The Fed's policy of raising interest rates to combat consumer inflation has the unintended consequence of making long-term, capital-intensive industrial projects unviable. This hollows out the manufacturing base and prevents the reshoring of critical materials processing essential for US security.

Related Insights

The administration's explicit focus on re-shoring manufacturing and preparing for potential geopolitical conflict provides a clear investment playbook. Capital should flow towards commodities and companies critical to the military-industrial complex, such as producers of copper, steel, and rare earth metals.

Recent inflation was primarily driven by fiscal spending, not the bank-lending credit booms of the 1970s. The Fed’s main tool—raising interest rates—is designed to curb bank lending. This creates a mismatch where the Fed is slowing the private sector to counteract a problem created by the public sector.

A U.S. national security document's phrase, "the future belongs to makers," signals a significant policy shift. Credit and tax incentives will likely be redirected from financial engineering (e.g., leveraged buyouts in private equity) to tangible industrial production in order to build resilient, non-Chinese supply chains.

The Fed's tool of raising interest rates is designed to slow bank lending. However, when inflation is driven by massive government deficits, this tool backfires. Higher rates increase the government's interest payments, forcing it to cover a larger deficit, which can lead to more money printing—the root cause of the inflation in the first place.

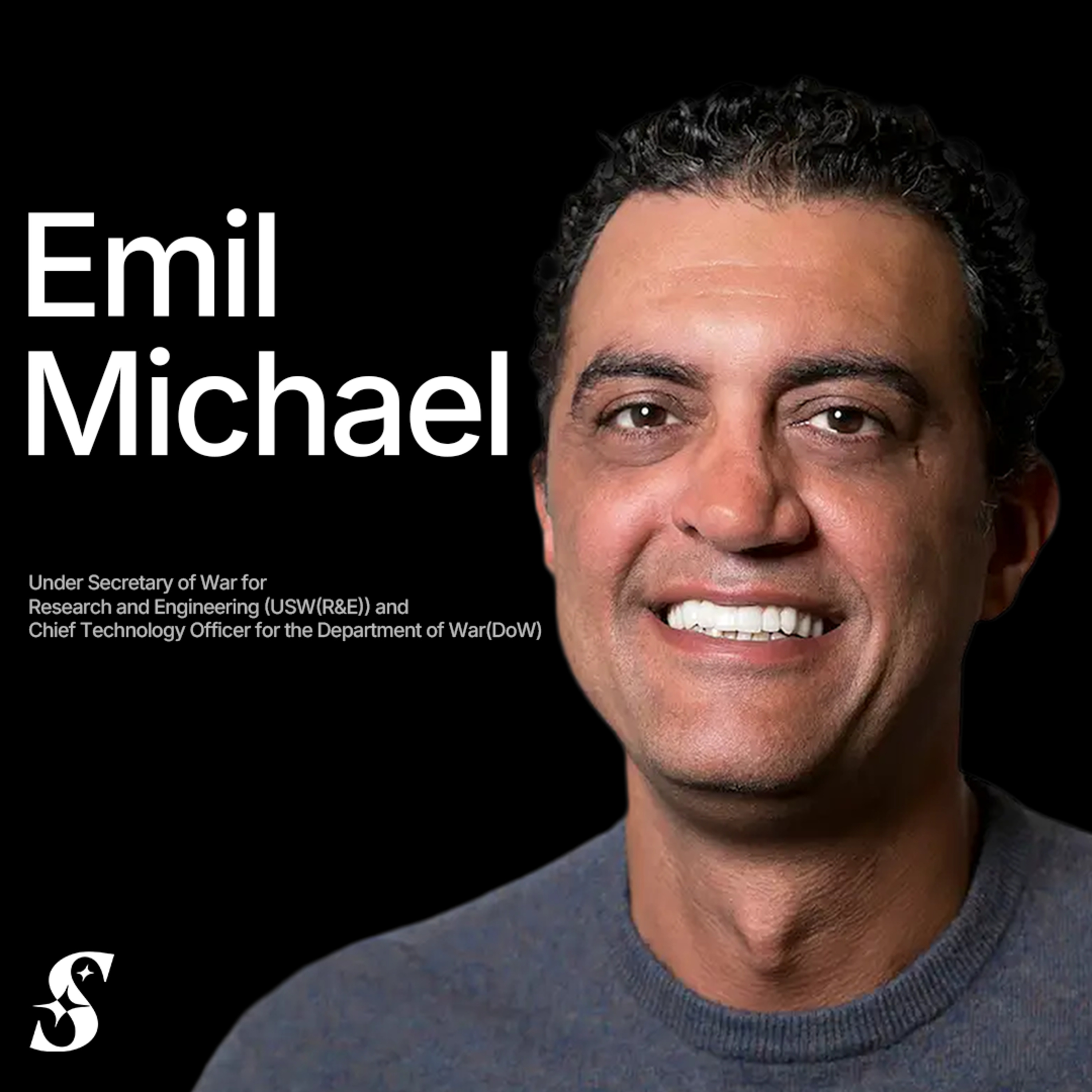

The Under Secretary of War defines the current "1938 moment" not as an imminent war, but as a critical juncture for rebuilding the domestic industrial base. The focus is on reversing decades of outsourcing critical components like minerals and pharmaceuticals, which created strategic vulnerabilities now deemed unacceptable for national security.

Businesses can adapt to stable, even unfavorable, policies. However, constant, unpredictable policy changes create an environment of ambient chaos where long-term capital investment is impossible. The lack of continuity, not the specific tariffs, is the primary reason industrial construction spending has turned negative.

Citing the 1940s playbook, future administrations may force the Fed to fix interest rates at low levels. This makes government borrowing cheap, enabling massive spending to revitalize industry and defense, similar to how war efforts were financed.

The U.S. military's power is no longer backed by a robust domestic industrial base. Decades of offshoring have made it dependent on rivals like China for critical minerals and manufacturing. This means the country can no longer sustain a prolonged conflict, a reality its defense planners ignore.

Instead of ineffective grants to incumbents, the US should leverage its world-leading capital markets. By providing lightweight government backstops for private bank loans—absorbing partial default risk—it can de-risk private investment and unlock the massive capital needed for new factories without distorting market incentives.

Anduril's co-founder argues America's atrophied manufacturing base is a critical national security vulnerability. The ultimate strategic advantage isn't a single advanced weapon, but the ability to mass-produce "tens of thousands of things" efficiently. Re-industrializing is therefore a core pillar of modern defense strategy.