Private capital is more efficient for defense R&D than government grants, which involve burdensome oversight. Startups thrive when the government commits to buying finished products rather than funding prototypes, allowing VCs to manage the risk and de-burdening small companies.

Related Insights

The conflict in Ukraine exposed the vulnerability of expensive, "exquisite" military platforms (like tanks) to inexpensive technologies (like drones). This has shifted defense priorities toward cheap, mass-producible, "attritable" systems. This fundamental change in product and economics creates a massive opportunity for startups to innovate outside the traditional defense prime model.

Luckey reveals that Anduril prioritized institutional engagement over engineering in its early days, initially hiring more lawyers and lobbyists. The biggest challenge wasn't building the technology, but convincing the Department of Defense and political stakeholders to believe in a new procurement model, proving that shaping the system is a prerequisite for success.

The government's procurement process often defaults to bidding out projects to established players like Lockheed Martin, even if a startup presents a breakthrough. Success requires navigating this bureaucratic reality, not just superior engineering.

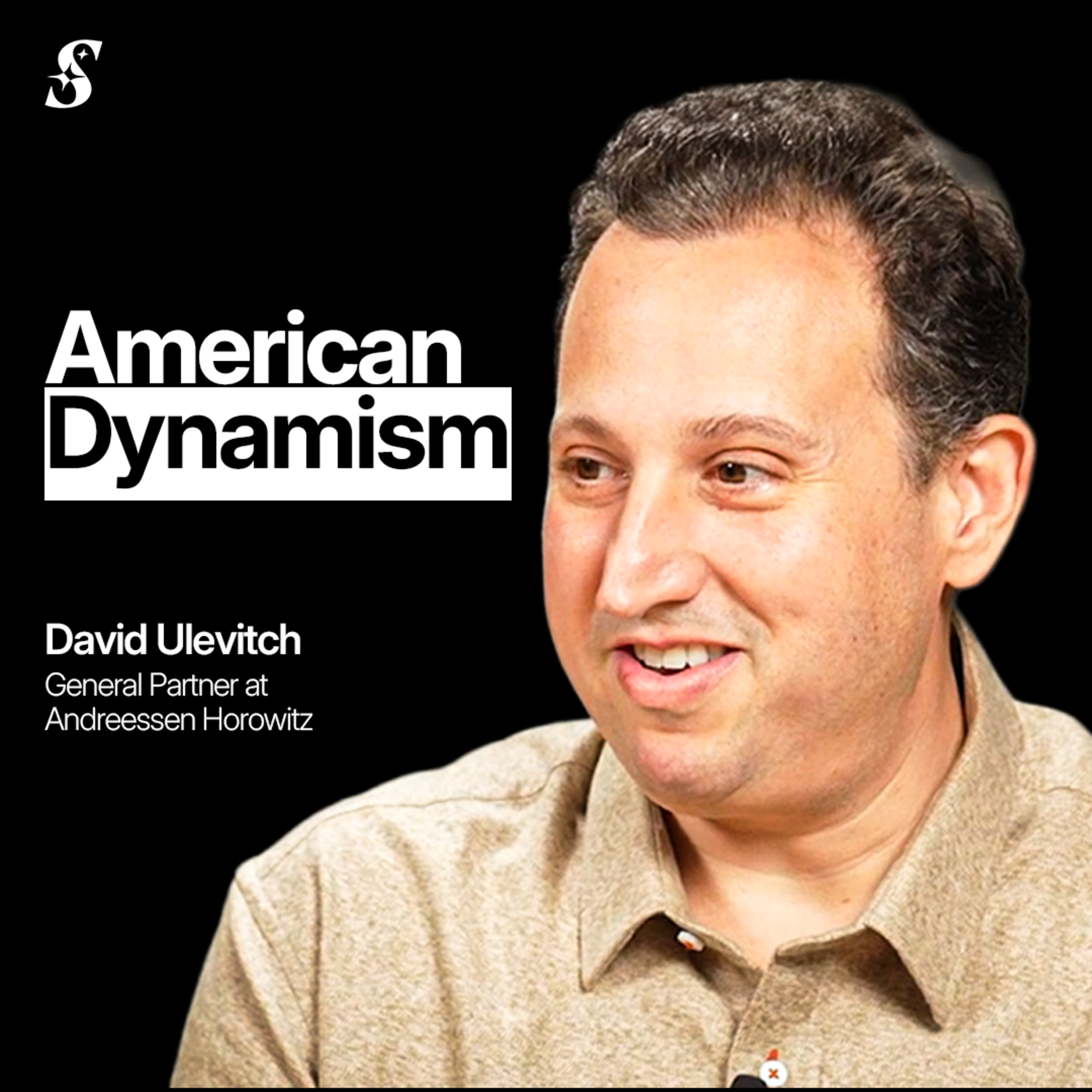

For its American Dynamism fund, Andreessen Horowitz provides more than capital; it fields a dedicated policy team in Washington D.C. This team works to change structural government problems, like defense procurement, creating a more favorable market for its portfolio and the broader startup ecosystem.

The most effective government role in innovation is to act as a catalyst for high-risk, foundational R&D (like DARPA creating the internet). Once a technology is viable, the government should step aside to allow private sector competition (like SpaceX) to drive down costs and accelerate progress.

Unlike traditional contractors paid for time and materials, Anduril invests its own capital to develop products first. This 'defense product company' model aligns incentives with the government's need for speed and effectiveness, as profits are tied to rapid, successful delivery, not prolonged development cycles.

The defense tech sector is experiencing a perfect storm. This 'golden triangle' consists of: 1) Desperate customers in the Pentagon and Congress seeking innovation, 2) A wave of experienced founders graduating from successful firms like SpaceX and Anduril, and 3) Abundant downstream capital ready to fund growth.

Many defense startups fail despite superior technology because the government isn't ready to purchase at scale. Anduril's success hinges on identifying when the customer is ready to adopt new capabilities within a 3-5 year window, making market timing its most critical decision factor.

The venture capital mantra that "hardware is hard" is outdated for the American Dynamism category. Startups in this space mitigate risk by integrating off-the-shelf commodity hardware with sophisticated software. This avoids the high capital costs and unpredictable sales cycles of consumer electronics.

Instead of ineffective grants to incumbents, the US should leverage its world-leading capital markets. By providing lightweight government backstops for private bank loans—absorbing partial default risk—it can de-risk private investment and unlock the massive capital needed for new factories without distorting market incentives.

![Palmer Luckey - Inventing the Future of Defense - [Invest Like the Best, CLASSICS] thumbnail](https://megaphone.imgix.net/podcasts/f7c9aa8e-cb8d-11f0-828e-0b281809c10a/image/cc07f91ec47f95abbde771a4956b37b7.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)