecture cannot be retrofitted later.

Unlike traditional tech, founders in the American Dynamism space often succeed because of their deep, first-hand understanding of the customer (e.g., government, military). Many have prior service, hold security clearances, or have sold to government before. This "customer intimacy" allows them to speak the language and navigate complex procurement, a crucial advantage.

Many defense startups fail despite superior technology because the government isn't ready to purchase at scale. Anduril's success hinges on identifying when the customer is ready to adopt new capabilities within a 3-5 year window, making market timing its most critical decision factor.

Marketing a defense company is fundamentally different from marketing a consumer product. Instead of a broad "one-to-all" campaign targeting millions of customers, defense marketing is a "one-to-few," hyper-targeted effort aimed at a small group of influential government decision-makers who could all fit in a single conference room.

Contrary to early narratives, a proprietary dataset is not the primary moat for AI applications. True, lasting defensibility is built by deeply integrating into an industry's ecosystem—connecting different stakeholders, leveraging strategic partnerships, and using funding velocity to build the broadest product suite.

The go-to-market strategy for defense startups has evolved. While the first wave (e.g., Anduril) had to compete directly with incumbents, the 'Defense 2.0' cohort can grow much faster. They act as suppliers and partners to legacy prime contractors, who are now actively seeking to integrate their advanced technology.

![Palmer Luckey - Inventing the Future of Defense - [Invest Like the Best, CLASSICS] thumbnail](https://megaphone.imgix.net/podcasts/f7c9aa8e-cb8d-11f0-828e-0b281809c10a/image/cc07f91ec47f95abbde771a4956b37b7.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)