China's key learning from the past year is not that the U.S. lacks economic leverage, but that it lacks the political will to use it. Beijing perceives an unwillingness in Washington to endure domestic consequences, like higher consumer prices during an election year, to win a trade war.

Related Insights

Beijing's unclear stance on Nvidia H200 chip imports is a strategic negotiation tactic, not a definitive ban. This ambiguity creates leverage to extract concessions from the U.S. in trade talks, using the tech sector as a pawn in a larger geopolitical game.

Unlike the US's focus on quarterly results and election cycles, China's leadership operates on a civilizational timescale. From their perspective, the US is a recent phenomenon, and losing the US market is an acceptable short-term cost in a much longer game of survival and dominance. This fundamental difference in strategic thinking is often missed.

The administration was influenced by bearish Wall Street analyses after China's zero-COVID policy and the "Peak China" narrative in the strategic community. This led them to believe China was economically weaker than it was, causing them to miscalculate China's ability and willingness to retaliate in a trade war.

China demonstrated its significant leverage over the U.S. by quickly pressuring the Trump administration through a partial embargo on rare earth metals. This showcased a powerful non-tariff weapon rooted in its control of critical mineral supply chains, which are also vital for defense applications.

Unlike the first trade war, where Beijing was caught flat-footed, it entered the second with a prepared policy plan and emotional resolve. China developed a toolkit of retaliatory measures, such as the rare earth card, and seized the initiative rather than simply reacting to U.S. actions.

Beijing believes that as the U.S. midterm elections approach, the Trump administration will feel increasing pressure to secure a tangible "win" or deal. By prolonging negotiations, China aims to maximize its leverage and extract more favorable terms, mapping this strategy from the first trade war.

Contrary to common perception, China holds the stronger hand in its relationship with the U.S. As the world's creditor and primary producer, China can sell its goods to billions of other global consumers. The U.S., as a debtor and consumer nation, is far more dependent on China than the other way around.

While the U.S. oscillates between trade policies with each new administration, China executes consistent long-term plans, like shifting to high-quality exports. This decisiveness has enabled China to find new global markets and achieve a record trade surplus, effectively outmaneuvering U.S. tactics.

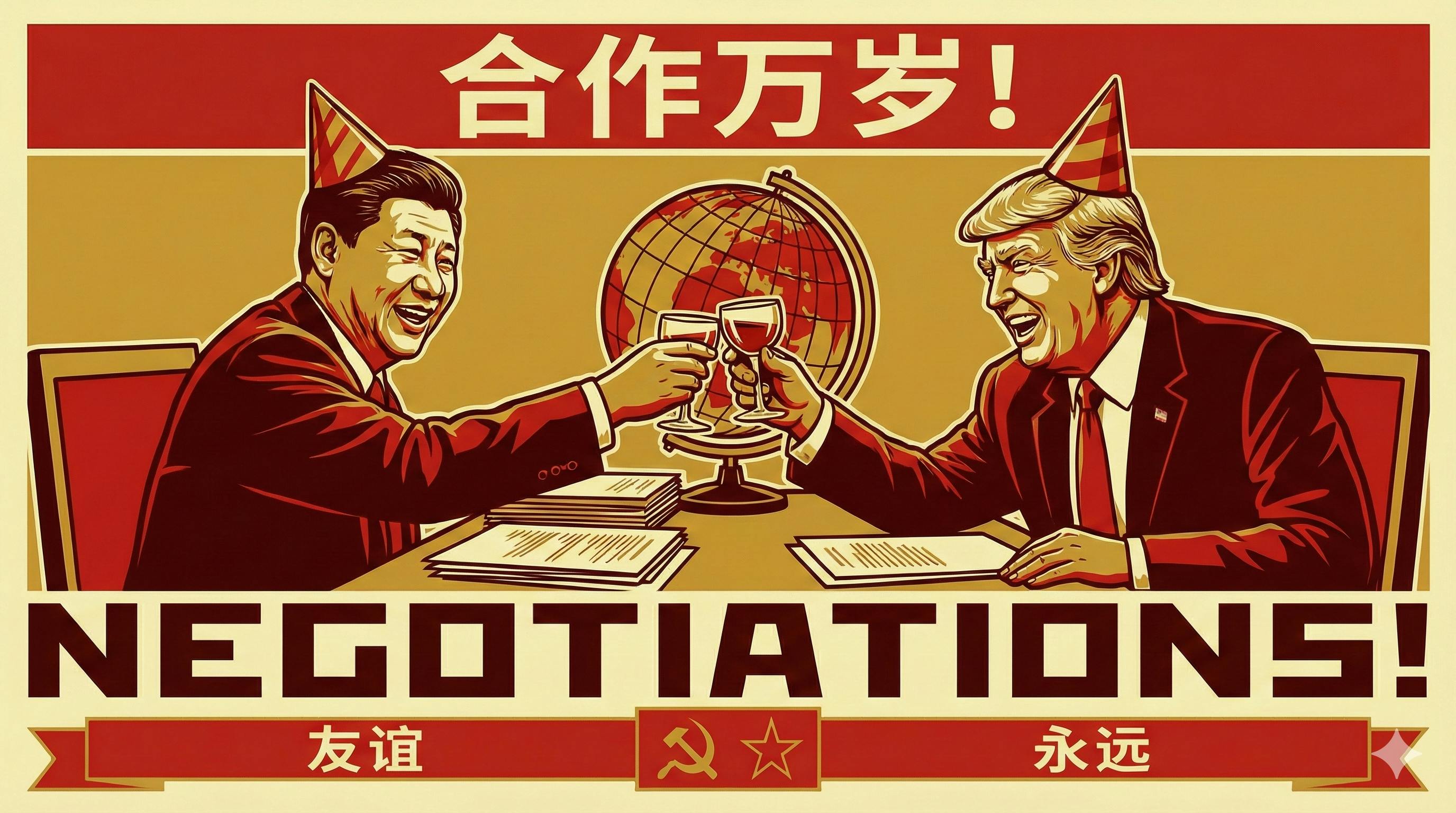

The latest US-China trade talks signal a shift from unilateral US pressure to a negotiation between equals. China is now effectively using its control over critical exports, like rare earth minerals, as a bargaining chip to compel the U.S. to pause its own restrictions on items like semiconductors.

China effectively steered talks away from major macroeconomic imbalances and unfair trade practices. Instead, the focus has been "whittled down" to sector-specific issues like TikTok or soybean purchases, allowing China to manage concessions without addressing core U.S. grievances in a game of "whack-a-mole."