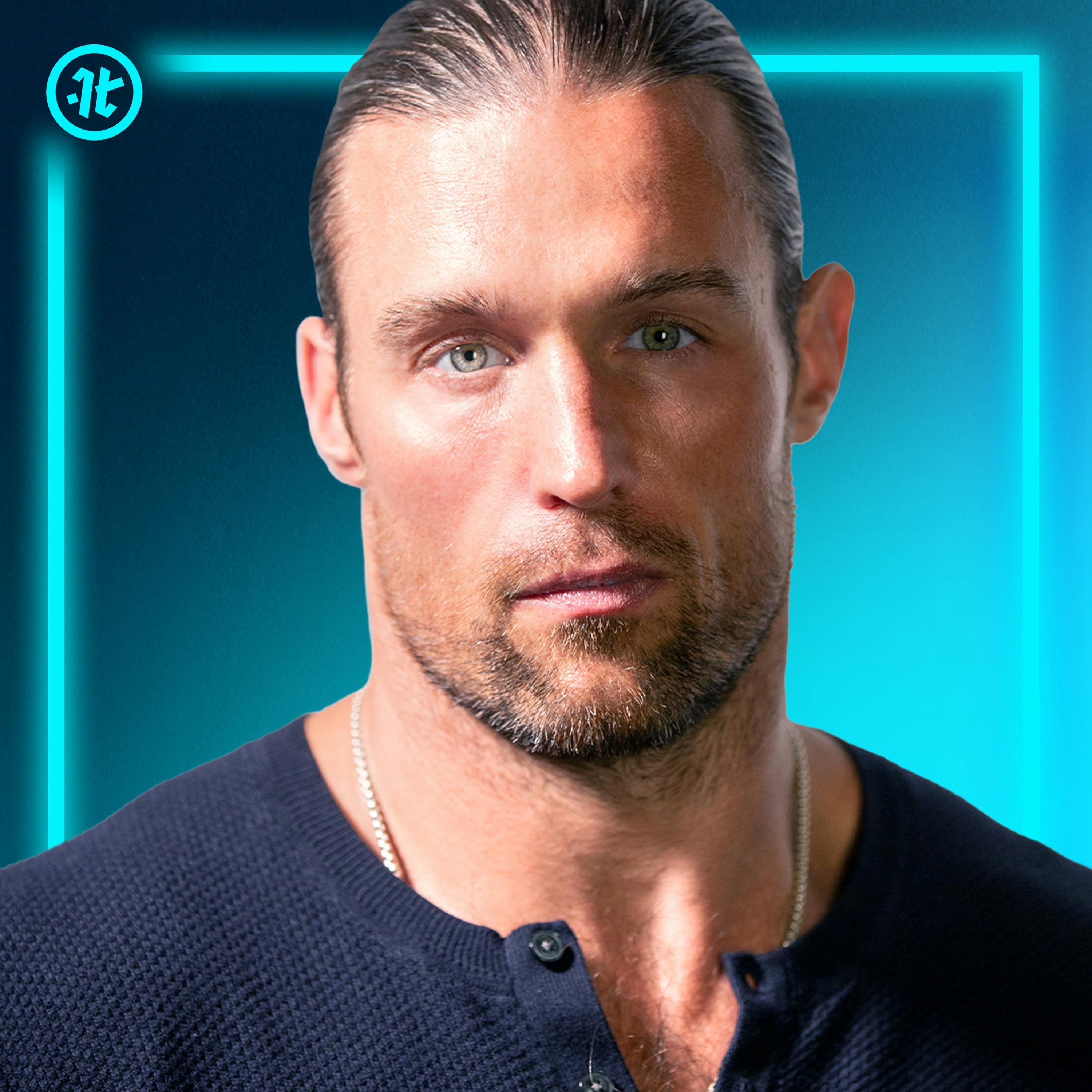

Kyle Samani is "intellectually short" Bitcoin because he sees it as an unproductive asset. He argues platforms like Ethereum and Solana offer the same core benefits—a fixed, code-defined supply—while also being economically productive. This makes them a superior long-term asset class from a first-principles perspective, despite his firm holding some Bitcoin financially.

Related Insights

While Bitcoin's code can be copied, its core innovation—verifiable absolute scarcity—cannot be replicated. It was a one-time discovery, like the number zero. Any subsequent digital asset lacks the pristine origin and established network effect, making Bitcoin a unique, non-disruptable phenomenon rather than just another technology.

As Bitcoin matures, its risk-return profile is changing. The era of doubling in value every couple of years may be over. Instead, it could transition into a high-performing asset that reliably generates 15-25% annualized returns, outperforming traditional assets but no longer offering the explosive, "get rich quick" upside of its early days.

The easy-to-understand and demonstrable power of AI has captured investor attention and capital that might otherwise go to Bitcoin. Unlike Bitcoin's significant educational lift, AI's value is immediately apparent, making it a "sexier" and more accessible investment thesis for those with disposable capital, thus acting as a narrative competitor.

Bitcoin's core properties (fixed supply, perfect portability) make it a superior safe haven to gold. However, the market currently treats it as a volatile, risk-on asset. This perception gap represents a unique, transitional moment in financial history.

Multicoin's conviction in Solana came from underwriting its founder, Anatoly Yakovenko. Unlike competitors focused on academic breakthroughs, Yakovenko prioritized shipping code and explicitly avoided trying to solve unsolved computer science problems. This pragmatic, execution-focused approach was the key differentiator that earned Multicoin's bet in the crowded Layer-1 race.

An asset can only function as money if it has intrinsic value to a subset of the population, establishing a price floor. Cigarettes work as currency in prison because some people actually want to smoke them. Bitcoin, having no underlying use, is like a "digital cigarette" you can't smoke, making its value purely speculative.

An investor's Bitcoin thesis rests on three pillars: 1) as a self-custodied asset for debanking/borderless scenarios, 2) as an investment for pure price appreciation ("number go up"), and 3) as an ethical holding to support a better financial system. This framework clarifies why proxies like MSTR satisfy the latter two needs but never the first.

Multicoin's central thesis is that crypto's ultimate purpose is creating "Internet Capital Markets"—the ability to trade any asset, from anywhere, 24/7, via any software. This broad vision of permissionless, programmable finance is seen as the most significant long-term impact of blockchain, destined to supersede more niche consumer applications or "Web3" concepts.

Multicoin's Kyle Samani gave up on Ethereum in 2017 after its leadership failed to present a clear scaling plan. He perceived a culture that was "to their core culturally oblivious" to the urgent need for a solution. This perceived failure in execution and focus, at the peak of Ethereum's dominance, directly motivated his firm to aggressively seek alternatives.

Kyle Samani has completely abandoned the thesis that crypto's future lies in non-financial consumer dApps (Web3). He now believes the thesis is "just wrong." Instead, crypto's primary role in developed nations will be as invisible financial plumbing, while its main user-facing application is for international users who need access to stablecoins.