To avoid being disintermediated by AI agents that could direct consumers elsewhere, retailers can leverage their physical assets. An AI agent will still prioritize retailers with extensive infrastructure and forward-positioned inventory to ensure fast and efficient delivery, creating a competitive moat against pure-play e-commerce.

Related Insights

According to Flexport's CEO, large incumbents hold significant AI advantages over startups. They possess vast proprietary data for model training, the domain expertise to target high-value problems (features, not companies), and instant distribution, allowing them to deploy AI solutions to thousands of customers overnight.

In the AI arms race, competitive advantage isn't just about models or talent; it's about the physical execution of building data centers. The complexity of construction, supply chain management, and navigating delays creates a real-world moat. Companies that excel at building physical infrastructure will outpace competitors.

While most tech giants focus on the digital world of "bits," Amazon's true dominance comes from its mastery of the physical world of "atoms." Its massive, hard-to-replicate logistics infrastructure for moving goods creates a formidable competitive advantage that software-only companies cannot challenge.

While AI agents could shift sales away from traditional retailers, companies with extensive physical infrastructure and forward-positioned inventory have a defense. AI agents prioritizing speed and efficiency for physical goods will likely still favor these established networks, preventing full disintermediation in the new agentic commerce landscape.

CEOs of platforms like ZocDoc and TaskRabbit are not worried about AI agent disruption. They believe the immense complexity of managing their real-world networks—like integrating with chaotic healthcare systems or vetting thousands of workers—is a defensible moat that pure software agents cannot easily replicate, giving them leverage over AI companies.

While AI fragments shopping channels, it also enables hyper-personalization of the fulfillment experience. By integrating external data like weather, transit times, and regional issues, brands can proactively communicate with customers about their orders, creating a deeper, more valuable connection.

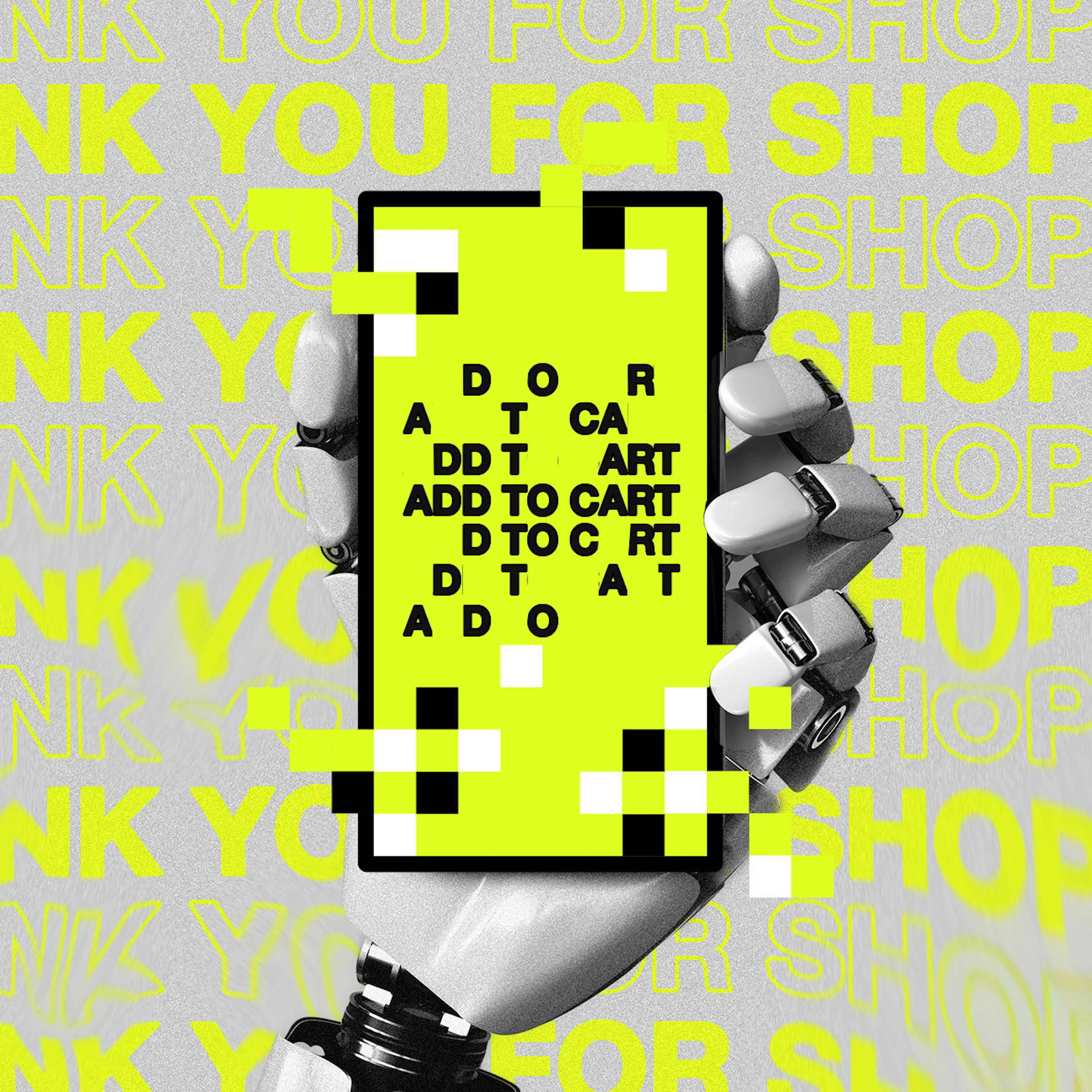

Middlemen like retailers exist because of information asymmetry. Personal AI agents, with deep knowledge of individual needs, will aggregate demand and purchase goods directly from producers like farmers and manufacturers. This will eliminate the need for advertisers and retailers and enable hyper-efficient supply chains.

AI makes the technical 'doing' of business, like coding, accessible to everyone. The durable competitive edge is no longer the ability to build a product, but the ability to reach and acquire customers. Audience and distribution channels are the new defensible assets.

AI will fragment the customer journey across countless platforms, moving purchases away from brand-owned websites. Retailers must build systems to manage inventory and product information across this decentralized landscape, not just focus on perfecting their own site experience.

New technology like AI doesn't automatically displace incumbents. Established players like DoorDash and Google successfully defend their turf by leveraging deep-rooted network effects (e.g., restaurant relationships, user habits). They can adopt or build competing tech, while challengers struggle to replicate the established ecosystem.