With Seed-to-A conversion below 20%, VCs are intensely vetting revenue quality. They are wary of "vibe ARR" inflated by pilots, credits, or non-recurring fees. Founders must demonstrate true, sticky recurring revenue with high customer loyalty and switching costs to secure a Series A.

Related Insights

Elias Torres argues that revenue is not the ultimate validator of a product. He has seen founders with $50 million in revenue who are "delusional" that their product truly works or is sticky. This time, he is prioritizing user obsession and product stickiness over early monetization to avoid this trap.

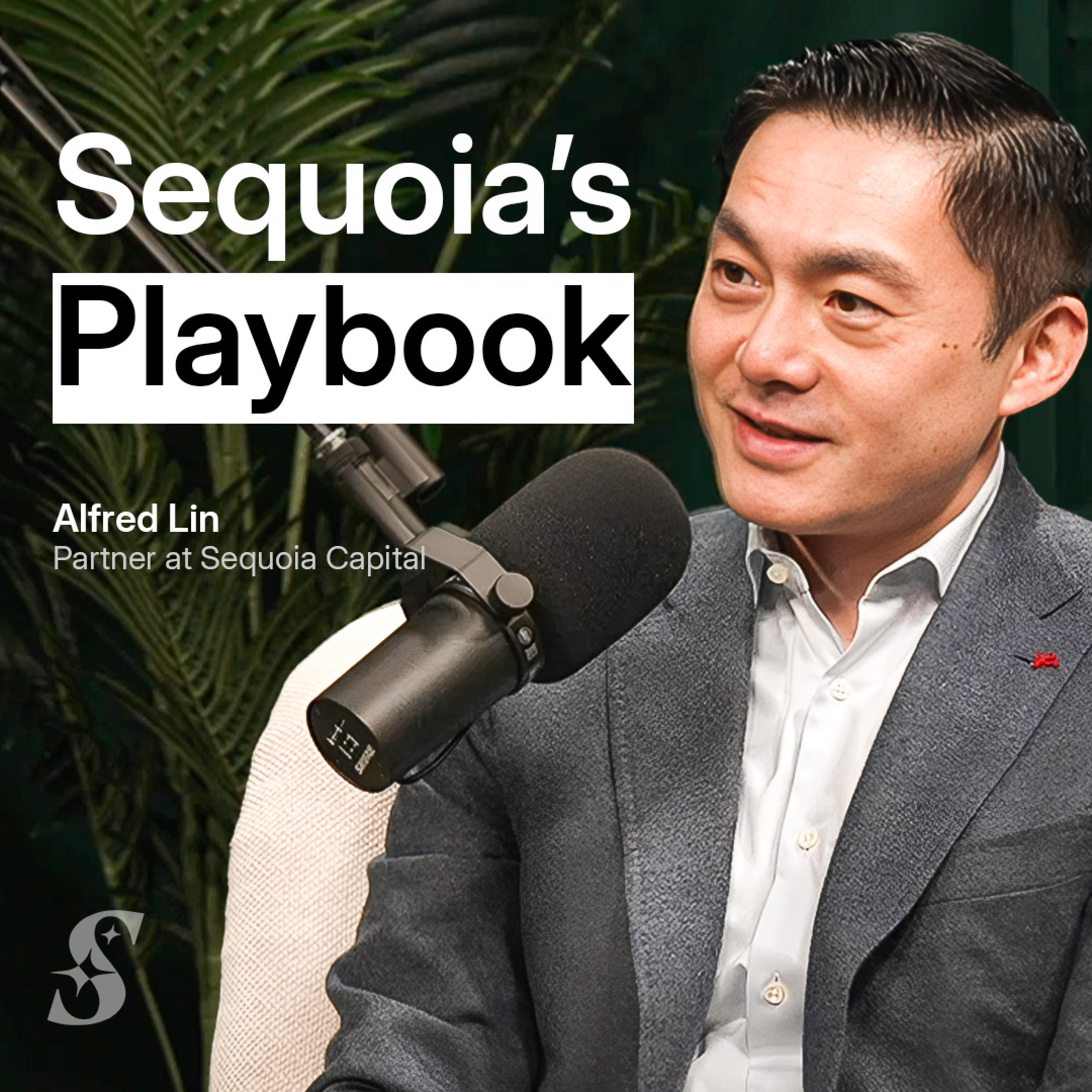

Lin warns that much of today's AI revenue is 'experimental,' where customers test solutions without long-term commitment. He calls annualizing this pilot revenue 'a joke.' He advises founders to prioritize slower, high-quality, high-retention revenue over fast, low-quality growth that will eventually churn.

Investors like Stacy Brown-Philpot and Aileen Lee now expect founders to demonstrate a clear, rapid path to massive scale early on. The old assumption that the next funding round would solve for scalability is gone; proof is required upfront.

Founders often mistake $1M ARR for product-market fit. The real milestone is proven repeatability: a predictable way to find and win a specific customer profile who reliably renews and expands. This signal of a scalable business model typically emerges closer to the $5M-$10M ARR mark.

Investors and acquirers pay premiums for predictable revenue, which comes from retaining and upselling existing customers. This "expansion revenue" is a far greater value multiplier than simply acquiring new customers, a metric most founders wrongly prioritize.

Venture rounds are compressing and conflating, with massive "seed" rounds of $30M+ essentially combining a seed and Series A. This sets a dangerous trap: the expectations for your next funding round will be equivalent to those of a traditional Series B company, dramatically raising the bar for growth.

Dynamic Signal generated millions in ARR, but analysis revealed customers treated the product like a one-off media buy, not a recurring software subscription. The high revenue hid an unsustainable, services-based model with low lifetime value.

Beyond outright fraud, startups often misrepresent financial health in subtle ways. Common examples include classifying trial revenue as ARR or recognizing contracts that have "out for convenience" clauses. These gray-area distinctions can drastically inflate a company's perceived stability and mislead investors.

Elite seed funds investing in YC companies with millions in ARR are effectively pre-Series A investors. Their portfolio companies can become profitable and scale significantly on seed capital alone ("seed strapping"), making the traditional "Series A graduation rate" an outdated measure of a seed fund's success.

While impressive, hypergrowth from zero to $100M+ ARR can be a red flag. The mechanics enabling such speed, like low-friction monthly subscriptions, often correlate with low switching costs, weak product depth, and poor long-term retention, resembling consumer apps more than enterprise SaaS.