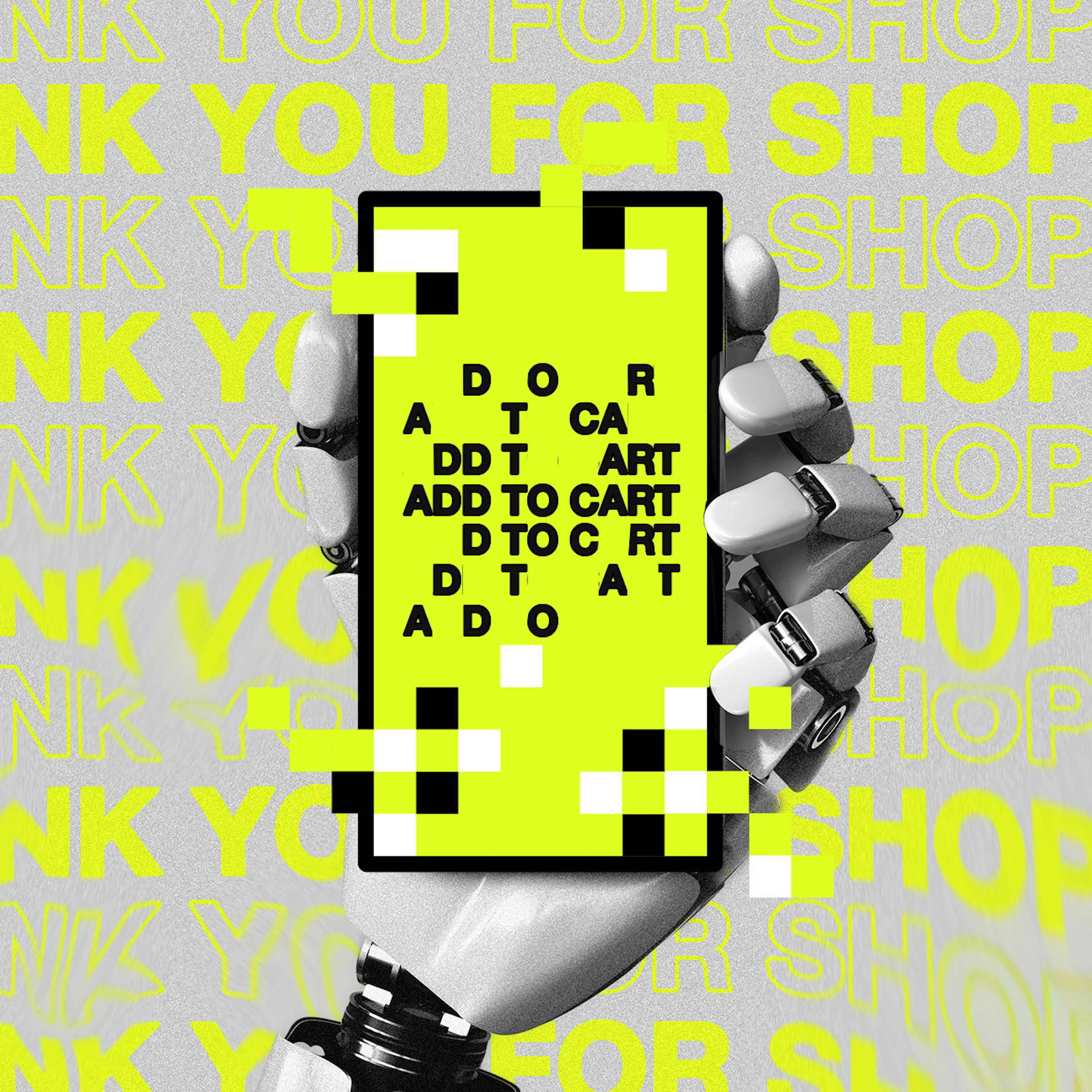

Amazon's ad business operates as a pay-to-play system where sellers buy top search placement. This harms consumers, as the top search result is, on average, 29% more expensive than the actual best match.

Related Insights

Prime Day encourages third-party sellers to inflate pre-sale prices to create the illusion of a deep discount. While not Amazon's direct action, this practice of "fakeflation" erodes customer trust in the entire platform, turning a key marketing event into a significant brand liability.

There is emerging evidence of a "pay-to-play" dynamic in AI search. Platforms like ChatGPT seem to disproportionately cite content from sources with which they have commercial deals, such as the Financial Times and Reddit. This suggests paid partnerships can heavily influence visibility in AI-generated results.

Hitting a ceiling on a winner-take-all platform like Amazon, where ad spend yields diminishing returns, often signals a product problem. The top competitor isn't just out-marketing you; they likely have a fundamentally better product that converts more effectively, giving them superior unit economics.

Rather than simply failing to police fraud, Meta perversely profits from it by charging higher rates for ads its systems suspect are fraudulent. This 'scam tax' creates a direct financial incentive to allow illicit ads, turning a blind eye into a lucrative revenue stream.

Amazon's potential commerce partnership with OpenAI is fraught with risk. Allowing ChatGPT to become the starting point for product searches threatens Amazon's highly profitable on-site advertising revenue, even if Amazon gains referral traffic. It's a classic battle to avoid being aggregated by another platform.

Contrary to the common view, algorithms charging different prices based on a consumer's wealth can be beneficial for market efficiency. The real harm occurs when algorithms exploit a lack of information or behavioral biases, not simply when they adjust prices based on a person's ability to pay.

TikTok Shop success creates a powerful "spillover" effect. Users see a product on TikTok, then search for it directly on Amazon for faster shipping. This high-intent, search-to-purchase behavior signals relevance to Amazon's algorithm, dramatically boosting the product's sales rank for key terms.

Unlike service platforms like Uber that rely on real-world networks, Amazon's high-margin ad business is existentially threatened by AI agents that bypass sponsored listings. This vulnerability explains its uniquely aggressive legal stance against Perplexity, as it stands to lose a massive, growing revenue stream if users stop interacting directly with its site.

In AI-driven commerce, brands win by being selected by an agent, not by ranking on a search page. This shift favors brands with trustworthy, structured, and verifiable data over those with the largest advertising budgets, leveling the playing field for smaller, agile companies.

While a commerce partnership with OpenAI seems logical, Amazon is hesitant. They recognize that if consumers start product searches on ChatGPT, it could disintermediate Amazon's on-site search, cannibalizing their high-margin advertising revenue and ceding aggregator power.