The core of the U.S. strategic deficit is not a lack of minerals but a bipartisan failure of leadership. Both public and private sectors are unwilling to make the long-term strategic investments necessary for national security if they don't yield immediate profits.

Related Insights

Politicians predictably declare initiatives for domestic production of critical goods like munitions or rare earths when dependencies are exposed. However, these declarations rarely translate into effective action, suggesting we must learn to manage economic entanglement as a form of mutual deterrence rather than wish it away.

The administration's explicit focus on re-shoring manufacturing and preparing for potential geopolitical conflict provides a clear investment playbook. Capital should flow towards commodities and companies critical to the military-industrial complex, such as producers of copper, steel, and rare earth metals.

The shift to a less adversarial China policy may be a strategic maneuver to avoid supply chain disruptions. The U.S. appears to be biding its time—likely for 5+ years—to wean itself off dependence on Chinese rare earth minerals, which are critical for both industry and defense manufacturing.

China's export ban on rare earth metals, critical for everything from iPhones to fighter jets, exposes a major US vulnerability. The solution is to treat domestic mining like vaccine development—a national security priority that requires fast-tracking the typical 30-year regulatory process for opening new mines.

China's leadership consists primarily of engineers who implement strategic, multi-year plans for infrastructure and technology. This contrasts sharply with the US, where a government of lawyers navigates short-term election cycles, hindering long-term national projects.

To combat China's ability to dump products and destabilize markets, the US government should act as a buyer of last resort for critical materials like rare earths. This would create a strategic reserve, similar to the petroleum reserve, ensuring price stability for domestic investment and manufacturing.

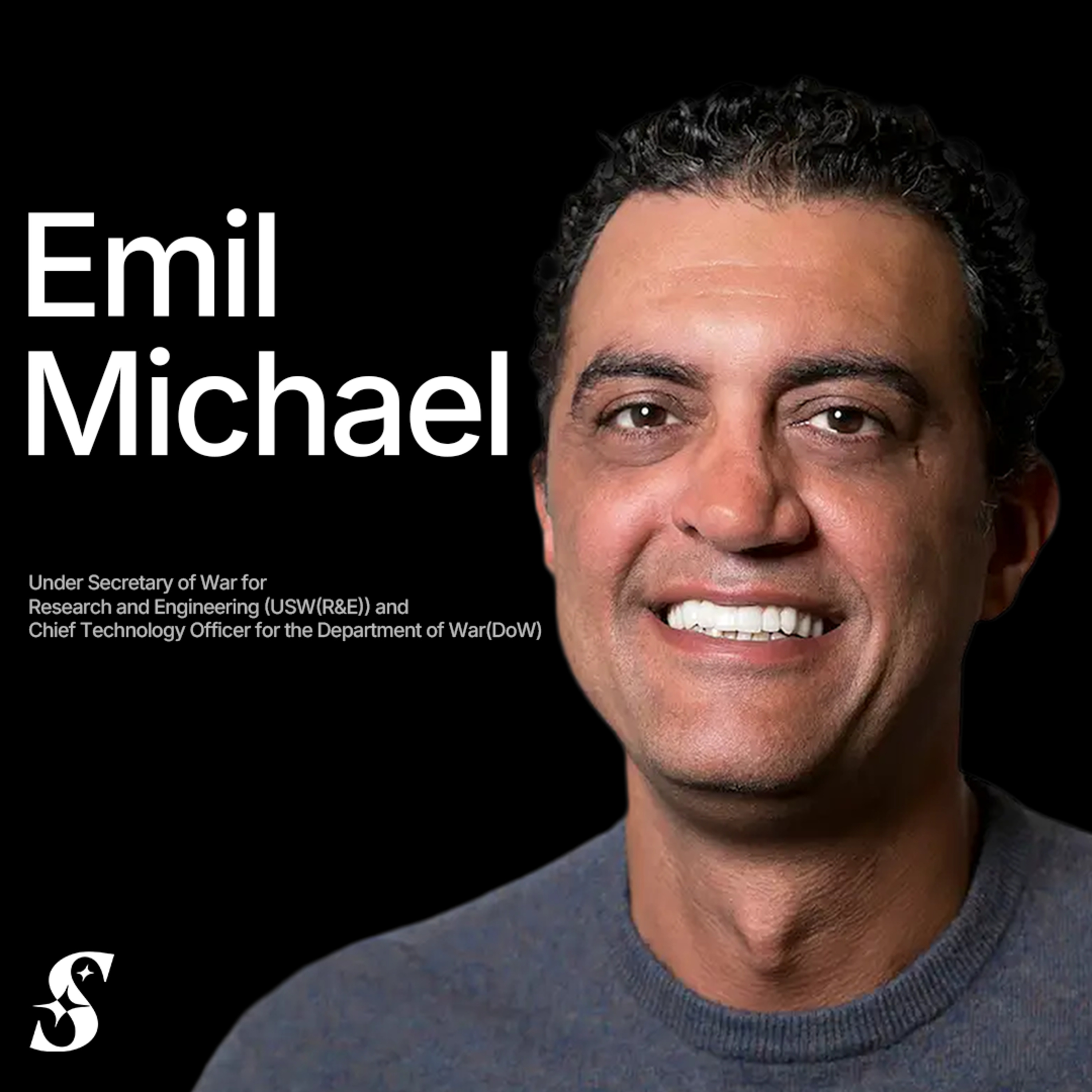

The Under Secretary of War defines the current "1938 moment" not as an imminent war, but as a critical juncture for rebuilding the domestic industrial base. The focus is on reversing decades of outsourcing critical components like minerals and pharmaceuticals, which created strategic vulnerabilities now deemed unacceptable for national security.

America's vulnerability in the rare earths supply chain stems from internal failures, not a lack of domestic resources. A 29-year average for mining permits, cuts to research funding, and alienating allies have created a strategic dependency that could have been avoided.

The U.S. reactively chases news headlines (like rare earths) without a rigorous framework to identify its most critical dependencies. Policymakers have not prioritized whether to secure wartime supply chains or mitigate China's leverage over consumer goods that could spark domestic political crises.

The U.S. military's power is no longer backed by a robust domestic industrial base. Decades of offshoring have made it dependent on rivals like China for critical minerals and manufacturing. This means the country can no longer sustain a prolonged conflict, a reality its defense planners ignore.