Instead of competing against the "buy local" trend, Amazon could incorporate it into its platform. By adding a "buy local" button that uses AI to source products from nearby stores, Amazon could generate revenue from local delivery or referral fees, turning a major point of criticism into a new business opportunity.

Related Insights

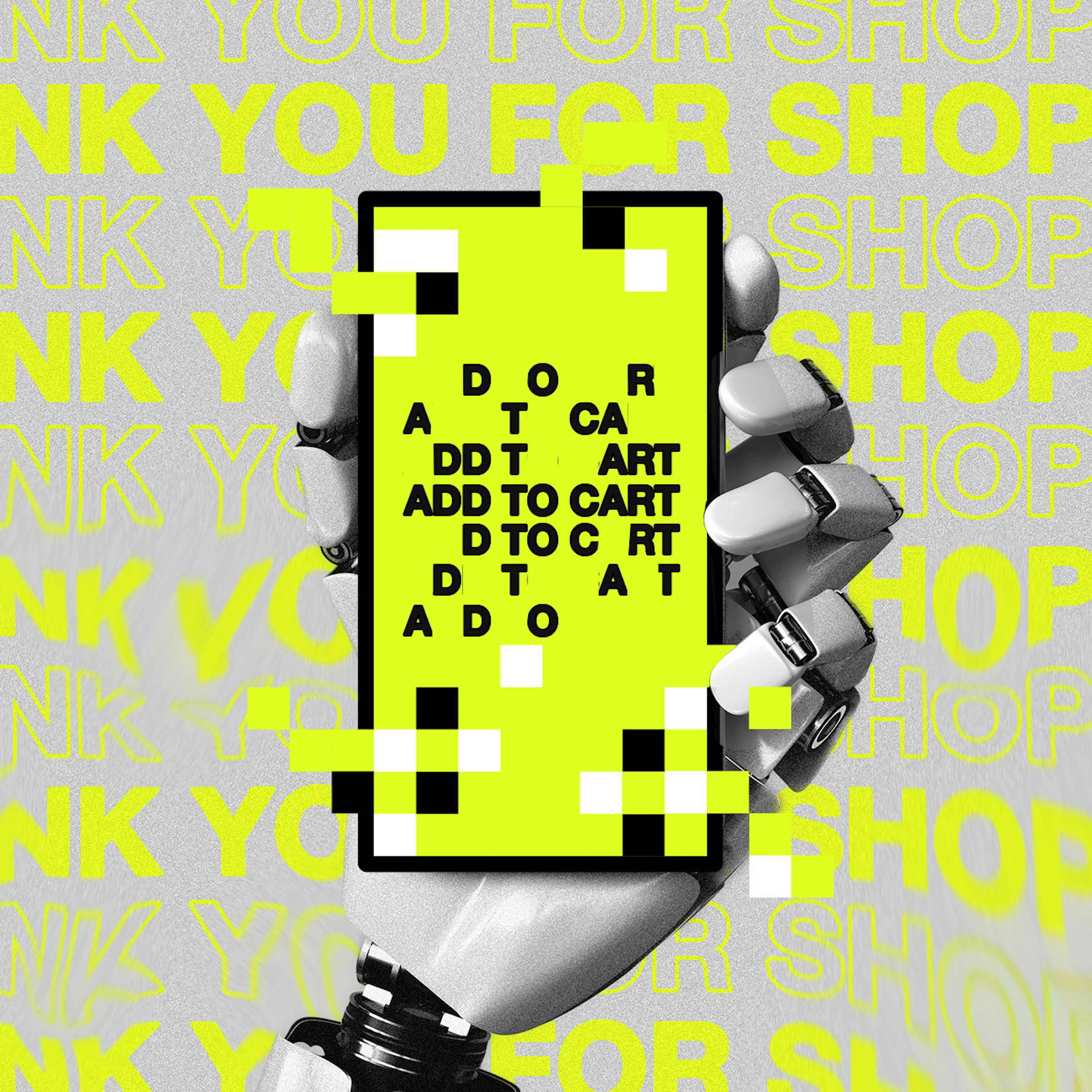

Consumer search behavior is shifting from browsers to AI assistants. E-commerce brands must adapt by treating agents like ChatGPT as new traffic sources. This requires making product data discoverable via APIs to enable seamless research and purchasing directly within conversational AI platforms.

By integrating shopping into ChatGPT, OpenAI can become a massive e-commerce engine. With a potential take rate of 15-30%, similar to Amazon or Meta, capturing just 20% of the $1.2T U.S. e-commerce market would generate tens of billions in new, high-margin revenue.

While AI fragments shopping channels, it also enables hyper-personalization of the fulfillment experience. By integrating external data like weather, transit times, and regional issues, brands can proactively communicate with customers about their orders, creating a deeper, more valuable connection.

The next frontier in e-commerce is inter-company AI collaboration. A brand's AI will detect an opportunity, like a needed digital shelf update, and generate a recommendation. After human approval, the request is sent directly to the retailer's AI agent for automatic execution.

The future of AI in e-commerce isn't just better search results like Amazon's Rufus. The shift will be towards proactive, conversational agents that handle the entire purchasing process for routine items, mirroring the "one-click" convenience of the original Amazon Dash button but with greater intelligence.

Tushy finds little sales cannibalization between its DTC site and Amazon because they serve different customer archetypes. Instead of forcing an 'Amazon shopper' to a .com site, brands should meet them where they are, focusing on mental and physical availability across all relevant channels.

Amazon's potential commerce partnership with OpenAI is fraught with risk. Allowing ChatGPT to become the starting point for product searches threatens Amazon's highly profitable on-site advertising revenue, even if Amazon gains referral traffic. It's a classic battle to avoid being aggregated by another platform.

Unlike service platforms like Uber that rely on real-world networks, Amazon's high-margin ad business is existentially threatened by AI agents that bypass sponsored listings. This vulnerability explains its uniquely aggressive legal stance against Perplexity, as it stands to lose a massive, growing revenue stream if users stop interacting directly with its site.

To avoid being disintermediated by AI agents that could direct consumers elsewhere, retailers can leverage their physical assets. An AI agent will still prioritize retailers with extensive infrastructure and forward-positioned inventory to ensure fast and efficient delivery, creating a competitive moat against pure-play e-commerce.

Instead of selling leads to local businesses like garage repair shops, create a superior online storefront and marketing funnel. You take the full customer payment, then subcontract the actual service to a local provider at their standard rate, profiting from the margin created by a better customer experience.