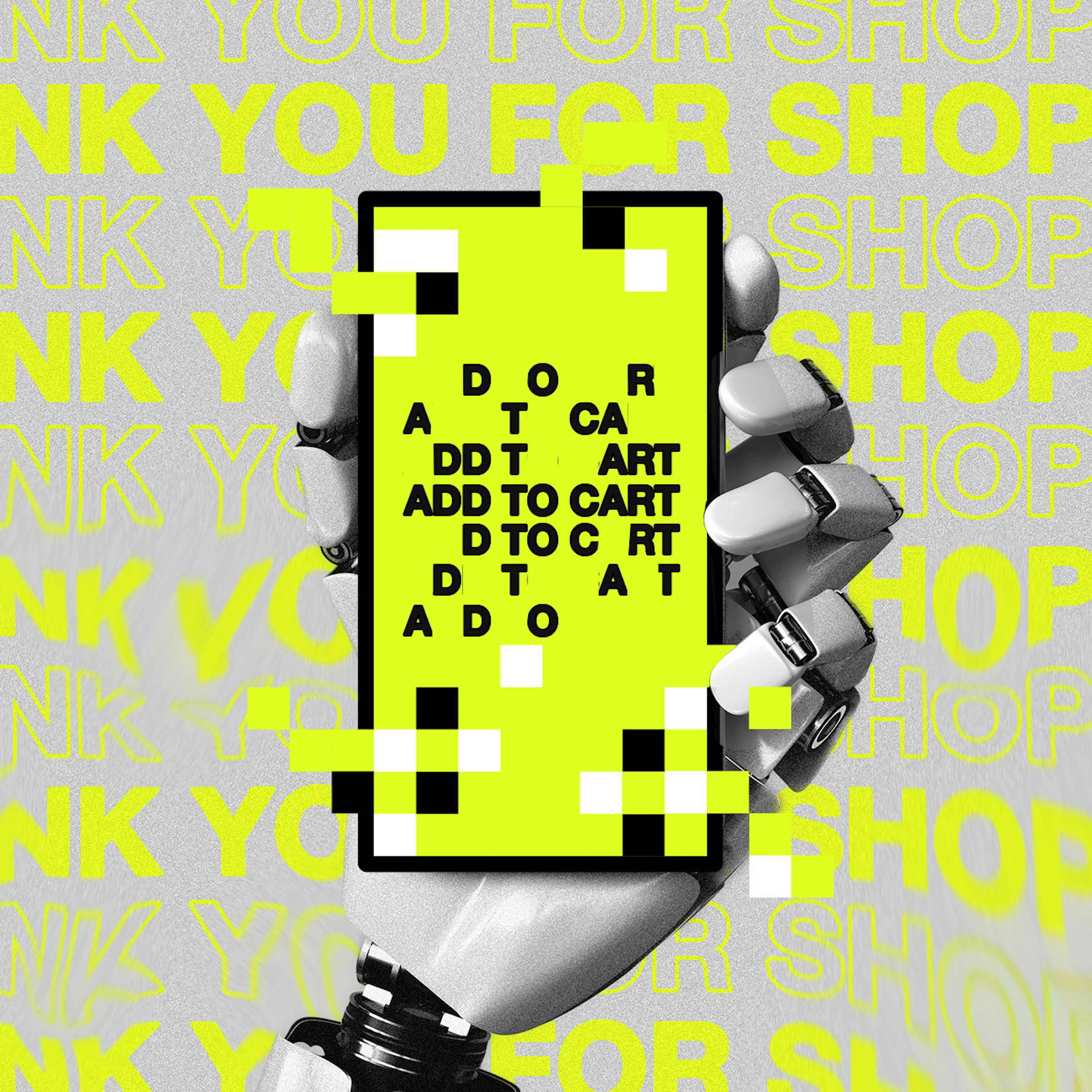

The "DoorDash Problem" posits that AI agents could reduce service platforms like Uber and Airbnb to mere commodity providers. By abstracting away the user interface, agents eliminate crucial revenue streams like ads, loyalty programs, and upsells. This shifts the customer relationship to the AI, eroding the core business model of the App Store economy's biggest winners.

Related Insights

Traditional SaaS companies are trapped by their per-seat pricing model. Their own AI agents, if successful, would reduce the number of human seats needed, cannibalizing their core revenue. AI-native startups exploit this by using value-based pricing (e.g., tasks completed), aligning their success with customer automation goals.

CEOs of platforms like ZocDoc and TaskRabbit are not worried about AI agent disruption. They believe the immense complexity of managing their real-world networks—like integrating with chaotic healthcare systems or vetting thousands of workers—is a defensible moat that pure software agents cannot easily replicate, giving them leverage over AI companies.

While many see autonomous vehicles as a threat to Uber's ride-hailing, its delivery segment may be more important and defensible. Automating last-mile delivery of goods from varied locations is significantly more complex and less economical than automating passenger transport, providing a durable moat.

For current AI valuations to be realized, AI must deliver unprecedented efficiency, likely causing mass job displacement. This would disrupt the consumer economy that supports these companies, creating a fundamental contradiction where the condition for success undermines the system itself.

Unlike service platforms like Uber that rely on real-world networks, Amazon's high-margin ad business is existentially threatened by AI agents that bypass sponsored listings. This vulnerability explains its uniquely aggressive legal stance against Perplexity, as it stands to lose a massive, growing revenue stream if users stop interacting directly with its site.

Service company CEOs believe strong brand loyalty is their primary defense against the "DoorDash Problem." Lyft's CEO argues that users are more likely to ask an AI specifically for "a Lyft" rather than a generic "ride." They are investing in brand to ensure they are requested by name, preventing them from being disintermediated and reduced to the cheapest commodity option.

Unlike traditional SaaS where high switching costs prevent price wars, the AI market faces a unique threat. The portability of prompts and reliance on interchangeable models could enable rapid commoditization. A price war could be "terrifying" and "brutal" for the entire ecosystem, posing a significant downside risk.

Similar to how mobile gave rise to the App Store, AI platforms like OpenAI and Perplexity will create their own ecosystems for discovering and using services. The next wave of winning startups will be those built to distribute through these new agent-based channels, while incumbents may be slow to adapt.

Dominant aggregator platforms are often misjudged as being vulnerable to technological disruption (e.g., Uber vs. robo-taxis). Their real strength lies in their network, allowing them to integrate and offer new technologies from various providers, thus becoming beneficiaries rather than victims of innovation.

New technology like AI doesn't automatically displace incumbents. Established players like DoorDash and Google successfully defend their turf by leveraging deep-rooted network effects (e.g., restaurant relationships, user habits). They can adopt or build competing tech, while challengers struggle to replicate the established ecosystem.