Tipping creates an 'economic surplus' because consumers mentally discount its cost (a $1 tip feels like 80¢) while couriers inflate its value. This inefficiency gives tipping-enabled platforms a competitive advantage, making the feature almost inevitable for any delivery app to maximize revenue and compete effectively.

Related Insights

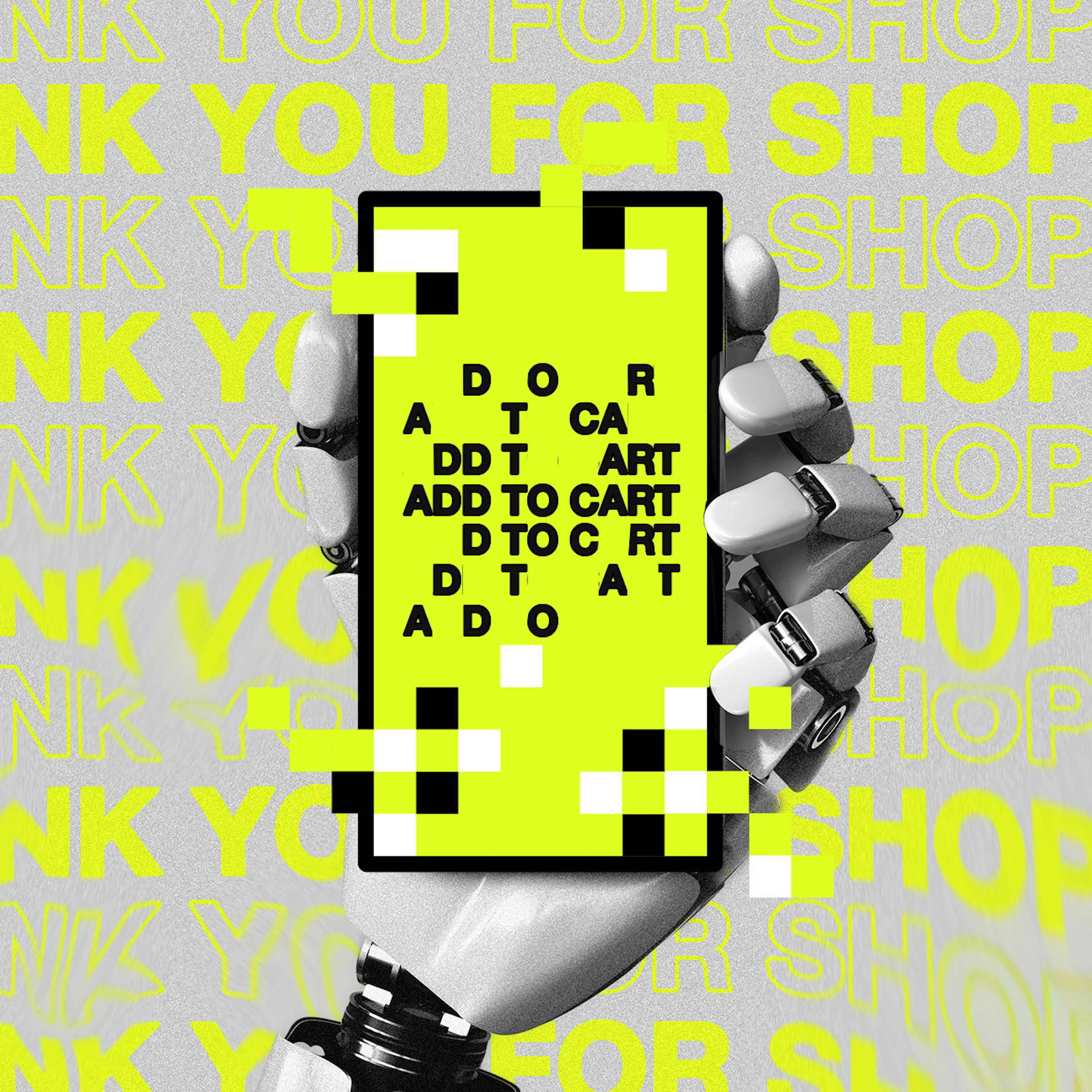

Businesses often launch with transparent, all-in pricing because it feels honest. However, as seen across e-commerce, strategies like partitioned pricing ($9.99 + shipping/tax) and added fees consistently convert better. This creates competitive pressure that makes adopting such psychological hacks almost inevitable for survival.

Instead of pre-negotiating revenue splits, Uber's CEO proposes allowing AI companies to integrate for free initially. This "experience first, economics later" approach prioritizes proving user value and measuring customer incrementality before determining a take rate. It’s a strategy focused on innovation speed over immediate monetization.

During major platform shifts like AI, it's tempting to project that companies will capture all the value they create. However, competitive forces ensure the vast majority of productivity gains (the "surplus") flows to end-users, not the technology creators.

While competitors viewed capital as a strategic weapon, DoorDash focused on capital efficiency. Their goal was to be twice as effective with every dollar spent on customer acquisition. Lin emphasizes that capital is fuel, but it's useless without a 'fire burning'—a product with real engagement.

Don't just ask customers about their business—independently verify it. When launching Uber Eats, the team couldn't get clear answers on restaurant economics. So they ordered food, weighed the ingredients, and built their own model, giving them the "ground truth" needed to confidently propose their pricing structure.

The principles influencing shoppers are not limited to retail; they are universal behavioral nudges. These same tactics are applied in diverse fields like public health (default organ donation), finance (apps gamifying saving), and even urban planning (painting eyes on bins to reduce littering), proving their broad applicability to human behavior.

Contrary to fearing a race to the bottom, Lyft's CEO encourages customers to compare prices with Uber. With only 30% market share and near-parity pricing, he believes Lyft would win a greater percentage of these direct comparisons, thus gaining market share.

Our willingness to pay isn't just about the product's utility. Richard Thaler's "transaction utility" concept shows context matters. We'll pay more for an identical beer from a boutique hotel than a beach shack, even if we drink it in the same spot, because our perception of a "fair" price is tied to the seller's perceived overheads.

The success of services like Uber isn't just about saving time; it's about the *perception* of convenience and control. A user might wait longer for an Uber than it would take to hail a cab, but the feeling of control from ordering on an app is so powerful that it overrides the actual loss of time. This psychological element is key.

Unlike industrial firms, digital marketplaces like Uber have immense operational leverage. Once the initial infrastructure is built, incremental revenue flows directly to the bottom line with minimal additional cost. The market can be slow to recognize this, creating investment opportunities in seemingly expensive stocks.

![David George - Building a16z Growth, Investing Across the AI Stack, and Why Markets Misprice Growth - [Invest Like the Best, EP.450] thumbnail](https://megaphone.imgix.net/podcasts/8da7dbd8-ceeb-11f0-941c-ef83bcdd4c9f/image/d44107bc94719f78fbe91befb141073e.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)