Travis Kalanick intentionally cut prices to trigger a growth flywheel: lower fares led to more riders, which attracted more drivers, enabling even lower prices. This strategy didn't just steal share from taxis; it fundamentally expanded the total addressable market for personal transportation.

Related Insights

As autonomous vehicles drop the per-mile cost of ride-sharing to under $1, it will become cheaper than owning a car. This price drop will induce massive demand, shifting most transportation to these networks and creating a market exponentially larger than the current industry.

The "winner-takes-most" nature of marketplace businesses means that even an industry leader can operate for over a decade before achieving profitability. This model demands immense capital investment to survive a long, costly war of attrition to establish network effects.

Co-founder Travis Kalanick pivoted Uber away from founder Garrett Camp's original, capital-intensive idea of buying a fleet of Mercedes. This critical shift to an asset-light platform model, connecting existing drivers with riders, was crucial for rapid, low-cost scalability.

David Risher dismisses the zero-sum view of competing with Uber. He points out that the total rideshare market (2.5B annual rides) is dwarfed by the personal car market (160B rides). Lyft's true growth strategy is to convert personal car trips into rideshare, making direct competition a much smaller part of the picture.

Lyft's CEO argues the competition is not a binary battle with Uber for their combined 2.5 billion annual rides. Instead, the true target market is the 160 billion rides Americans take in their own cars. This reframes the opportunity from market share theft to massive market expansion and conversion.

Unprofitable AI models mirror Uber's early strategy. By subsidizing services, they integrate into workflows and create dependency. Once users rely on the tool (e.g., a law firm replacing an associate), prices can be increased dramatically to reflect the massive value created, ultimately achieving profitability.

Early competitors failed because they tried to partner with existing taxi fleets, inheriting their inefficiencies. Uber's key strategic advantage was building a parallel system with non-taxi drivers, allowing it to scale frictionlessly and deliver a superior, technology-driven experience.

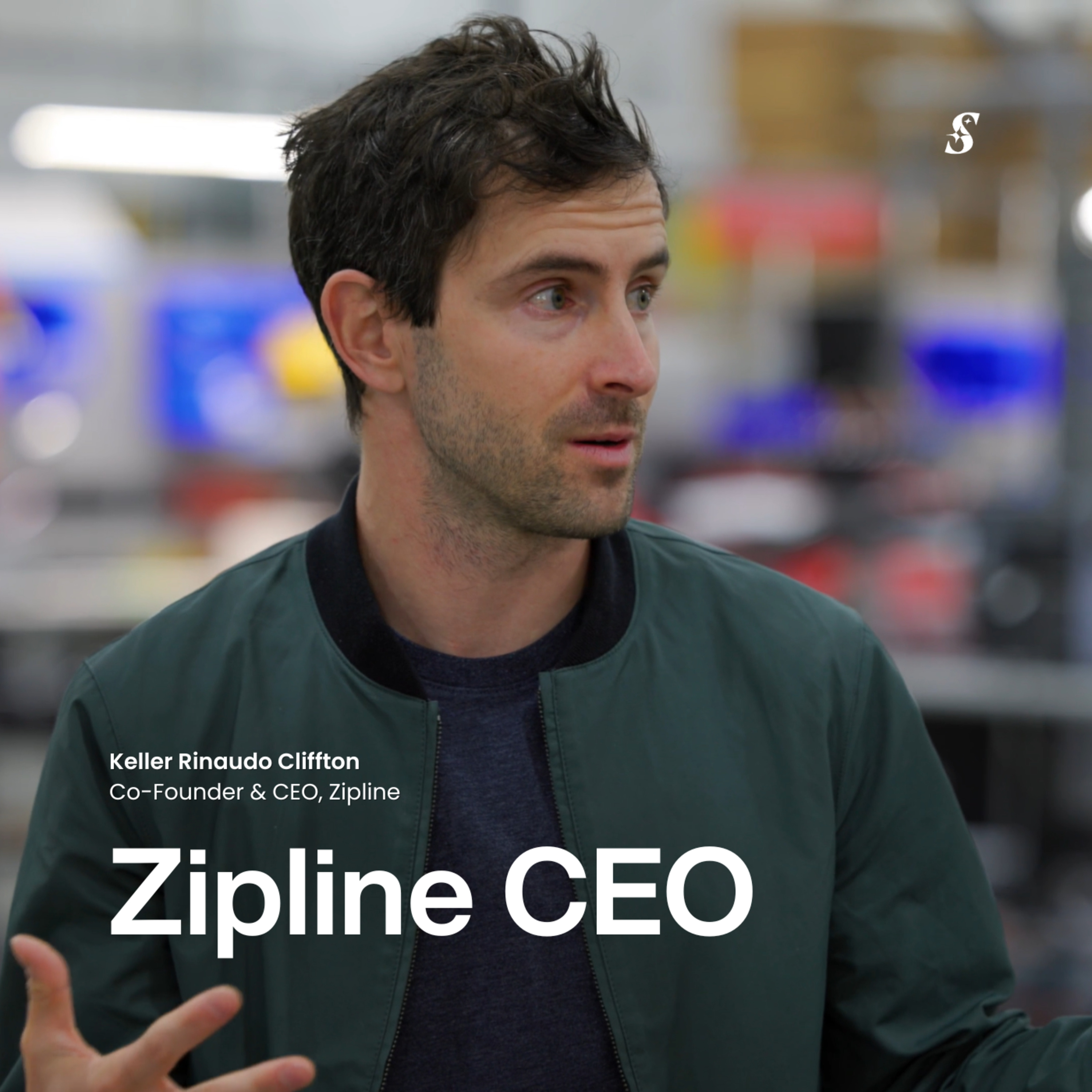

Zipline found that making delivery 10x faster and more convenient didn't just win customers from existing apps. It fundamentally changed user behavior, increasing order frequency so dramatically that they project the total addressable market is actually 10 times larger than currently estimated.

Uber framed its dynamic pricing not as a way to gouge customers, but as a mechanism to solve supply shortages. Higher fares during peak times incentivized more drivers to get on the road, increasing vehicle availability and ensuring the service remained reliable for riders.

Contrary to the belief that AVs will simply replace human drivers, Uber is seeing markets with autonomous vehicles grow faster overall. The novelty of the product attracts a new customer segment, expanding the total addressable market rather than just substituting existing rides.