Pizza chains historically dominated food delivery because they had their own drivers. The rise of apps like DoorDash and Uber Eats has given every restaurant access to a delivery fleet, eroding pizza's core moat and contributing to its decline from its peak popularity.

Related Insights

Domino's became a top-performing stock not by having the best pizza, but by focusing on convenience through technology. Their app created a direct customer relationship, enabling better targeting and a smoother experience. This tech advantage transitioned into a physical world distribution and scale advantage.

In the competitive food delivery market, service fees frustrate both customers and restaurants. By eliminating this key fee, similar to Robinhood's disruption of trading commissions, DoorDash could become the preferred platform. Shifting to a subscription model like Costco would foster immense goodwill and lock in loyalty.

Dara Khosrowshahi predicts the restaurant industry is splitting. One path is pure utility, optimized for delivery via dark kitchens. The other is pure romance, focused on in-person hospitality and ambiance. Restaurants that fail to excel at one or the other and get stuck in the middle will lose share.

While competitors viewed capital as a strategic weapon, DoorDash focused on capital efficiency. Their goal was to be twice as effective with every dollar spent on customer acquisition. Lin emphasizes that capital is fuel, but it's useless without a 'fire burning'—a product with real engagement.

While many see autonomous vehicles as a threat to Uber's ride-hailing, its delivery segment may be more important and defensible. Automating last-mile delivery of goods from varied locations is significantly more complex and less economical than automating passenger transport, providing a durable moat.

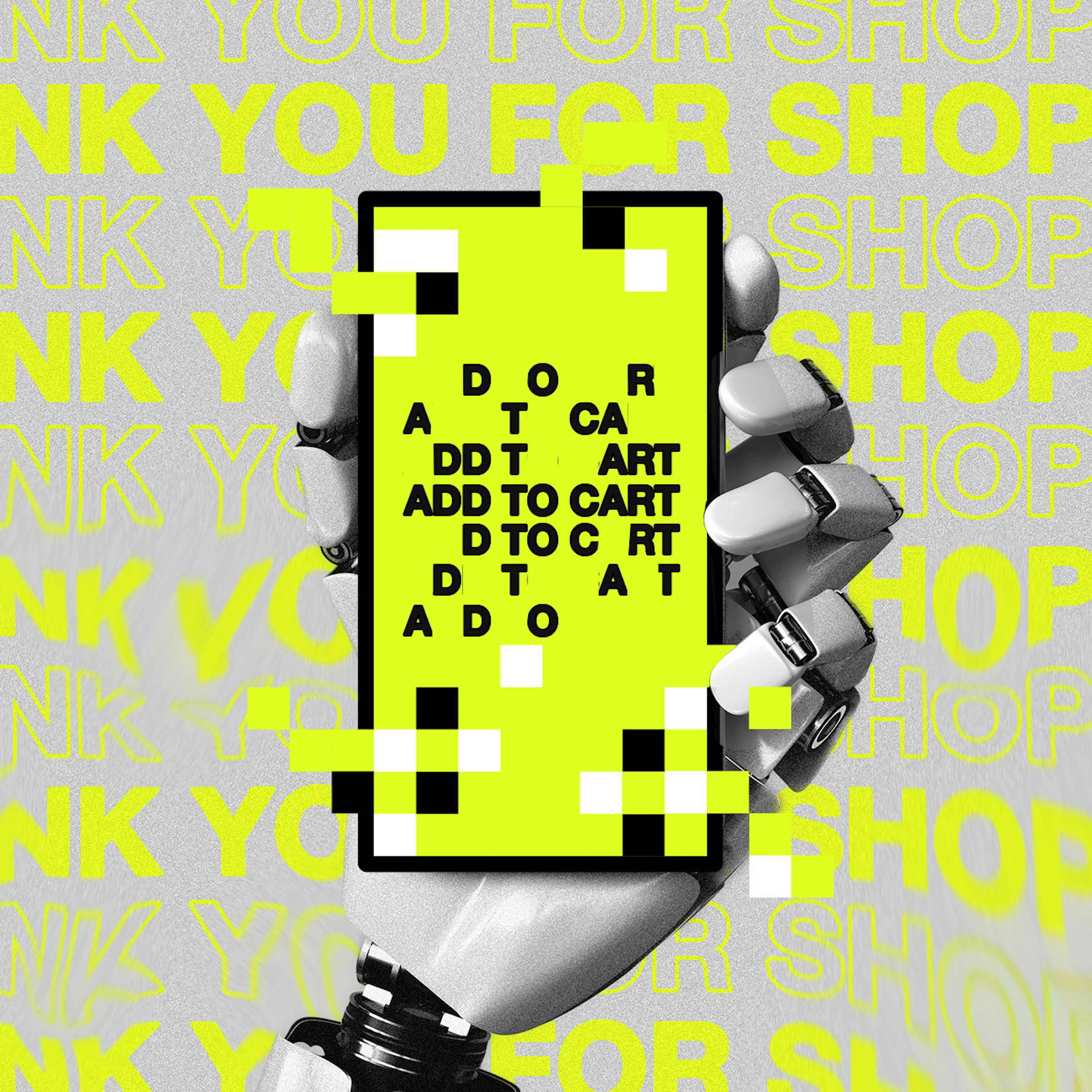

The "DoorDash Problem" posits that AI agents could reduce service platforms like Uber and Airbnb to mere commodity providers. By abstracting away the user interface, agents eliminate crucial revenue streams like ads, loyalty programs, and upsells. This shifts the customer relationship to the AI, eroding the core business model of the App Store economy's biggest winners.

The market often misjudges companies like DoorDash by focusing on the high-level service (food delivery) while missing the massive, compounding value created by its obsessive focus on fine-grained logistical details. These small, chained-together improvements create a powerful, hard-to-replicate moat over time.

Instead of creating a market expansion strategy from scratch, ServiceUp explicitly copied the playbook of DoorDash, a successful three-sided marketplace in an adjacent vertical. This involved entering a new city and simultaneously acquiring customers, suppliers (shops), and drivers, accelerating growth.

While massive "kingmaking" funding rounds can accelerate growth, they don't guarantee victory. A superior product can still triumph over a capital-rich but less-efficient competitor, as seen in the DoorDash vs. Uber Eats battle. Capital can create inefficiency and unforced errors.

New technology like AI doesn't automatically displace incumbents. Established players like DoorDash and Google successfully defend their turf by leveraging deep-rooted network effects (e.g., restaurant relationships, user habits). They can adopt or build competing tech, while challengers struggle to replicate the established ecosystem.