There appears to be a predictable 5-10 year lag between a startup's innovation gaining traction (e.g., Calendly) and a tech giant commoditizing it as a feature (e.g., Google Calendar's scheduling). This "commoditization window" is the crucial timeframe for a startup to build a brand, network effects, and a durable moat.

Related Insights

Unlike cloud or mobile, which incumbents initially ignored, AI adoption is consensus. Startups can't rely on incumbents being slow. The new 'white space' for disruption exists in niche markets large companies still deem too small to enter.

Startups often fail by making a slightly better version of an incumbent's product. This is a losing strategy because the incumbent can easily adapt. The key is to build something so fundamentally different in structure that competitors have a very hard time copying it, ensuring a durable advantage.

While adjacent, incremental innovation feels safer and is easier to get approved, Nubar Afeyan warns that everyone else is doing the same thing. This approach inevitably leads to commoditization and erodes sustainable advantage. Leaping to new possibilities is the only way to truly own a new space.

As AI and no-code tools make software easier to build, technological advantage is no longer a defensible moat. The most successful companies now win through unique distribution advantages, such as founder-led content or deep community building. Go-to-market strategy has surpassed product as the key differentiator.

Unlike mobile or internet shifts that created openings for startups, AI is an "accelerating technology." Large companies can integrate it quickly, closing the competitive window for new entrants much faster than in previous platform shifts. The moat is no longer product execution but customer insight.

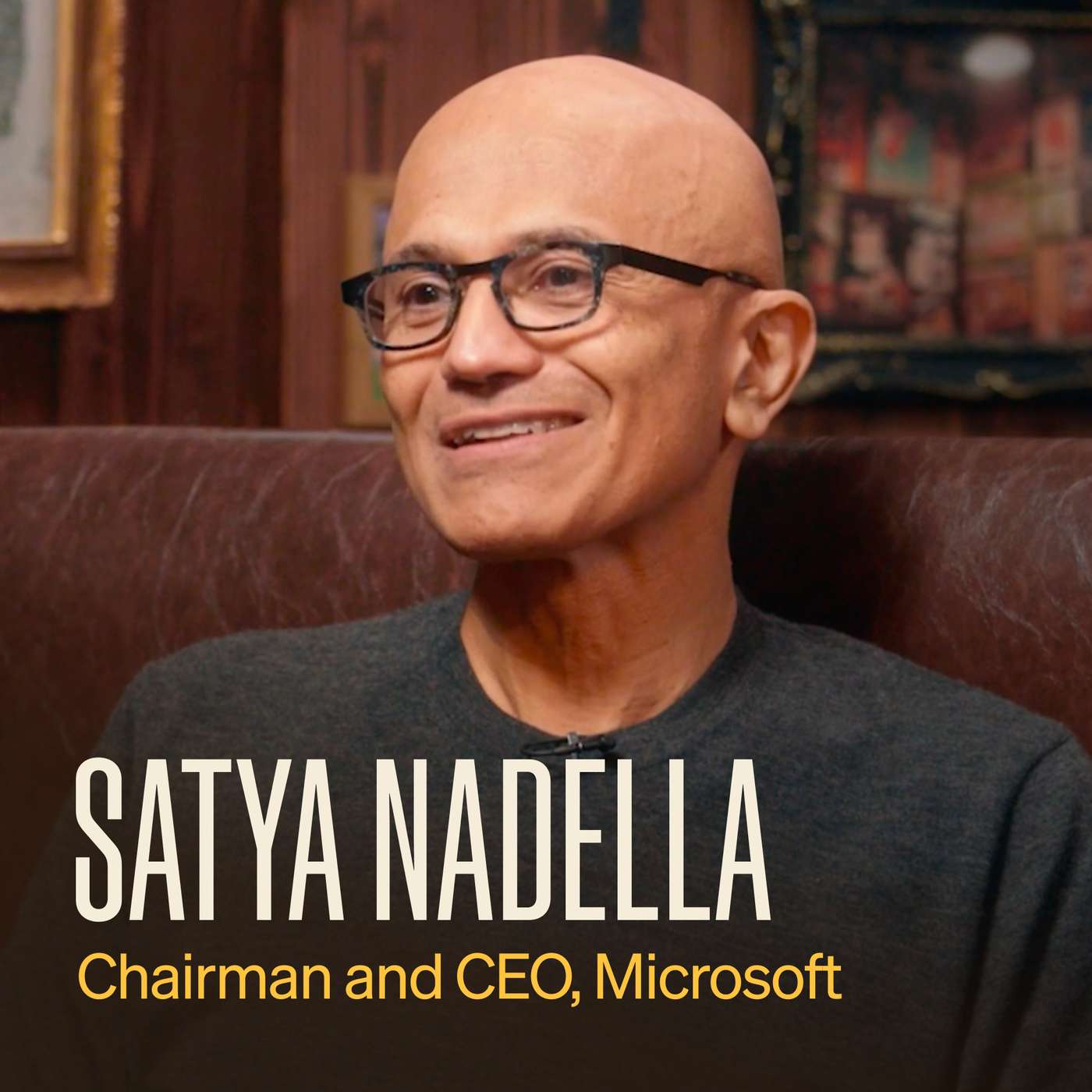

To stay relevant, tech platform companies must obsessively follow developers and startups. They are the primary source of insight into emerging workloads and platform requirements. This isn't just for partnerships, but for fundamental product strategy and learning.

Large platforms focus on massive opportunities right in front of them ('gold bricks at their feet'). They consciously ignore even valuable markets that require more effort ('gold bricks 100 feet away'). This strategic neglect creates defensible spaces for startups in those niche areas.

AI drastically accelerates the ability of incumbents and competitors to clone new products, making early traction and features less defensible. For seed investors, this means the traditional "first-mover advantage" is fragile, shifting the investment thesis heavily towards the quality and adaptability of the founding team.

When competing with AI giants, The Browser Company's strategy isn't a traditional moat like data or distribution. It's rooted in their unique "sensibility" and "vibes." This suggests that as AI capabilities commoditize, a product's distinct point of view, taste, and character become key differentiators.

Instead of predicting short-term outcomes, focus on macro trends that seem inevitable over a decade (e.g., more e-commerce, more 3D interaction). This framework, used by Tim Ferriss to invest in Shopify and by Roblox for mobile, helps identify high-potential areas and build with conviction.

![Palmer Luckey - Inventing the Future of Defense - [Invest Like the Best, CLASSICS] thumbnail](https://megaphone.imgix.net/podcasts/f7c9aa8e-cb8d-11f0-828e-0b281809c10a/image/cc07f91ec47f95abbde771a4956b37b7.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)