Microsoft's deal with OpenAI includes a powerful exclusivity clause. If a third-party company wants to do a deep, custom integration or model training with OpenAI, that workload must be hosted on Azure, effectively funneling major enterprise AI deals through Microsoft's cloud.

Related Insights

OpenAI's strategy involves getting partners like Oracle and Microsoft to bear the immense balance sheet risk of building data centers and securing chips. OpenAI provides the demand catalyst but avoids the fixed asset downside, positioning itself to capture the majority of the upside while its partners become commodity compute providers.

By structuring massive, multi-billion dollar deals, OpenAI is deliberately entangling partners like NVIDIA and Oracle in its ecosystem. Their revenue and stock prices become directly tied to OpenAI's continued spending, creating a powerful coalition with a vested interest in ensuring OpenAI's survival and growth, effectively making it too interconnected to fail.

As countries from Europe to India demand sovereign control over AI, Microsoft leverages its decades of experience with local regulation and data centers. It builds sovereign clouds and offers services that give nations control, turning a potential geopolitical challenge into a competitive advantage.

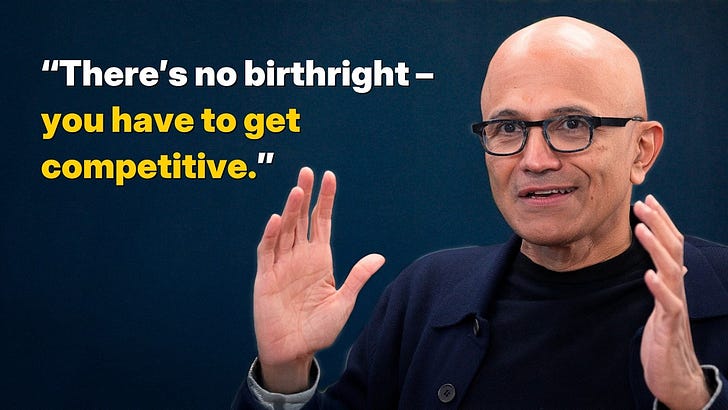

Satya Nadella reveals that Microsoft prioritizes building a flexible, "fungible" cloud infrastructure over catering to every demand of its largest AI customer, OpenAI. This involves strategically denying requests for massive, dedicated data centers to ensure capacity remains balanced for other customers and Microsoft's own high-margin products.

The high-speed link between AWS and GCP shows companies now prioritize access to the best AI models, regardless of provider. This forces even fierce rivals to partner, as customers build hybrid infrastructures to leverage unique AI capabilities from platforms like Google and OpenAI on Azure.

The partnership goes far beyond a customer relationship. Microsoft receives the intellectual property for OpenAI's system designs and innovations, which it can then use to build infrastructure for OpenAI and extend for its own purposes, a critical and little-known aspect of their deal.

Microsoft's early OpenAI investment was a calculated, risk-adjusted decision. They saw that generalizable AI platforms were a 'must happen' future and asked, 'Can we remain a top cloud provider without it?' The clear 'no' made the investment a defensive necessity, not just an offensive gamble.

Beyond the equity stake and Azure revenue, Satya Nadella highlights a core strategic benefit: royalty-free access to OpenAI's IP. For Microsoft, this is equivalent to having a "frontier model for free" to deeply integrate across its entire product suite, providing a massive competitive advantage without incremental licensing costs.

By inking deals with NVIDIA, AMD, and major cloud providers, OpenAI is making its survival integral to the entire tech ecosystem. If OpenAI faces financial trouble, its numerous powerful partners will be heavily incentivized to provide support, effectively making it too big to fail.

OpenAI’s pivotal partnership with Microsoft was driven more by the need for massive-scale cloud computing than just cash. To train its ambitious GPT models, OpenAI required infrastructure it could not build itself. Microsoft Azure provided this essential, non-commoditized resource, making them a perfect strategic partner beyond their balance sheet.