Blue Origin's CEO reframes the competition with SpaceX not as a zero-sum game, but as a strategic necessity for the United States. He argues the U.S. needs two vigorous, competing launch companies to drive innovation and maintain its edge against global adversaries, a sophisticated positioning that lobbies for continued support.

Related Insights

Jeff Bezos predicts Blue Origin will become his most significant business, bigger than Amazon. The launch of TerraWave, a satellite internet network for enterprise and government, indicates a strategic focus on infrastructure over tourism.

The next wave of space companies is moving away from the vertically integrated "SpaceX model" where everything is built in-house. Instead, a new ecosystem is emerging where companies specialize in specific parts of the stack, such as satellite buses or ground stations. This unbundling creates efficiency and lowers barriers to entry for new players.

SpaceX's dominant position can be framed for an IPO not as a player in terrestrial industries, but as the owner of 90% of the entire universe's launch capabilities. This narrative positions it as controlling the infrastructure for all future off-planet economies, from connectivity to defense, dwarfing Earth-bound tech giants.

Despite trailing SpaceX by 10 years, Jeff Bezos's Blue Origin demonstrates that in capital-intensive industries like space, long-term persistence funded by a founder's deep pockets can overcome a significant time deficit—a strategy unviable for typical VC-backed startups.

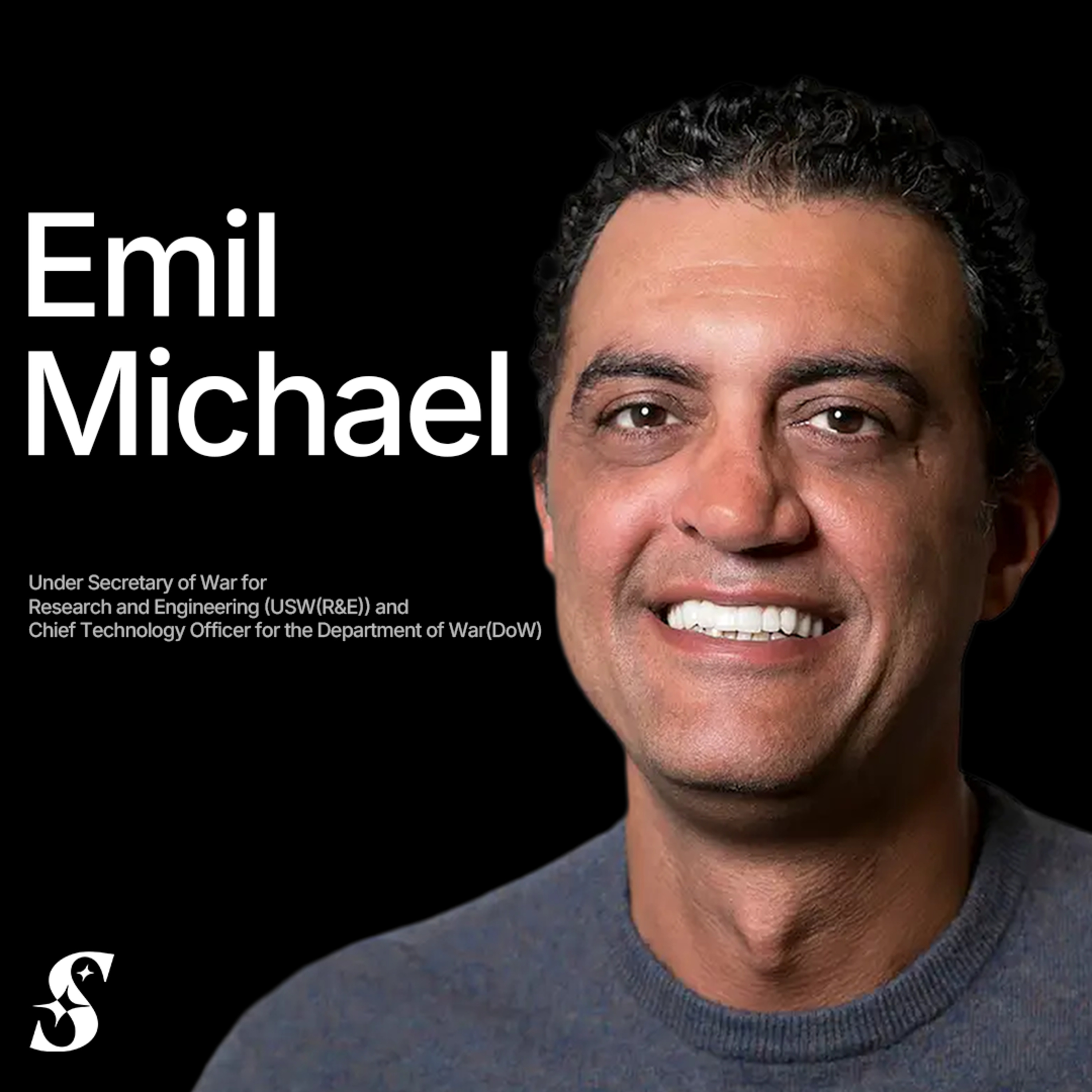

The Under Secretary of War's primary job is not just to fund technology, but to actively cultivate an ecosystem of new defense contractors. The stated goal is to create five more major companies capable of challenging established primes like Lockheed Martin, fostering competition and bringing new capabilities into the defense sector.

SpaceX's regular tender offers provide employees with life-changing liquidity, creating a powerful incentive that rival Blue Origin lacks. This 'unfair advantage' in compensation structure is crucial in the long-term war for elite aerospace talent, going beyond just salary.

A major shift in government procurement for space defense now favors startups. The need for rapid innovation in a newly contested space environment has moved the government from merely tolerating startups to actively seeking them out over traditional prime contractors.

Elon Musk's idea for a space-based data center was initially met with skepticism in the West. It was immediately legitimized as a serious geopolitical frontier when Chinese state media announced a competing national project, transforming an incredulous concept into another front in the global AI power struggle.

Beyond its technical lead, SpaceX holds a key recruiting advantage over rivals like Blue Origin by offering regular tender offers. This provides employees with consistent, tangible liquidity for their stock options, making compensation feel more valuable and attracting top talent.

While being a decade behind a competitor like SpaceX would be a death sentence in software, it's a winning strategy in industries like space exploration where massive capital and persistence can overcome a time deficit. The barrier to entry is capital, not just speed.