When a prime contractor like RTX uses cash for stock buybacks instead of M&A, it's a powerful market signal. It suggests they see 'dead ends' and 'pure vapor' among defense tech startups, lacking confidence in their IP and viability. This indicates a suppressed or unhealthy innovation ecosystem.

Related Insights

The conflict in Ukraine exposed the vulnerability of expensive, "exquisite" military platforms (like tanks) to inexpensive technologies (like drones). This has shifted defense priorities toward cheap, mass-producible, "attritable" systems. This fundamental change in product and economics creates a massive opportunity for startups to innovate outside the traditional defense prime model.

Once a clear buy signal for investors, large-scale share repurchases now often indicate that a company with a legacy moat has no better use for its cash. This can be a red flag that its core business is being disrupted by new technology, as seen with cable networks and department stores.

The government's procurement process often defaults to bidding out projects to established players like Lockheed Martin, even if a startup presents a breakthrough. Success requires navigating this bureaucratic reality, not just superior engineering.

The future IPO of Anduril, a private defense tech firm, is viewed as a critical test for the entire sector. Its performance will signal Wall Street's appetite for a new class of defense startups that have been heavily funded by venture capital with speculative, low-revenue profiles.

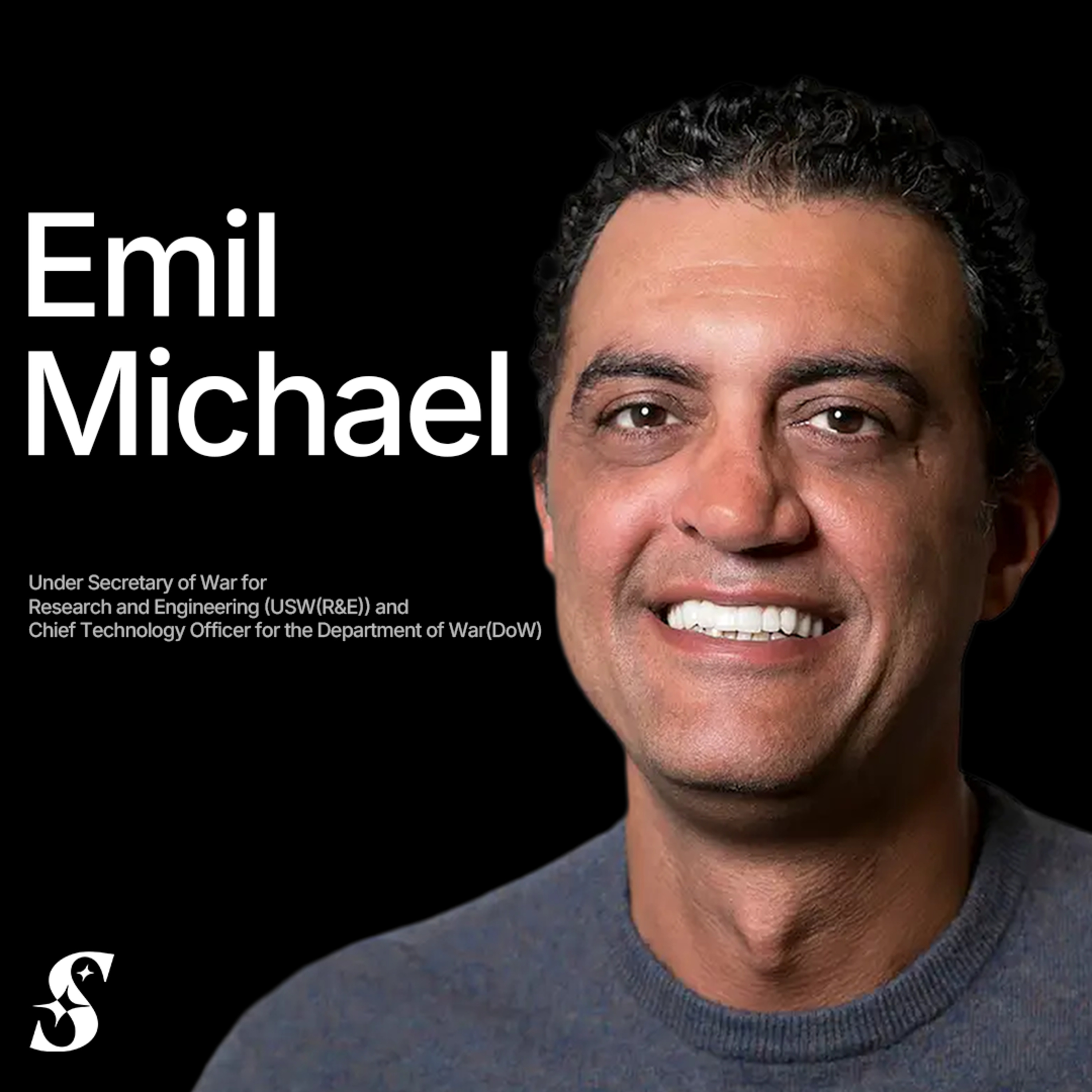

The Under Secretary of War's primary job is not just to fund technology, but to actively cultivate an ecosystem of new defense contractors. The stated goal is to create five more major companies capable of challenging established primes like Lockheed Martin, fostering competition and bringing new capabilities into the defense sector.

A major upcoming change in the National Defense Authorization Act (NDAA) is the removal of "past performance" as a key criterion in procurement. This rule has historically favored large, incumbent defense contractors over innovative startups. Eliminating it allows new companies to compete on the merits of their technology, representing a significant unlock for the entire defense tech ecosystem.

The defense tech sector is experiencing a perfect storm. This 'golden triangle' consists of: 1) Desperate customers in the Pentagon and Congress seeking innovation, 2) A wave of experienced founders graduating from successful firms like SpaceX and Anduril, and 3) Abundant downstream capital ready to fund growth.

Traditional defense primes are coupled to customer requirements and won't self-fund speculative projects. "Neo primes" like Epirus operate like product companies, investing their own capital to address military capability gaps, proving out new technologies, and then selling the finished solution.

A surge in capital expenditure indicates rising corporate confidence and, more importantly, a strategic pivot. Companies are moving away from passive stock repurchases, showing an urgency to pursue active growth through investments and acquisitions.

The go-to-market strategy for defense startups has evolved. While the first wave (e.g., Anduril) had to compete directly with incumbents, the 'Defense 2.0' cohort can grow much faster. They act as suppliers and partners to legacy prime contractors, who are now actively seeking to integrate their advanced technology.