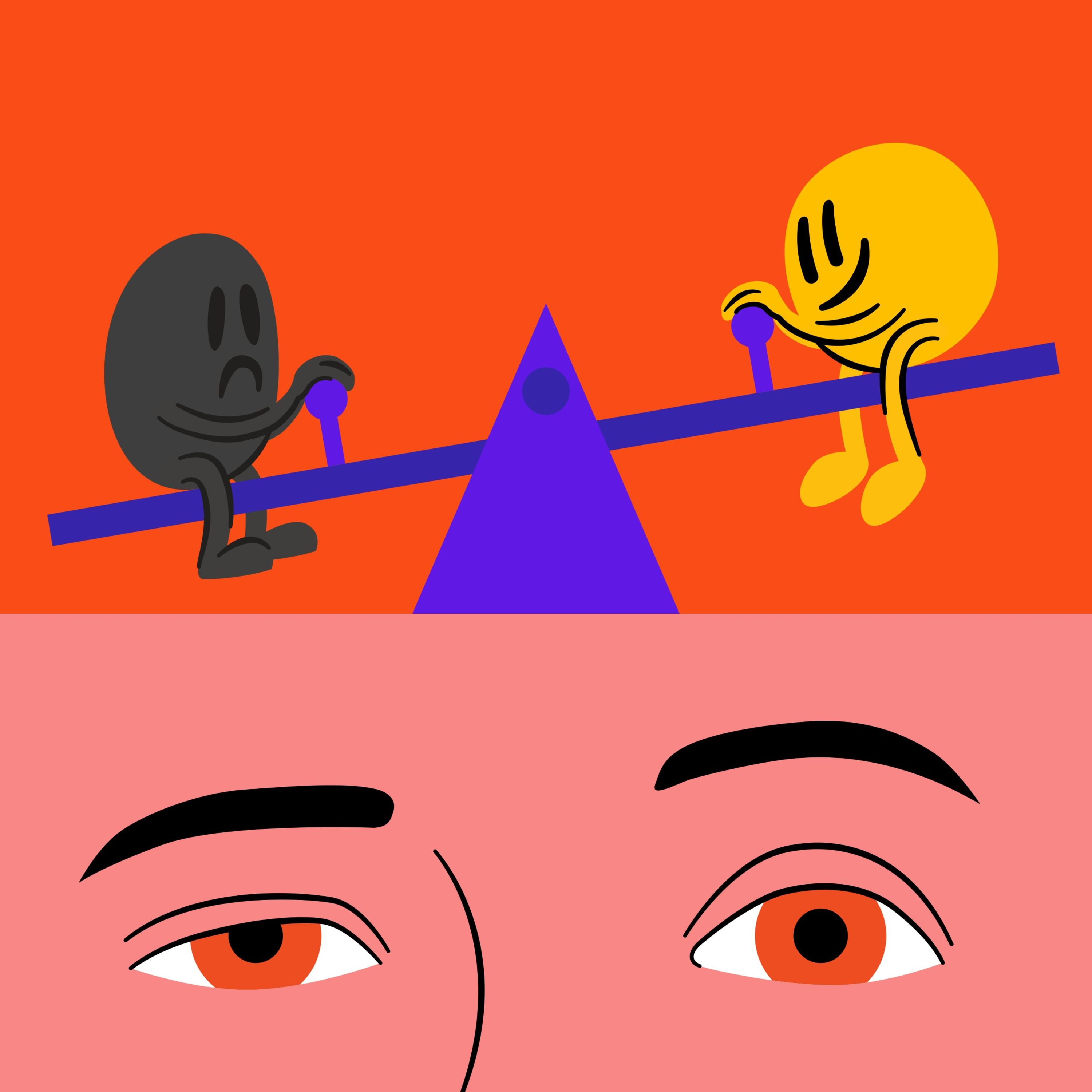

Making high-stakes products (finance, health) easy and engaging risks encouraging overuse or uninformed decisions. The solution isn't restricting access but embedding education into the user journey to empower informed choices without being paternalistic.

Related Insights

Reducing the number of clicks is a misguided metric. A process with eight trivially easy clicks is better than one with two fraught, confusing decisions. Each decision burns cognitive energy and risks making the user feel stupid. The ultimate design goal should be to prevent users from having to think.

Modern society turns normal behaviors like eating or gaming into potent drugs by manipulating four factors: making them infinitely available (quantity/access), more intense (potency), and constantly new (novelty). This framework explains how behavioral addictions are engineered, hijacking the brain’s reward pathways just like chemical substances.

The obsession with removing friction is often wrong. When users have low intent or understanding, the goal isn't to speed them up but to build their comprehension of your product's value. If software asks you to make a decision you don't understand, it makes you feel stupid, which is the ultimate failure.

The antidote to the destructive, isolating risk of online gambling is not risk aversion, but the redirection of that appetite toward constructive, real-world challenges. This involves encouraging social risks like approaching strangers, asking someone out, and investing in relationships—actions that build character and connection rather than draining finances.

Don't design solely for the user. The best product opportunities lie at the nexus of what users truly need (not what they say they want), the company's established product principles, and its core business objectives.

Unlike other tech verticals, fintech platforms cannot claim neutrality and abdicate responsibility for risk. Providing robust consumer protections, like the chargeback process for credit cards, is essential for building the user trust required for mass adoption. Without that trust, there is no incentive for consumers to use the product.

In 'unsexy' yet vital industries like finance and healthcare, product success requires mastering complex regulations while simultaneously transforming user fear into engagement through delightful, educational experiences. The mission's profound impact justifies the difficulty and attracts talent.

The principles influencing shoppers are not limited to retail; they are universal behavioral nudges. These same tactics are applied in diverse fields like public health (default organ donation), finance (apps gamifying saving), and even urban planning (painting eyes on bins to reduce littering), proving their broad applicability to human behavior.

To navigate regulatory hurdles and build user trust, Robinhood deliberately sequenced its AI rollout. It started by providing curated, factual information (e.g., 'why did a stock move?') before attempting to offer personalized advice or recommendations, which have a much higher legal and ethical bar.

Avoid the 'settings screen' trap where endless customization options cater to a vocal minority but create complexity for everyone. Instead, focus on personalization: using behavioral data to intelligently surface the right features to the right users, improving their experience without adding cognitive load for the majority.