Trump's call to cap defense executive pay at $5M primarily targets the high cash salaries at legacy primes. Newer firms like Anduril, where founders and executives have lower salaries but significant equity, would be less impacted, potentially giving them a talent and operational advantage.

Related Insights

Unlike traditional defense contractors, Anduril's marketing targets the American public and potential employees, not just Pentagon buyers. The strategy is to build a transparent, powerful brand around national security to attract top talent who would otherwise avoid the historically opaque and controversial industry.

The future IPO of Anduril, a private defense tech firm, is viewed as a critical test for the entire sector. Its performance will signal Wall Street's appetite for a new class of defense startups that have been heavily funded by venture capital with speculative, low-revenue profiles.

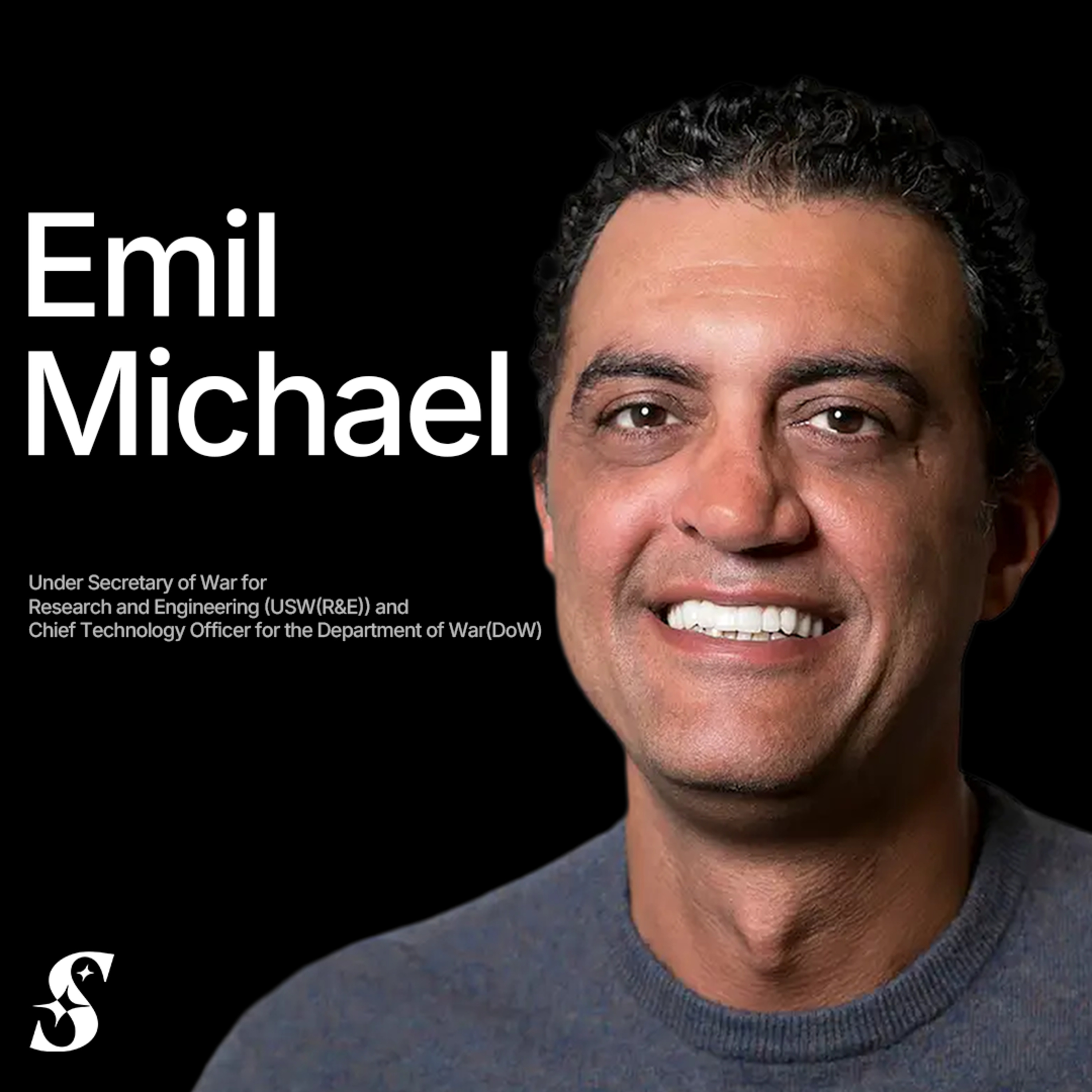

The Under Secretary of War's primary job is not just to fund technology, but to actively cultivate an ecosystem of new defense contractors. The stated goal is to create five more major companies capable of challenging established primes like Lockheed Martin, fostering competition and bringing new capabilities into the defense sector.

A major upcoming change in the National Defense Authorization Act (NDAA) is the removal of "past performance" as a key criterion in procurement. This rule has historically favored large, incumbent defense contractors over innovative startups. Eliminating it allows new companies to compete on the merits of their technology, representing a significant unlock for the entire defense tech ecosystem.

Elon Musk's ambitious, performance-tied compensation plan isn't just about Tesla. It establishes a powerful precedent for other founders, like those at late-stage unicorns, to negotiate for massive new equity grants by tying them to audacious growth targets, reshaping founder incentive structures.

Despite the potential business impact, Palmer Luckey argues that when a company is funded by taxpayers, the public has the right to impose restrictions, including executive salary caps. This view champions accountability for the "war fighter" over complete corporate freedom, a nuanced stance for a tech founder.

Unlike traditional contractors paid for time and materials, Anduril invests its own capital to develop products first. This 'defense product company' model aligns incentives with the government's need for speed and effectiveness, as profits are tied to rapid, successful delivery, not prolonged development cycles.

Musk's performance-based compensation sets a precedent for other CEOs to approach their boards with ambitious growth targets in exchange for significant equity increases. This challenges the traditional one-way dilution model for founders and executives.

Traditional defense primes are coupled to customer requirements and won't self-fund speculative projects. "Neo primes" like Epirus operate like product companies, investing their own capital to address military capability gaps, proving out new technologies, and then selling the finished solution.

The go-to-market strategy for defense startups has evolved. While the first wave (e.g., Anduril) had to compete directly with incumbents, the 'Defense 2.0' cohort can grow much faster. They act as suppliers and partners to legacy prime contractors, who are now actively seeking to integrate their advanced technology.