To manage a highly binary stock ahead of trial results, the AI trimmed its position by 62%, leaving shares with a near-zero cost basis. This tactic, known as playing with 'house money,' preserves exposure to massive potential upside while making a negative outcome manageable and non-existential to the portfolio.

Related Insights

Titus treated his initial $100 in blackjack as "startup capital." Once he doubled it and secured his initial investment, he was playing with winnings. This allowed for bolder plays with zero risk of personal loss, a model applicable to de-risking new ventures.

Instead of making large initial bets, a more effective strategy is to take small, "junior varsity" positions. Investors then aggressively ramp up their size only when the thesis begins to demonstrably play out, a method described as "high conviction, inflection investing."

Allocate more capital to businesses with a highly predictable future (a narrow "cone of uncertainty"), like Costco. Less predictable, high-upside bets should be smaller positions, as their future has a wider range of possible outcomes. Conviction and certainty should drive allocation size.

To pursue massive upside, one must first survive. Gardner mitigates risk by never allocating more than 5% of his portfolio to any new position. This discipline prevents catastrophic losses from a single bad idea, ensuring he stays in the game long enough for the big winners to emerge.

While holding a long-term deep value thesis, ARK Invest actively trades high-conviction stocks. They trim positions when a stock like Tesla surges to 13-14% of the portfolio and buy back in during dips. This strategy uses the market's inherent volatility and controversy around a stock to rebalance and improve their cost basis.

To combat the emotional burden of binary sell-or-hold decisions, use the "Go Havsies" method. Instead of selling a full position, sell half. This simple algorithm diversifies potential outcomes—you benefit if it rises and are protected if it falls—which significantly reduces the psychological pain of regret from making the "wrong" choice.

To manage the risk of volatile or 'bubble' stocks, investors should systematically take profits until their original cost basis is recovered. After this point, any remaining shares represent 'house money.' This simple mechanical rule removes emotion and protects principal while allowing for continued upside exposure.

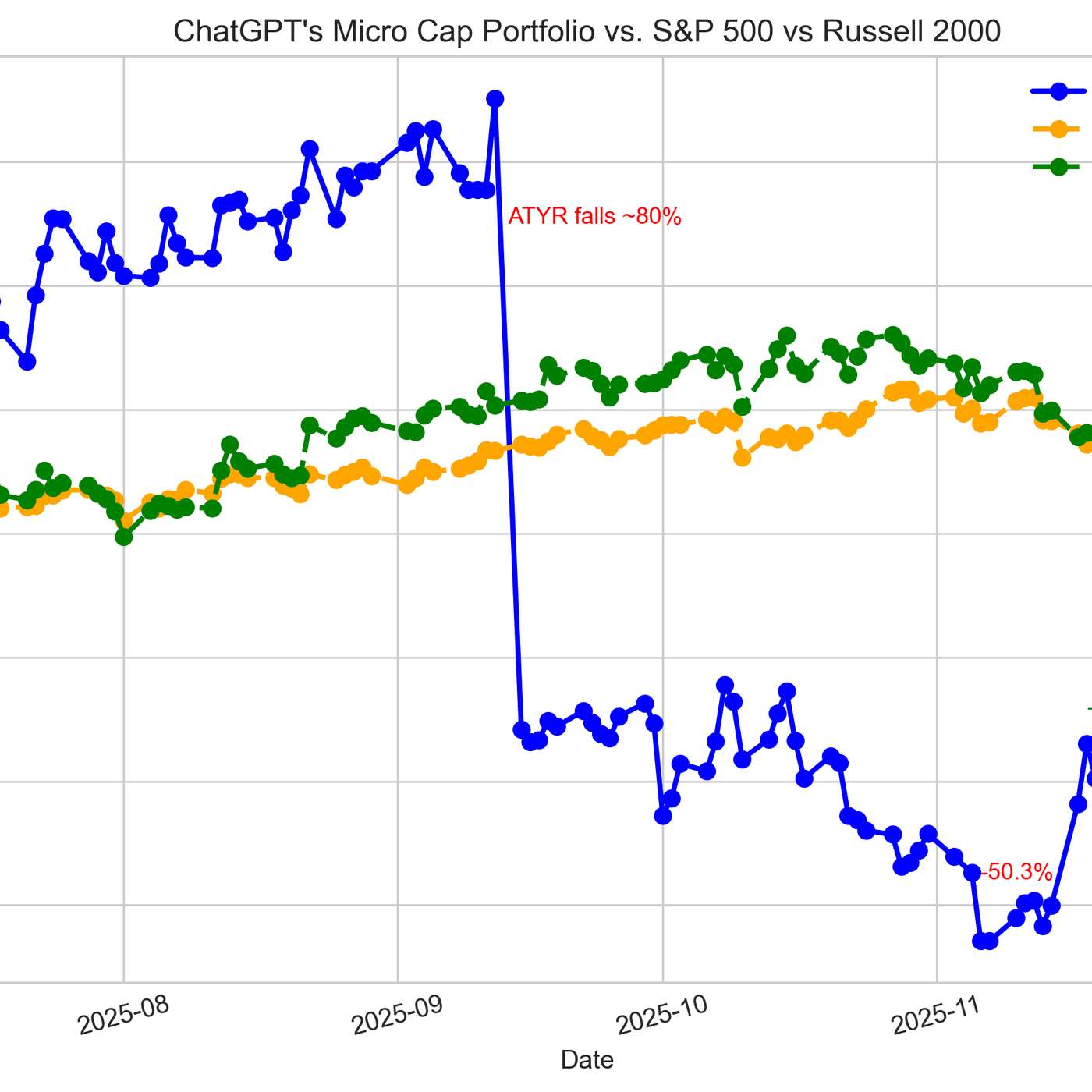

Nearing the end of a six-month experiment, the ChatGPT-managed portfolio pivoted from high-risk, single-catalyst bets to a balanced, risk-controlled setup. The primary goal is now to preserve gains and limit downside, demonstrating a dynamic strategy that adapts to the experiment's timeline.

Rather than passively holding a stock, the "buy and optimize" strategy involves actively managing its weighting in a portfolio. As a stock becomes more expensive relative to its intrinsic value, the position is trimmed, and when it gets cheaper, it is increased, creating an additional layer of return.

Contrary to the common VC advice to "play the game on the field" during hot markets, Founder Collective reduces its check size for high-valuation deals. This strategy allows them to maintain exposure to promising companies while intentionally keeping the fund's overall weighted average cost basis low.