Investing in defense, energy, and public safety is not just another vertical. These foundational sectors uphold the stable democracy on which all other tech, like B2B SaaS, depends. A failure in these foundations renders investments in higher-level software and services worthless.

A key supply-side driver for the "American Dynamism" sector is the flow of experienced talent. Alumni from pioneering companies like Palantir, SpaceX, and Oculus are leaving to start new ventures, bringing deep domain expertise in building for complex government and industrial sectors.

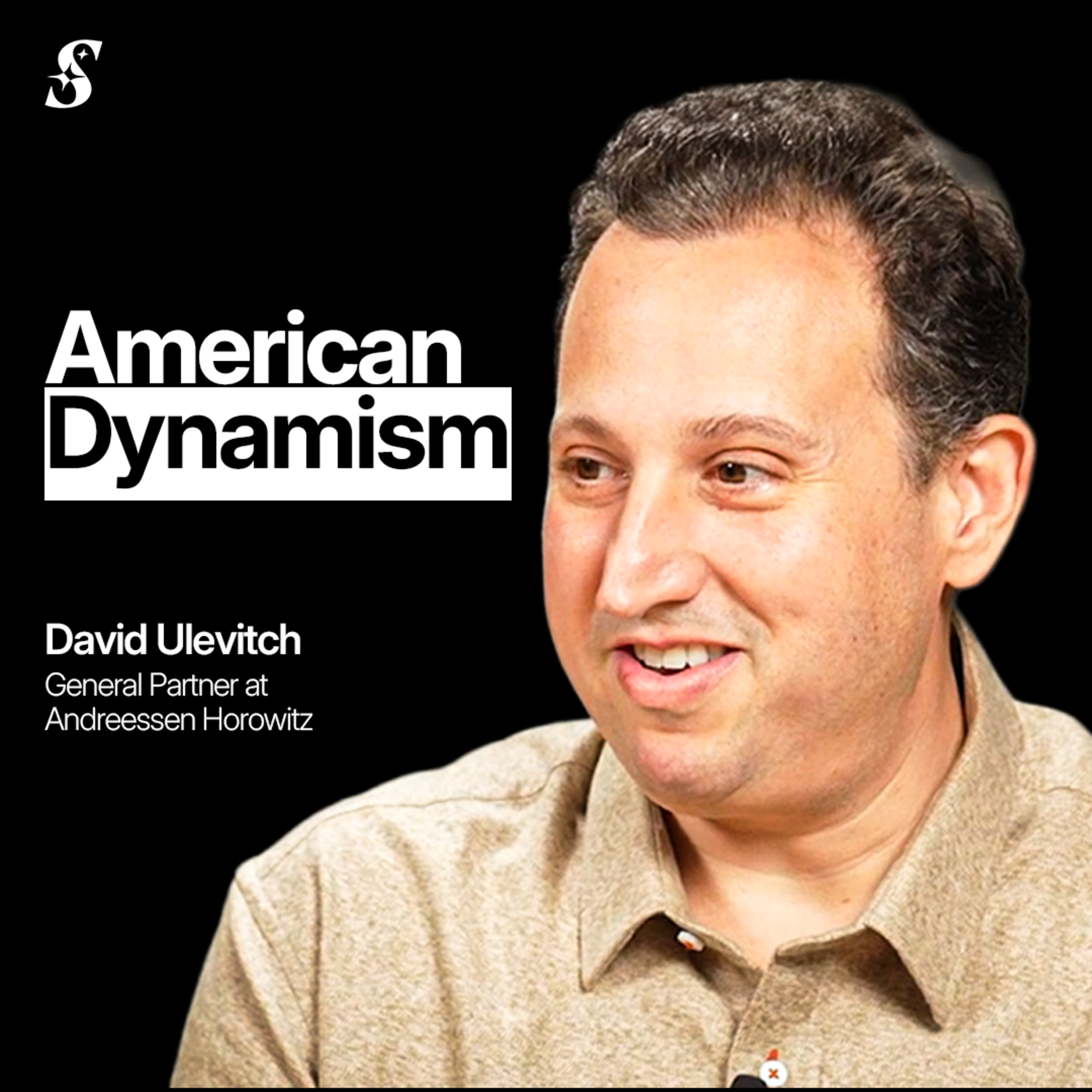

Andreessen Horowitz first established "American Dynamism" as a public narrative and investment practice, using its main venture fund for initial deals. This "meme-first" strategy built momentum and a track record, proving the thesis before they raised a dedicated, specialized fund.

In a tech climate wary of defense work, Anduril was "very unapologetic that they were a defense company." This clear, strong positioning acted as a crucial filter, repelling skeptical investors but attracting partners like Andreessen Horowitz who were fully aligned with their mission from the start.

Private capital is more efficient for defense R&D than government grants, which involve burdensome oversight. Startups thrive when the government commits to buying finished products rather than funding prototypes, allowing VCs to manage the risk and de-burdening small companies.

For its American Dynamism fund, Andreessen Horowitz provides more than capital; it fields a dedicated policy team in Washington D.C. This team works to change structural government problems, like defense procurement, creating a more favorable market for its portfolio and the broader startup ecosystem.