Contrary to fearing a race to the bottom, Lyft's CEO encourages customers to compare prices with Uber. With only 30% market share and near-parity pricing, he believes Lyft would win a greater percentage of these direct comparisons, thus gaining market share.

Related Insights

David Risher's turnaround plan started by reducing rider prices and increasing driver pay. The subsequent layoff of 26% of staff was a necessary consequence to fund these core customer-obsessed changes, rather than being the primary goal itself. This reordering of priorities put the customer experience first.

David Risher dismisses the zero-sum view of competing with Uber. He points out that the total rideshare market (2.5B annual rides) is dwarfed by the personal car market (160B rides). Lyft's true growth strategy is to convert personal car trips into rideshare, making direct competition a much smaller part of the picture.

Lyft's CEO argues the competition is not a binary battle with Uber for their combined 2.5 billion annual rides. Instead, the true target market is the 160 billion rides Americans take in their own cars. This reframes the opportunity from market share theft to massive market expansion and conversion.

Lyft maintains a 29-point advantage over competitors in driver preference. A key factor is their guarantee that drivers will never make less than 70% of what riders pay weekly, after insurance. This fosters loyalty and pride, acting as a competitive moat in the gig economy.

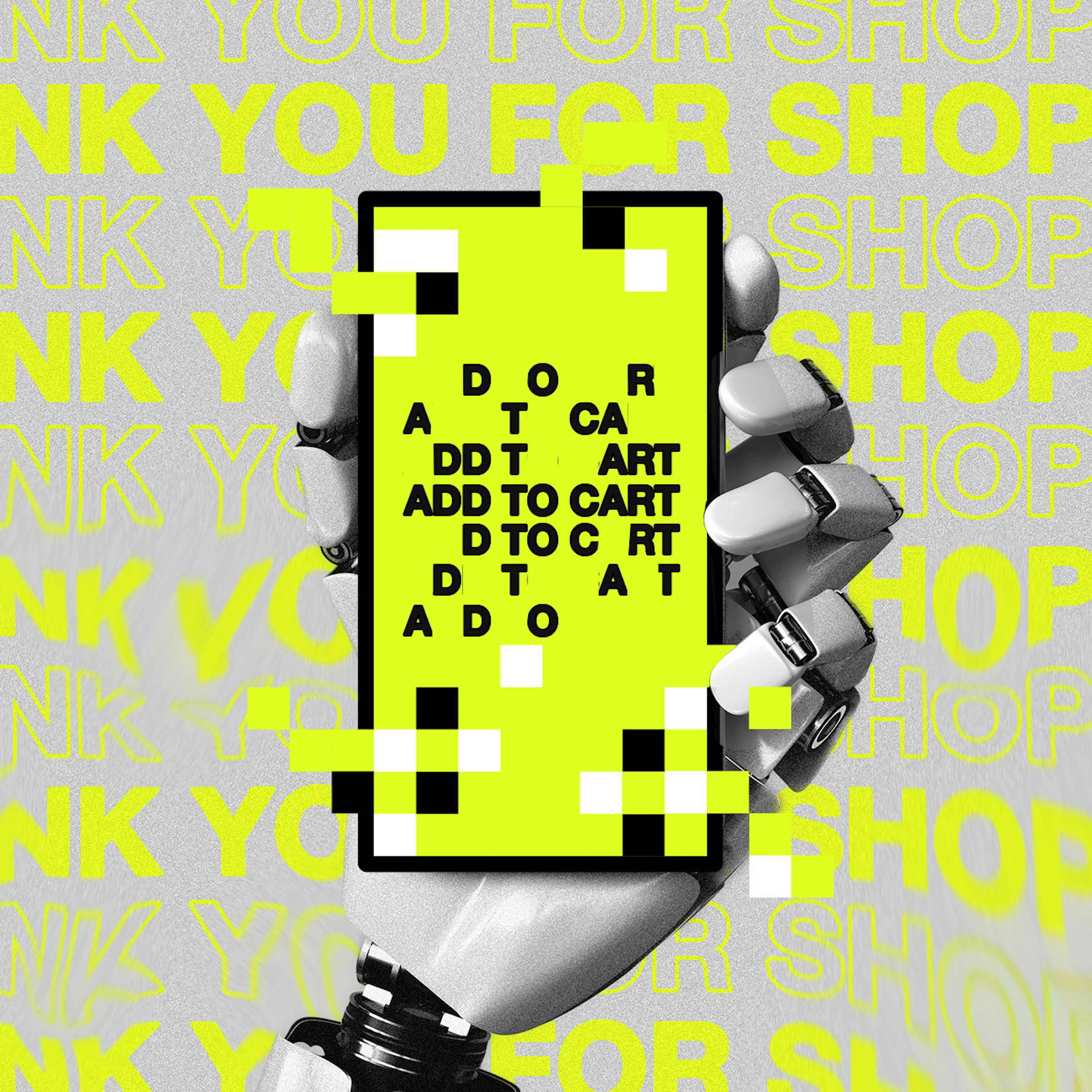

Lyft's CEO isn't overly concerned about AI agents commoditizing rideshare because the service is physical. Customers need to trust the safety and reliability of who picks them up, a factor that generic AI agents can't easily replicate or guarantee.

Service company CEOs believe strong brand loyalty is their primary defense against the "DoorDash Problem." Lyft's CEO argues that users are more likely to ask an AI specifically for "a Lyft" rather than a generic "ride." They are investing in brand to ensure they are requested by name, preventing them from being disintermediated and reduced to the cheapest commodity option.

CEO David Risher claims data refutes the idea that AVs displace human drivers. Instead, Lyft's growth is faster in cities with AVs like San Francisco and Phoenix. He suggests AVs "oxygenate the market," expanding overall demand for ridesharing rather than just cannibalizing existing rides.

To avoid platform decay, Lyft's CEO focuses on fixing severe customer annoyances, like driver cancellations. Even though a metric like 'ride completes' looked acceptable due to re-matching, he used his intuition to overrule a data-only approach, recognizing the frustrating user experience demanded a fix.

David Risher framed his decision to lay off over half the company not just as a cost-cutting measure, but as a strategic necessity. Slimming down the cost structure was the only way to afford competitive prices for riders and fair pay for drivers, the core of his customer-obsession thesis.

By driving for Lyft, CEO David Risher learned firsthand that surge pricing, while economically sound, creates immense daily stress for riders. This qualitative insight, which data might miss, led Lyft to remove $50 million in surge pricing and launch a 'Price Lock' subscription feature based directly on a passenger's story.