A major shift in government procurement for space defense now favors startups. The need for rapid innovation in a newly contested space environment has moved the government from merely tolerating startups to actively seeking them out over traditional prime contractors.

Related Insights

The Department of Defense is moving from rigid, program-specific contracts to a portfolio model. New Portfolio Acquisition Executives can now reallocate funds from underperforming projects to more promising startups mid-stream, rewarding agility and results over incumbency.

The conflict in Ukraine exposed the vulnerability of expensive, "exquisite" military platforms (like tanks) to inexpensive technologies (like drones). This has shifted defense priorities toward cheap, mass-producible, "attritable" systems. This fundamental change in product and economics creates a massive opportunity for startups to innovate outside the traditional defense prime model.

Luckey reveals that Anduril prioritized institutional engagement over engineering in its early days, initially hiring more lawyers and lobbyists. The biggest challenge wasn't building the technology, but convincing the Department of Defense and political stakeholders to believe in a new procurement model, proving that shaping the system is a prerequisite for success.

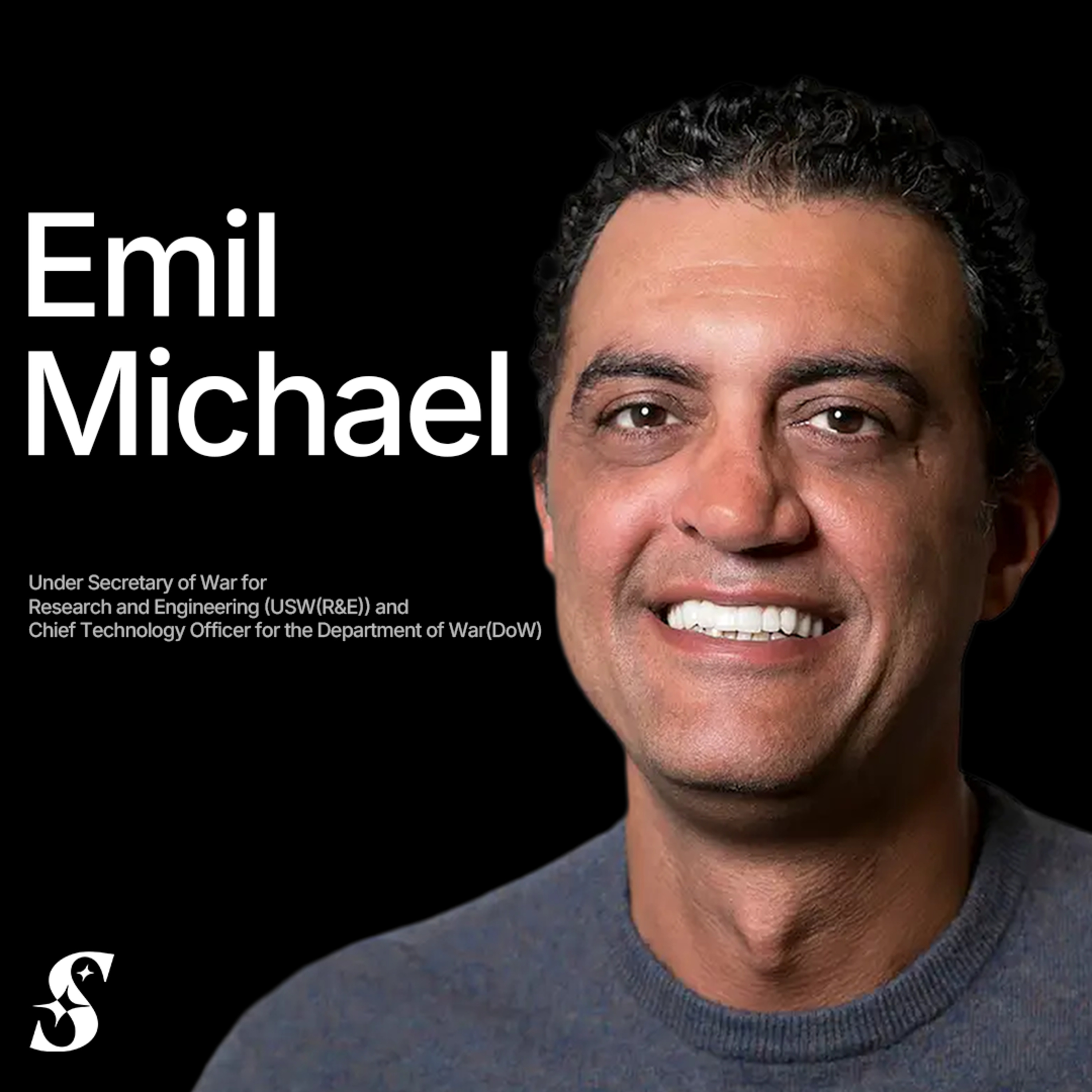

The Under Secretary of War's primary job is not just to fund technology, but to actively cultivate an ecosystem of new defense contractors. The stated goal is to create five more major companies capable of challenging established primes like Lockheed Martin, fostering competition and bringing new capabilities into the defense sector.

A major upcoming change in the National Defense Authorization Act (NDAA) is the removal of "past performance" as a key criterion in procurement. This rule has historically favored large, incumbent defense contractors over innovative startups. Eliminating it allows new companies to compete on the merits of their technology, representing a significant unlock for the entire defense tech ecosystem.

Unlike traditional contractors paid for time and materials, Anduril invests its own capital to develop products first. This 'defense product company' model aligns incentives with the government's need for speed and effectiveness, as profits are tied to rapid, successful delivery, not prolonged development cycles.

The defense tech sector is experiencing a perfect storm. This 'golden triangle' consists of: 1) Desperate customers in the Pentagon and Congress seeking innovation, 2) A wave of experienced founders graduating from successful firms like SpaceX and Anduril, and 3) Abundant downstream capital ready to fund growth.

The US government no longer just funds defense-specific space tech. It now mandates that startups demonstrate a clear dual-use commercialization plan, ensuring the technology fosters a broader economic ecosystem and isn't solely reliant on defense budgets.

Traditional defense primes are coupled to customer requirements and won't self-fund speculative projects. "Neo primes" like Epirus operate like product companies, investing their own capital to address military capability gaps, proving out new technologies, and then selling the finished solution.

The go-to-market strategy for defense startups has evolved. While the first wave (e.g., Anduril) had to compete directly with incumbents, the 'Defense 2.0' cohort can grow much faster. They act as suppliers and partners to legacy prime contractors, who are now actively seeking to integrate their advanced technology.

![Palmer Luckey - Inventing the Future of Defense - [Invest Like the Best, CLASSICS] thumbnail](https://megaphone.imgix.net/podcasts/f7c9aa8e-cb8d-11f0-828e-0b281809c10a/image/cc07f91ec47f95abbde771a4956b37b7.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)