The AI's portfolio construction goes beyond simple asset diversification by intentionally balancing three distinct investment theses: a de-risked 'anchor' (Mist), an asymmetric 'moonshot' (SLS), and a valuation-driven 'rebound' (JSPR). This strategy diversifies risk across different potential paths to success.

Related Insights

An LP's diversification strategy across different venture funds is undermined when every fund converges on a single theme like AI. This creates a highly correlated portfolio, concentrating systemic risk rather than spreading it. The traditional diversification benefits of investing across multiple managers, stages, and geographies are nullified.

WCM realized their portfolio became too correlated because their research pipeline itself was the root cause, with analysts naturally chasing what was working. To fix this, they built custom company categorization tools to force diversification at the idea generation stage, ensuring a broader set of opportunities is always available.

Owning multiple stocks or ETFs does not create a genuinely diversified portfolio. True diversification involves owning assets that react differently to various economic conditions like inflation, recession, and liquidity shifts. This means spreading capital across productive equities, real assets, commodities, hard money like gold, and one's own earning power.

Contrary to typical risk-off strategies, ARK Invest manages risk by concentrating its portfolio into its highest-conviction names during market downturns. Conversely, during bull markets, as opportunities like IPOs increase, the firm diversifies its holdings to capture broader upside.

A more robust diversification strategy involves spreading exposure across assets that behave differently under various macroeconomic environments like inflation, deflation, growth, and contraction. This provides better protection against uncertainty than simply mixing asset classes.

Advanced AI tools can model an organization's internal investment beliefs and processes. This allows investment committees to use the AI to "red team" proposals by prompting it to generate a memo with a negative stance or to re-evaluate a deal based on a new assumption, like a net-zero mandate.

The goal of diversification is to hold assets that behave differently. By design, some part of your portfolio will likely be underperforming at all times. Accepting this discomfort is a key feature of a well-constructed portfolio, not a bug to be fixed.

The increased volatility and shorter defensibility windows in the AI era challenge traditional VC portfolio construction. The logical response to this heightened risk is greater diversification. This implies that early-stage funds may need to be larger to support more investments or write smaller checks into more companies.

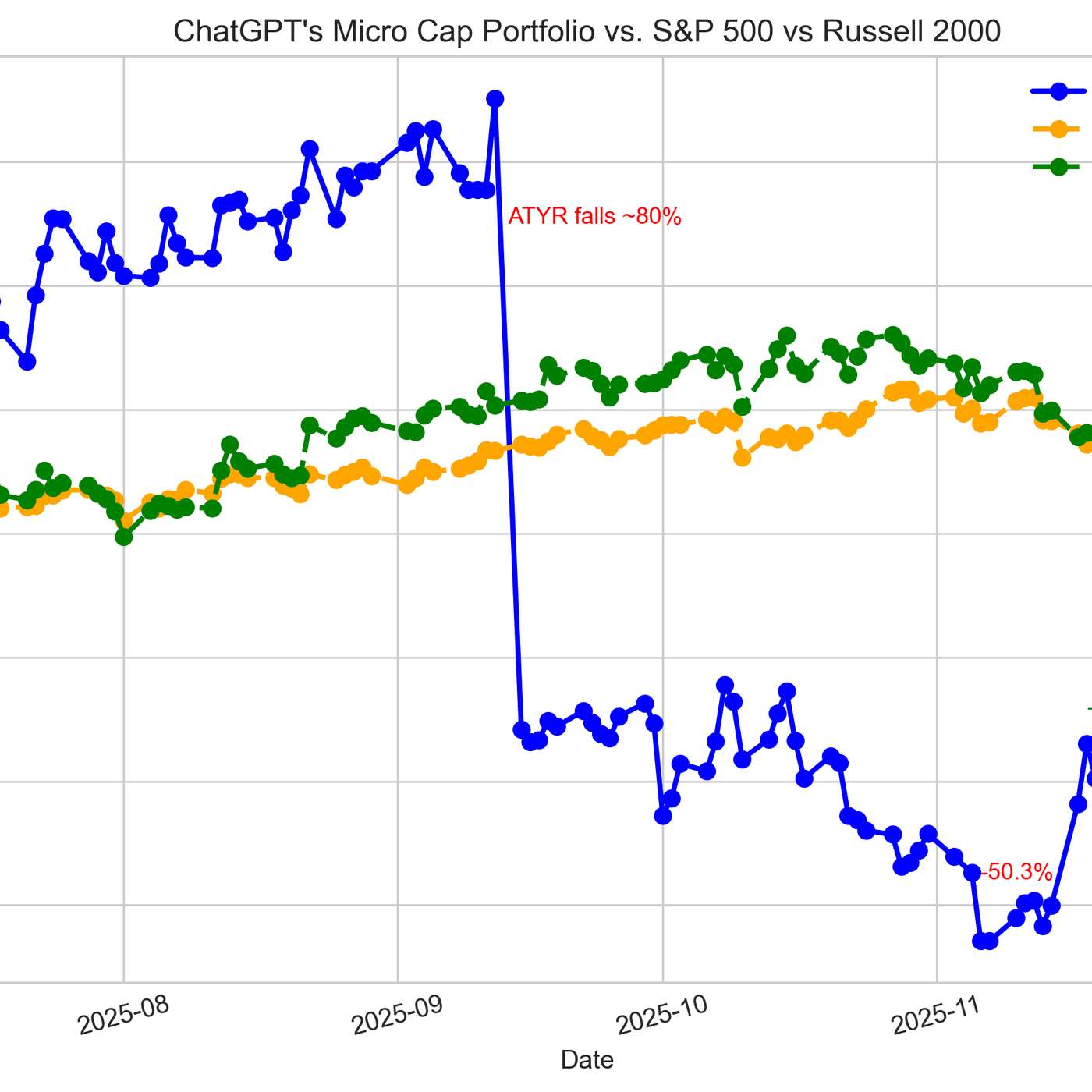

Nearing the end of a six-month experiment, the ChatGPT-managed portfolio pivoted from high-risk, single-catalyst bets to a balanced, risk-controlled setup. The primary goal is now to preserve gains and limit downside, demonstrating a dynamic strategy that adapts to the experiment's timeline.

Investor Mark Ein argues against sector-specific focus, viewing his broad portfolio (prop tech, sports, etc.) as a key advantage. It enables him to transfer insights and best practices from one industry to another, uncovering opportunities that specialists might miss.