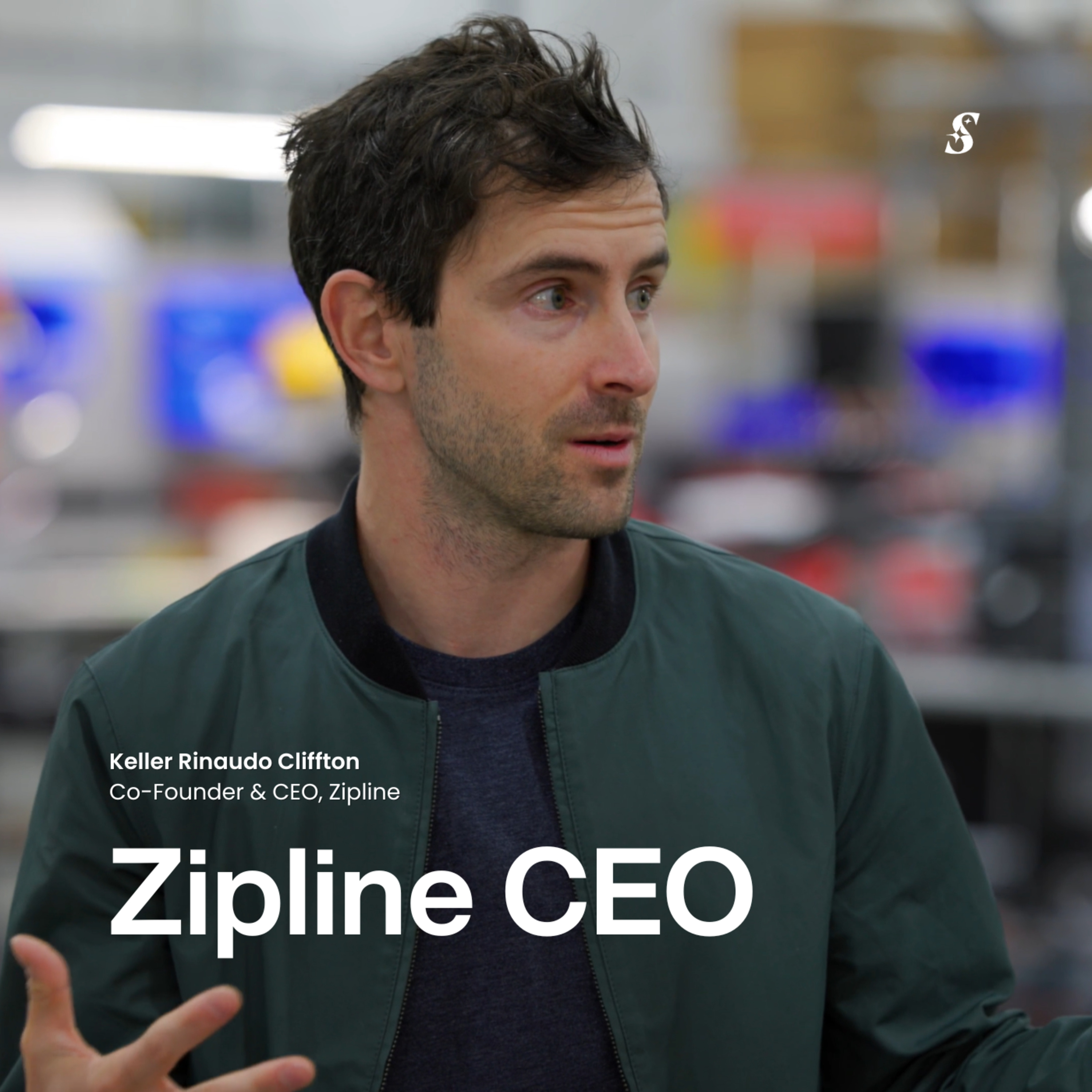

Zipline found that making delivery 10x faster and more convenient didn't just win customers from existing apps. It fundamentally changed user behavior, increasing order frequency so dramatically that they project the total addressable market is actually 10 times larger than currently estimated.

Related Insights

A 'dam' represents pent-up demand where users are frustrated and merely 'coping' with the status quo. Introducing a 10x better solution, often via new tech, doesn't create demand; it bursts the dam, releasing a flood of customers who see it as a magical fix for a problem they already have.

A slightly better UI or a faster experience is not enough to unseat an entrenched competitor. The new product's value must be so overwhelmingly superior that it makes the significant cost and effort of switching an obvious, undeniable decision for the customer from the very first demo.

Successful AI products like Gamma and Cursor don't just add a feature; they create so much value they can charge orders of magnitude more than legacy alternatives. This massive Total Addressable Market (TAM) expansion, not a simple price bump, is the engine of their explosive growth.

OpenAI's browser 'Atlas' might only be a 1.1x improvement over Chrome. This marginal gain is insufficient to drive mass adoption, as users require a 5-10x better experience—like ChatGPT was over Google Search—to switch established habits.

Traditional market sizing, which analyzes existing demand, is useless for true technological breakthroughs. A fundamental change on the supply side (e.g., GPUs for AI, cloud for software) unlocks markets that are orders of magnitude larger than their predecessors (e.g., gaming, on-prem software).

Drone delivery service Zipline achieved 46% market penetration among households in one of its Dallas service areas, far exceeding typical 2-5% market share benchmarks for new tech. This demonstrates that highly differentiated services can achieve utility-like adoption levels very rapidly, becoming a new normal for communities.

Companies like Amazon (from books to cloud) and Intuitive Surgical (from one specific surgery to many) became massive winners by creating new markets, not just conquering existing ones. Investors should prioritize businesses with the innovative capacity to expand their TAM, as initial market sizes are often misleadingly small.

When a new, superior technology paradigm emerges (e.g., cloud software), it doesn't just compete with the old one (on-premise). It grows the entire market by an order of magnitude. This principle suggests Databricks could be 10 times bigger than Oracle.

Investors err when they size a new market based on its predecessor (e.g., Uber vs. taxis). A fundamental supply-side change creates new capabilities that unlock massive, previously invisible demand, making initial market size calculations dangerously conservative.

A common misconception is that market size is fixed. However, as investor Alex Rampell notes, the market for a product executed exceptionally well can be orders of magnitude larger than for a merely adequate solution. Superior execution doesn't just capture a market; it dramatically expands it.