OpenAI's previous structure allowed it to potentially end Microsoft's IP rights by declaring AGI. By removing this clause in the new deal, OpenAI has given up its most powerful negotiating lever, signaling that AGI is not a near-term reality or that the partnership was more critical than the threat.

Related Insights

Microsoft's deal with OpenAI includes a powerful exclusivity clause. If a third-party company wants to do a deep, custom integration or model training with OpenAI, that workload must be hosted on Azure, effectively funneling major enterprise AI deals through Microsoft's cloud.

Despite public drama, OpenAI's restructuring settled based on each party's leverage. Microsoft got a 10x return, the foundation was massively capitalized, and employees gained liquidity. This pragmatic outcome, which clears the path for an IPO, proves that calculated deal-making ultimately prevails over controversy.

The most difficult part of Microsoft's initial OpenAI investment wasn't the capital, but navigating the complex non-profit/for-profit structure that caused traditional VCs to pass on the deal. This highlights how innovative deal-structuring can be a competitive advantage.

Microsoft’s new superintelligence team is a direct result of a renegotiated OpenAI deal. The previous contract restricted Microsoft from building AGI past a certain computational threshold. Removing this clause was a pivotal, strategic move to pursue AI self-sufficiency.

Microsoft solidified its 27% stake, secured exclusive IP rights until 2032, and locked in a $250B Azure commitment. This captures near-term value while de-risking Microsoft from having to solely fund OpenAI's massive future build-out, positioning Azure as a platform for all AI models, not just OpenAI's.

The mind-boggling $1.4T in compute commitments likely isn't fully guaranteed. Such large contracts often include clauses for deferral, extension, or cancellation, giving OpenAI flexibility and making its actual financial risk much lower than public perception suggests.

The partnership goes far beyond a customer relationship. Microsoft receives the intellectual property for OpenAI's system designs and innovations, which it can then use to build infrastructure for OpenAI and extend for its own purposes, a critical and little-known aspect of their deal.

Microsoft's early OpenAI investment was a calculated, risk-adjusted decision. They saw that generalizable AI platforms were a 'must happen' future and asked, 'Can we remain a top cloud provider without it?' The clear 'no' made the investment a defensive necessity, not just an offensive gamble.

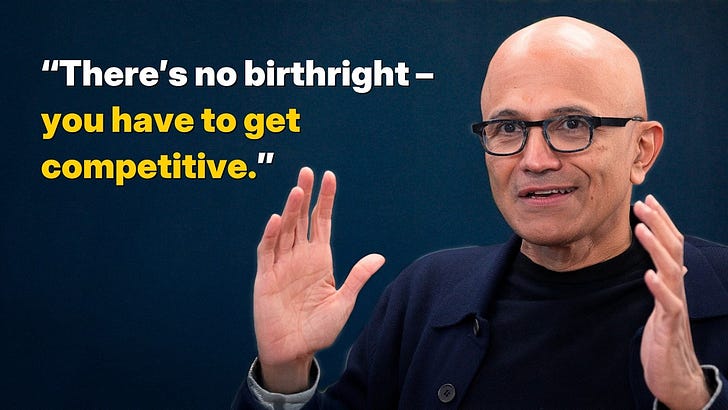

Beyond the equity stake and Azure revenue, Satya Nadella highlights a core strategic benefit: royalty-free access to OpenAI's IP. For Microsoft, this is equivalent to having a "frontier model for free" to deeply integrate across its entire product suite, providing a massive competitive advantage without incremental licensing costs.

OpenAI’s pivotal partnership with Microsoft was driven more by the need for massive-scale cloud computing than just cash. To train its ambitious GPT models, OpenAI required infrastructure it could not build itself. Microsoft Azure provided this essential, non-commoditized resource, making them a perfect strategic partner beyond their balance sheet.