While AI can write code, Affirm CEO Max Levchin states it can't replicate the true moats of a fintech company. These include deep capital markets relationships, a full suite of money transmitter licenses (which take ~18 months to acquire), and years of building consumer trust.

Related Insights

Max Levchin claims any single data point that seems to dramatically improve underwriting accuracy is a red herring. He argues these 'magic bullets' are brittle and fail when market conditions shift. A robust risk model instead relies on aggregating small lifts from many subtle factors.

In the AI era, where technology can be replicated quickly, the true moat is a founder's credibility and network built over decades. This "unfair advantage" enables faster sales cycles with trusted buyers, creating a first-mover advantage that is difficult for competitors to overcome.

As AI commoditizes user interfaces, enduring value will reside in the backend systems that are the authoritative source of data (e.g., payroll, financial records). These 'systems of record' are sticky due to regulation, business process integration, and high switching costs.

When asked if AI commoditizes software, Bravo argues that durable moats aren't just code, which can be replicated. They are the deep understanding of customer processes and the ability to service them. This involves re-engineering organizations, not just deploying a product.

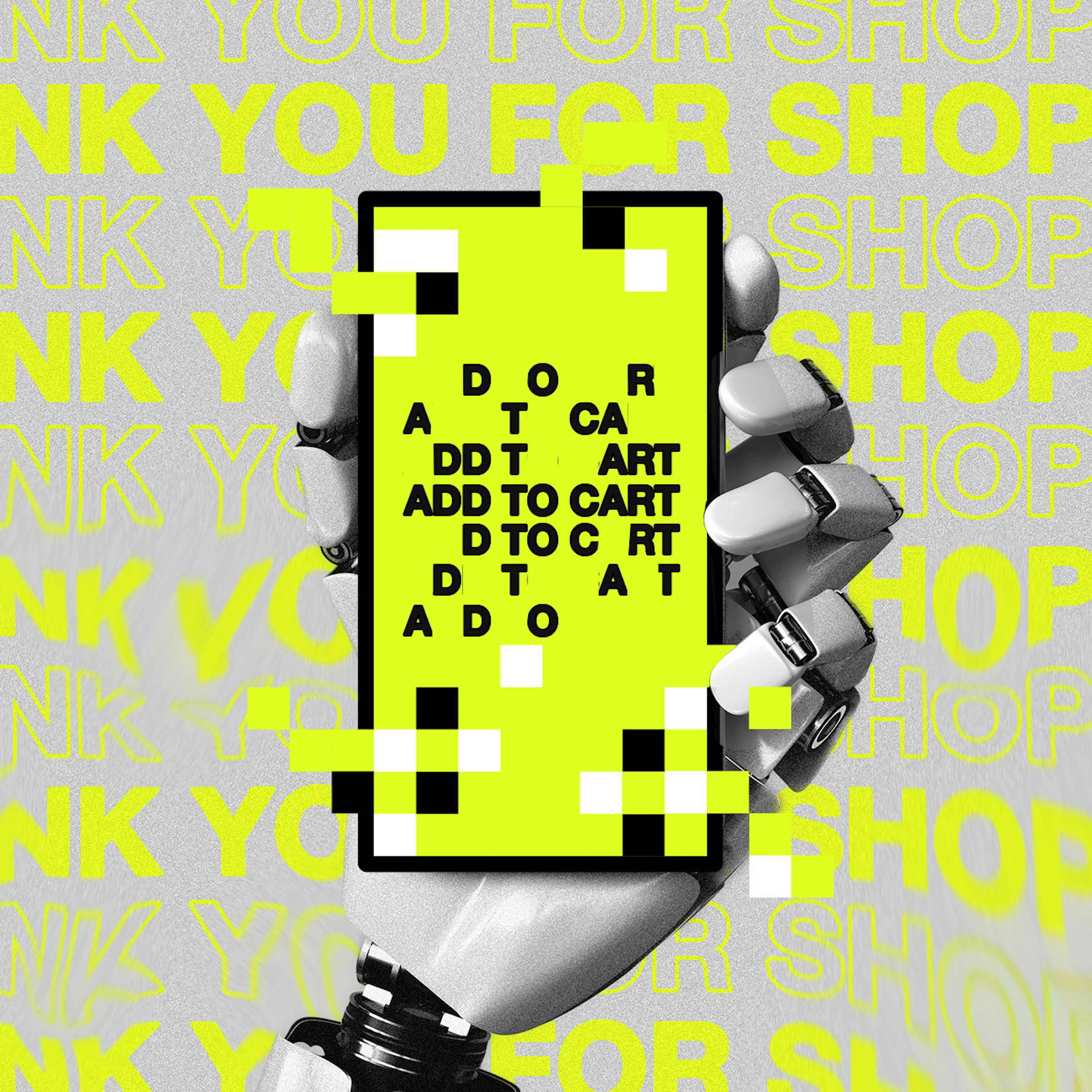

As AI and better tools commoditize software creation, traditional technology moats are shrinking. The new defensible advantages are forms of liquidity: aggregated data, marketplace activity, or social interactions. These network effects are harder for competitors to replicate than code or features.

CEOs of platforms like ZocDoc and TaskRabbit are not worried about AI agent disruption. They believe the immense complexity of managing their real-world networks—like integrating with chaotic healthcare systems or vetting thousands of workers—is a defensible moat that pure software agents cannot easily replicate, giving them leverage over AI companies.

The long-held belief that a complex codebase provides a durable competitive advantage is becoming obsolete due to AI. As software becomes easier to replicate, defensibility shifts away from the technology itself and back toward classic business moats like network effects, brand reputation, and deep industry integration.

Investor Mitchell Green argues that the fear of AI "vibe coding" away SaaS businesses is overblown. Incumbents like Workday spent decades building trust and deep enterprise integrations, a moat that can't be easily replicated with code alone, regardless of AI's power.

Tarek Mansour views Kalshi's strict, federally regulated approach as a strategic advantage. It forces robust system pressure-testing and makes the platform an unattractive venue for fraud or insider trading, which naturally flows to unregulated, offshore alternatives.

As AI commoditizes technology, traditional moats are eroding. The only sustainable advantage is "relationship capital"—being defined by *who* you serve, not *what* you do. This is built through depth (feeling seen), density (community belonging), and durability (permission to offer more products).