Revenue figures for AI companies can be misleading. The same dollar is often counted multiple times as it moves from the end customer through a SaaS provider and a cloud platform before reaching the model provider, creating a "margin stacking" effect that obscures the true net revenue.

While AI threatens to reduce software seats in support and sales, it's having the opposite effect on engineering and product. AI tools are increasing developer output, leading to the creation of more software and stabilizing team sizes, making them a resilient customer segment for SaaS.

The perceived slowdown in public SaaS growth is misleading. The metric is skewed because no new, high-growth companies are going public. The current average only reflects the natural deceleration of older companies without the offsetting effect of fast-growing IPOs that historically lifted the median.

The rise of AI support agents is changing the purpose of internal documentation. Knowledge bases are now being written less for human readers and more for AI agents to consume. This leads to more structured, procedural content designed to be parsed by a machine to answer questions accurately.

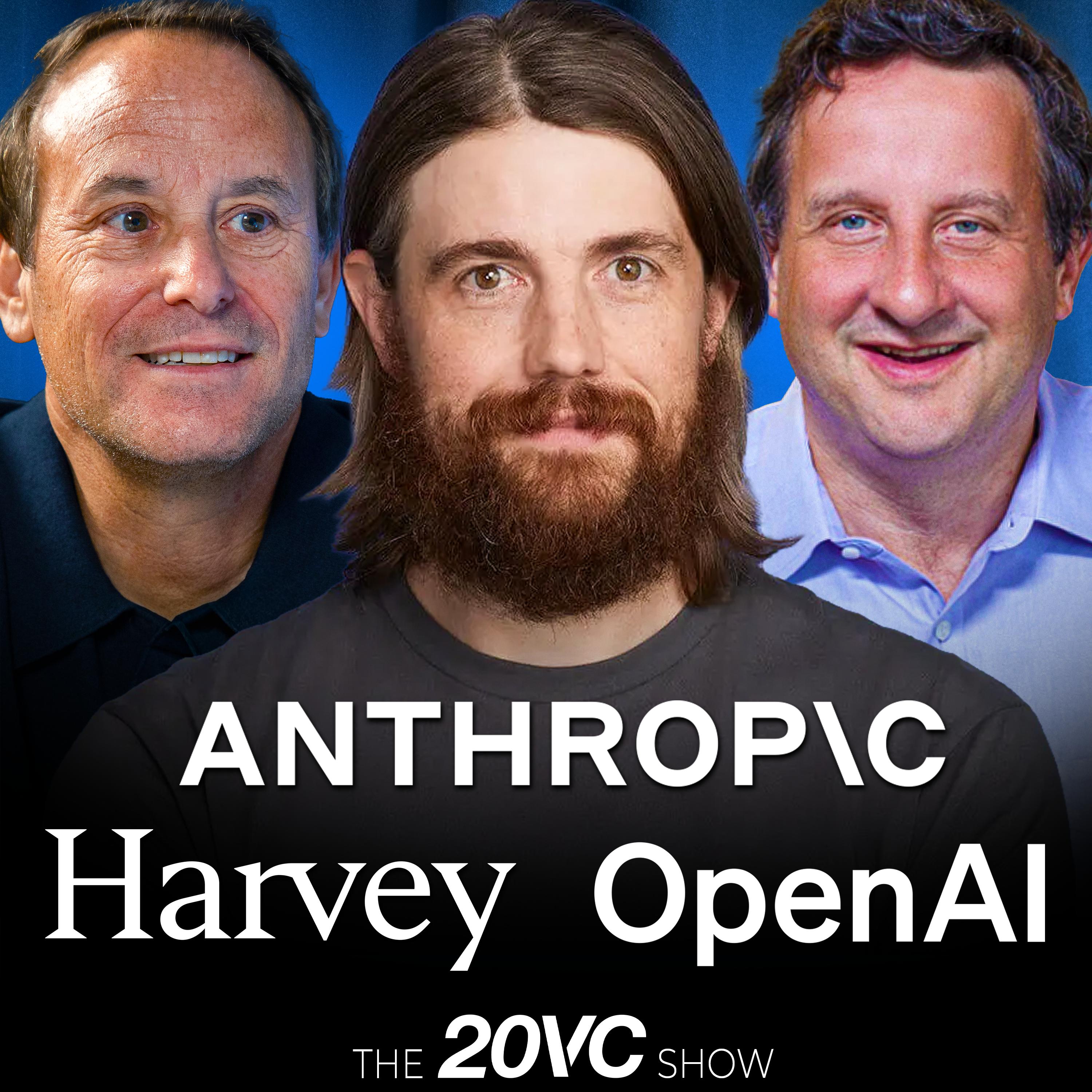

Anthropic's and OpenAI's massive revenue forecasts ($300B+ combined) aren't about displacing existing software spend. The core bet is that AI will capture a large portion of the trillion-dollar consulting and services budget, dramatically expanding the total addressable market for technology.

Atlassian co-founder Mike Cannon-Brookes dismisses the "death of software" narrative. He argues the current AI shift is a typical tech cycle of creative destruction where some companies fail but the overall category thrives. Businesses will always find value in buying efficient, pre-built solutions.

Atlassian's founder suggests a model for AI's impact. In "input-constrained" fields like legal or support, AI drives efficiency on a finite set of tasks. In "creation-constrained" fields like software development, AI amplifies output on an infinite roadmap, leading to market expansion.

Public company CEOs are caught between short-term investor pressure for profitability and the long-term strategic necessity of investing heavily in AI. The challenge is to manage capital allocation to satisfy quarterly expectations while simultaneously funding the fundamental R&D required to compete in the AI era.

For AI companies experiencing explosive growth like Harvey (tripling ARR in a year), traditional TAM analysis is an obstacle, not a tool. Such growth signals the company is capturing a new budget pool (e.g., labor costs) that dwarfs the existing software market. In these cases, the revenue trajectory itself becomes the best indicator of the true TAM.

The seemingly bizarre Super Bowl ad from Anthropic, which targeted a product it doesn't have, wasn't for the mass market. It was an expensive signal directed at a niche audience: potential engineering hires and enterprise buyers in Silicon Valley, positioning itself as the "good guy" enterprise alternative to OpenAI.

The intense investment in customer support AI isn't just about solving support tickets. It's a strategic entry point. A support agent can become the primary AI interface for a company, creating a "Trojan horse" to expand into other functions like sales, marketing, and research, ultimately becoming a horizontal enterprise platform.

The venture market has shifted from seeking contrarian bets to piling capital into consensus winners, even at extreme valuations. The new logic resembles the old adage "you can't get fired for buying IBM," where investing in a perceived leader with a 1x preference is deemed a safer, more defensible capital allocation decision.