Supply chain vulnerability isn't just about individual parts. The real test is whether a complex defense system, like a directed energy weapon, can be manufactured *entirely* from components sourced within the U.S. or from unshakeable allies. Currently, this is not possible, representing a critical security gap.

Related Insights

The romantic notion that the US can rapidly pivot its industrial base for war is a misleading myth. Today's weapons are vastly more complex and reliant on fragile global supply chains for components that are controlled by adversaries, making a WWII-style industrial mobilization impossible without years of preparation.

Major US tech-industrial companies like SpaceX are forced to vertically integrate not as a strategic choice, but out of necessity. This reveals a critical national infrastructure gap: the absence of a multi-tiered ecosystem of specialized component suppliers that thrives in places like China.

The current trade friction is part of a larger, long-term bipartisan U.S. strategy of "competitive confrontation." This involves not just tariffs but also significant domestic investment, like the CHIPS Act, to build resilient supply chains and reduce reliance on China for critical industries, a trend expected to persist across administrations.

The push to build defense systems in America reveals that critical sub-components, like rocket motors or high-powered amplifiers, are no longer manufactured domestically at scale. This forces new defense companies to vertically integrate and build their own factories, essentially rebuilding parts of the industrial base themselves.

Massive backlogs for critical US military hardware are making America an unreliable supplier. This strategic vulnerability is pushing allied nations to develop their own defense industrial bases, creating a huge market for companies like Anduril that can co-develop and establish local production.

Building hardware compliant with US defense standards (NDAA) presents a major cost hurdle. Marine robotics company CSATS notes that switching from a mass-produced Chinese component to a US-made alternative can increase the price by 8x to 15x, a significant economic challenge for re-shoring manufacturing.

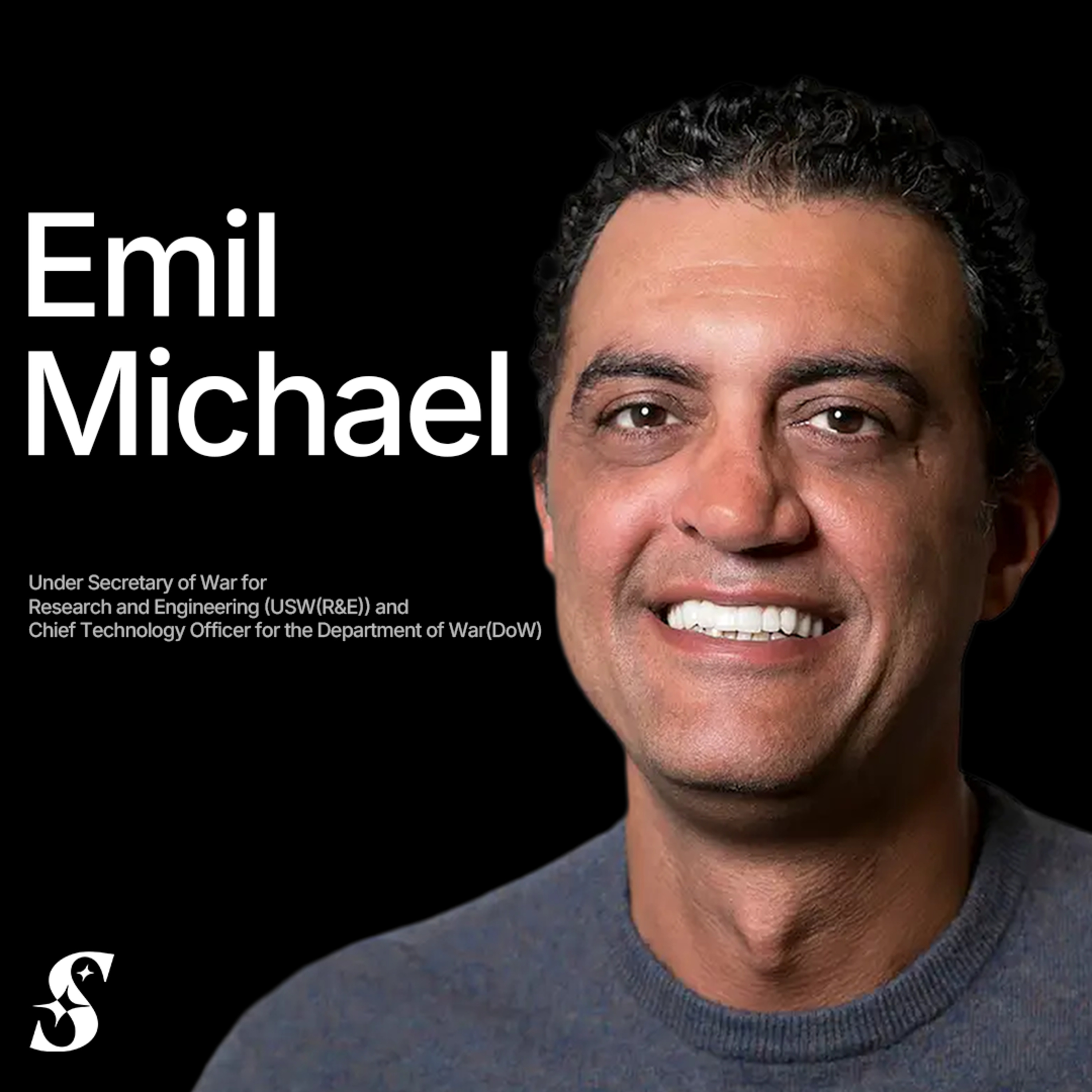

The Under Secretary of War defines the current "1938 moment" not as an imminent war, but as a critical juncture for rebuilding the domestic industrial base. The focus is on reversing decades of outsourcing critical components like minerals and pharmaceuticals, which created strategic vulnerabilities now deemed unacceptable for national security.

The U.S. military's power is no longer backed by a robust domestic industrial base. Decades of offshoring have made it dependent on rivals like China for critical minerals and manufacturing. This means the country can no longer sustain a prolonged conflict, a reality its defense planners ignore.

Industrial control systems (OT) on factory floors are largely unencrypted and unsecured, a stark contrast to heavily protected IT systems. This makes manufacturing a critical vulnerability; an adversary can defeat a weapon system not on the battlefield, but by compromising the industrial base that produces it.

Anticipating that independence from China will be a long-term, bipartisan US policy goal, Rivian intentionally designed its new R2 supply chain to be U.S.-centric. This strategic planning aims to align the business with persistent geopolitical trends, rather than just reacting to current tariffs.