America's vulnerability in the rare earths supply chain stems from internal failures, not a lack of domestic resources. A 29-year average for mining permits, cuts to research funding, and alienating allies have created a strategic dependency that could have been avoided.

Related Insights

Politicians predictably declare initiatives for domestic production of critical goods like munitions or rare earths when dependencies are exposed. However, these declarations rarely translate into effective action, suggesting we must learn to manage economic entanglement as a form of mutual deterrence rather than wish it away.

For 30 years, China identified rare earths as a strategic industry. By massively subsidizing its own companies and dumping product to crash prices, it methodically drove US and global competitors out of business, successfully creating a coercive dependency for the rest of the world.

The shift to a less adversarial China policy may be a strategic maneuver to avoid supply chain disruptions. The U.S. appears to be biding its time—likely for 5+ years—to wean itself off dependence on Chinese rare earth minerals, which are critical for both industry and defense manufacturing.

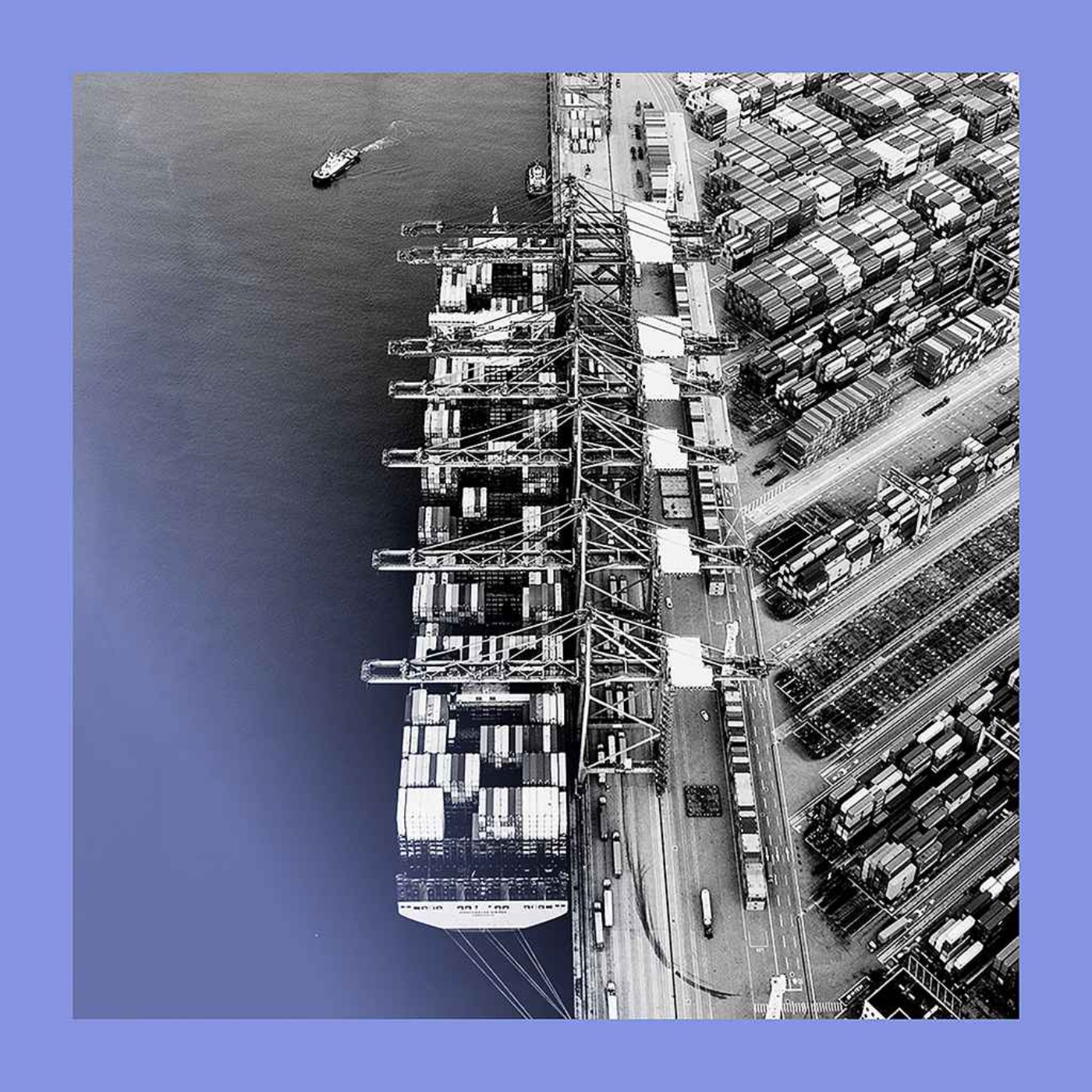

China's export ban on rare earth metals, critical for everything from iPhones to fighter jets, exposes a major US vulnerability. The solution is to treat domestic mining like vaccine development—a national security priority that requires fast-tracking the typical 30-year regulatory process for opening new mines.

China is leveraging its 90% control over rare earth processing not just against the US, but globally. By requiring licenses from any company worldwide, it creates a chokehold on high-tech manufacturing and establishes a new template for economic coercion.

The core of the U.S. strategic deficit is not a lack of minerals but a bipartisan failure of leadership. Both public and private sectors are unwilling to make the long-term strategic investments necessary for national security if they don't yield immediate profits.

While headlines focus on advanced chips, China’s real leverage comes from its strategic control over less glamorous but essential upstream inputs like rare earths and magnets. It has even banned the export of magnet-making technology, creating critical, hard-to-solve bottlenecks for Western manufacturing.

To combat China's ability to dump products and destabilize markets, the US government should act as a buyer of last resort for critical materials like rare earths. This would create a strategic reserve, similar to the petroleum reserve, ensuring price stability for domestic investment and manufacturing.

Facing China's export restrictions on rare earth metals, the U.S. immediate strategy is "ally-shoring": striking a major deal with Australia. This secures the supply chain through geopolitical partnerships as a faster, more pragmatic alternative to the long process of building domestic capacity from scratch.

China achieved its near-monopoly on rare earths not by chance, but through a long-term state-sponsored strategy. This involved providing capital to key firms, funding overseas acquisitions, banning foreign ownership of domestic mines, and consolidating the industry to control global prices.