While tech giants could technically replicate Perplexity, their core business models—advertising for Google, e-commerce for Amazon—create a fundamental conflict of interest. An independent player can align purely with the user's best interests, creating a strategic opening that incumbents are structurally unable to fill without cannibalizing their primary revenue streams.

Related Insights

Tech giants like Google and Meta are positioned to offer their premium AI models for free, leveraging their massive ad-based business models. This strategy aims to cut off OpenAI's primary revenue stream from $20/month subscriptions. For incumbents, subsidizing AI is a strategic play to acquire users and boost market capitalization.

Perplexity's CEO, Aravind Srinivas, translated a core principle from his PhD—that every claim needs a citation—into a key product feature. By forcing AI-generated answers to reference authoritative sources, Perplexity built trust and differentiated itself from other AI models.

Incumbents are disincentivized from creating cheaper, superior products that would cannibalize existing high-margin revenue streams. Organizational silos also hinder the creation of blended solutions that cross traditional product lines, creating opportunities for startups to innovate in the gaps.

While competitors focus on subscription models for their AI tools, Google's primary strategy is to leverage its core advertising business. By integrating sponsored results into its AI-powered search summaries, Google is the first to turn on an ad-based revenue model for generative AI at scale, posing a significant threat to subscription-reliant players like OpenAI.

Fal strategically focused on generative media over LLMs, identifying it as a "net new" market. They reasoned that LLM inference directly competed with Google's core search business—a fight an incumbent would win at all costs. The emergent media market lacked a dominant player, creating a perfect greenfield opportunity for a startup to lead and define.

AI favors incumbents more than startups. While everyone builds on similar models, true network effects come from proprietary data and consumer distribution, both of which incumbents own. Startups are left with narrow problems, but high-quality incumbents are moving fast enough to capture these opportunities.

Incumbents face the innovator's dilemma; they can't afford to scrap existing infrastructure for AI. Startups can build "AI-native" from a clean sheet, creating a fundamental advantage that legacy players can't replicate by just bolting on features.

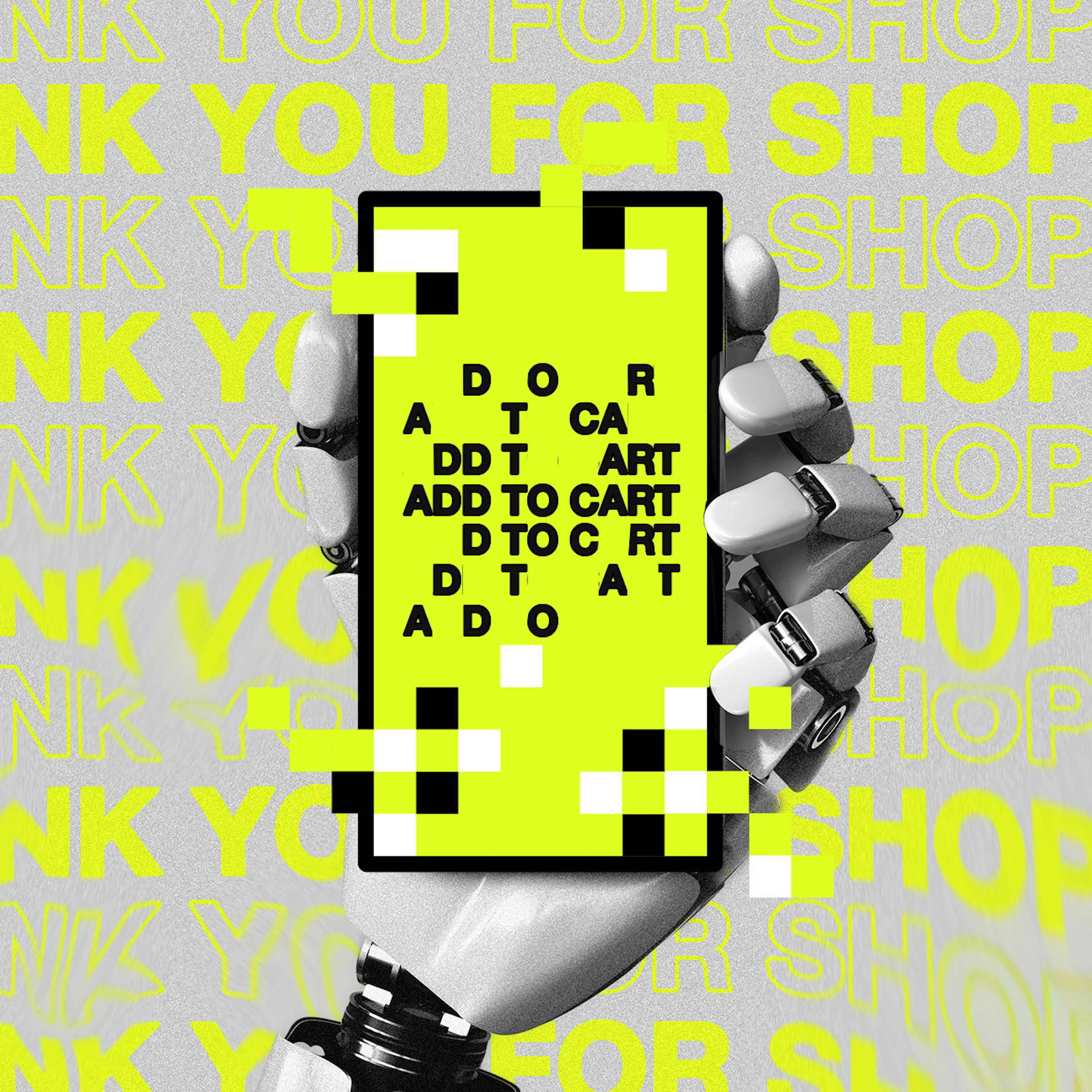

Unlike service platforms like Uber that rely on real-world networks, Amazon's high-margin ad business is existentially threatened by AI agents that bypass sponsored listings. This vulnerability explains its uniquely aggressive legal stance against Perplexity, as it stands to lose a massive, growing revenue stream if users stop interacting directly with its site.

As the current low-cost producer of AI tokens via its custom TPUs, Google's rational strategy is to operate at low or even negative margins. This "sucks the economic oxygen out of the AI ecosystem," making it difficult for capital-dependent competitors to justify their high costs and raise new funding rounds.

Google can dedicate nearly all its resources to AI product development because its core business handles infrastructure and funding. In contrast, OpenAI must constantly focus on fundraising and infrastructure build-out. This mirrors the dynamic where a focused Facebook outmaneuvered a distracted MySpace, highlighting a critical incumbent advantage.

![Gavin Baker - Nvidia v. Google, Scaling Laws, and the Economics of AI - [Invest Like the Best, EP.451] thumbnail](https://megaphone.imgix.net/podcasts/d97fee14-d4d7-11f0-8951-8324b640c1c1/image/d3a8b5ecbf3957de5b91f278a191c9ff.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)