The U.S. industrial strategy isn't pure "reshoring" but "friend-shoring." The goal is to build a global supply chain that excludes China, not to bring all production home. This creates massive investment opportunities in allied countries like Mexico, Vietnam, Korea, and Japan, which are beneficiaries of this geopolitical realignment.

Related Insights

The move toward a less efficient, more expensive global supply chain is not a failure but a strategic correction. Over-prioritizing efficiency created a dangerous dependency on China. Diversification, while costlier in the short term, is a fundamental principle of long-term risk management.

The concept of 'weaponized interdependence,' highlighted by China's use of export controls, is driving Asian nations like Japan, India, and South Korea to implement economic security acts. This shifts investment toward domestic supply chains in critical minerals, semiconductors, and defense, creating state-backed opportunities.

The tariff war was not primarily about revenue but a strategic move to create an "artificial negotiating point." By imposing tariffs, the U.S. could then offer reductions in exchange for European countries committing to American technology and supply chains over China's growing, low-cost alternatives.

The current trade friction is part of a larger, long-term bipartisan U.S. strategy of "competitive confrontation." This involves not just tariffs but also significant domestic investment, like the CHIPS Act, to build resilient supply chains and reduce reliance on China for critical industries, a trend expected to persist across administrations.

A U.S. national security document's phrase, "the future belongs to makers," signals a significant policy shift. Credit and tax incentives will likely be redirected from financial engineering (e.g., leveraged buyouts in private equity) to tangible industrial production in order to build resilient, non-Chinese supply chains.

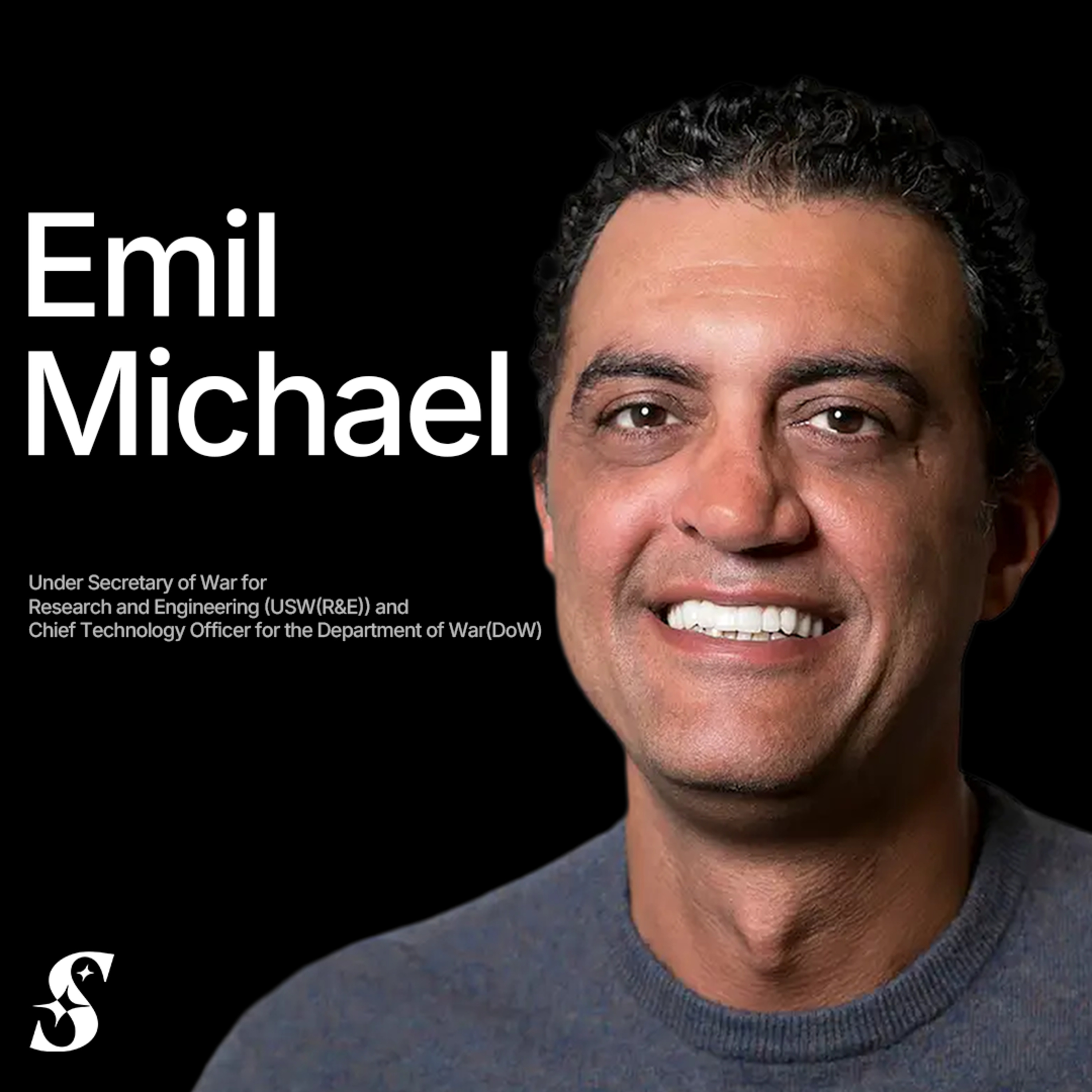

The Under Secretary of War defines the current "1938 moment" not as an imminent war, but as a critical juncture for rebuilding the domestic industrial base. The focus is on reversing decades of outsourcing critical components like minerals and pharmaceuticals, which created strategic vulnerabilities now deemed unacceptable for national security.

Due to its deep integration with the US economy, Mexico has developed a massive industrial base. If Mexico were located elsewhere and had more diversified trade relationships, it would be globally recognized as a major industrial power, rivaling European giants like Germany and France.

When trade policies force allies like Canada to find new partners, it's not a temporary shift. They build new infrastructure and relationships that won't be abandoned even if the political climate changes. The trust is broken, making the economic damage long-lasting and difficult to repair.

The credit's requirements for North American manufacturing and sourcing from trade partners were designed to counter China's dominance in the EV supply chain. Its elimination undermines this strategic goal, leaving tariffs as the primary, less effective tool.

Anticipating that independence from China will be a long-term, bipartisan US policy goal, Rivian intentionally designed its new R2 supply chain to be U.S.-centric. This strategic planning aims to align the business with persistent geopolitical trends, rather than just reacting to current tariffs.