Drawing parallels to closed-end funds, Berkshire Hathaway, and well-managed banks, analyst Andy Edstrom argues against high MNAV (multiple of net asset value) multiples for Bitcoin treasury companies. Historical precedent suggests these firms should trade between a slight discount (0.8x) and a modest premium (2-2.5x MNAV), not the extreme valuations seen previously.

Related Insights

As Bitcoin matures, its risk-return profile is changing. The era of doubling in value every couple of years may be over. Instead, it could transition into a high-performing asset that reliably generates 15-25% annualized returns, outperforming traditional assets but no longer offering the explosive, "get rich quick" upside of its early days.

Traditional valuation models assume growth decays over time. However, when a company at scale, like Databricks, begins to reaccelerate, it defies these models. This rare phenomenon signals an expanding market or competitive advantage, justifying massive valuation premiums that seem disconnected from public comps.

Analyst Andy Edstrom categorizes most Bitcoin treasury companies, excluding MicroStrategy, as "dumpster fires." He attributes their failure to inexperienced CEOs, reporting issues, a lack of cash flow to service debt, and consequently, catastrophic stock price collapses of 80-95% from their peaks.

Bitcoin's core properties (fixed supply, perfect portability) make it a superior safe haven to gold. However, the market currently treats it as a volatile, risk-on asset. This perception gap represents a unique, transitional moment in financial history.

A proposed mental model frames MicroStrategy's issuance of preferred stock as analogous to Tether issuing stablecoins. Instead of using treasuries, MSTR uses heavily over-collateralized Bitcoin (e.g., 5-to-1 ratio) to create a yield-bearing, dollar-denominated instrument, effectively securitizing its Bitcoin holdings to generate returns for equity holders.

Bitcoin's 27% plunge, far exceeding the stock market's dip, shows how high-beta assets react disproportionately to macro uncertainty. When the central bank signals a slowdown due to a "foggy" outlook, investors flee to safety, punishing the riskiest assets the most.

Financial models struggle to project sustained high growth rates (>30% YoY). Analysts naturally revert to the mean, causing them to undervalue companies that defy this and maintain high growth for years, creating an opportunity for investors who spot this persistence.

The primary driver of Bitcoin's recent appreciation isn't hardcore believers, but mainstream speculators who bought ETFs. These investors lack ideological commitment and will rush for the exits during a downturn, creating a mass liquidation event that the market's limited liquidity cannot absorb.

An investor's Bitcoin thesis rests on three pillars: 1) as a self-custodied asset for debanking/borderless scenarios, 2) as an investment for pure price appreciation ("number go up"), and 3) as an ethical holding to support a better financial system. This framework clarifies why proxies like MSTR satisfy the latter two needs but never the first.

The high profits enjoyed by stablecoin issuers like Tether and Circle are temporary. Major financial institutions (Visa, JPMorgan) will eventually launch their own stablecoins, not as primary profit centers, but as low-cost tools to acquire and retain customers. This will drive margins down for the entire industry.

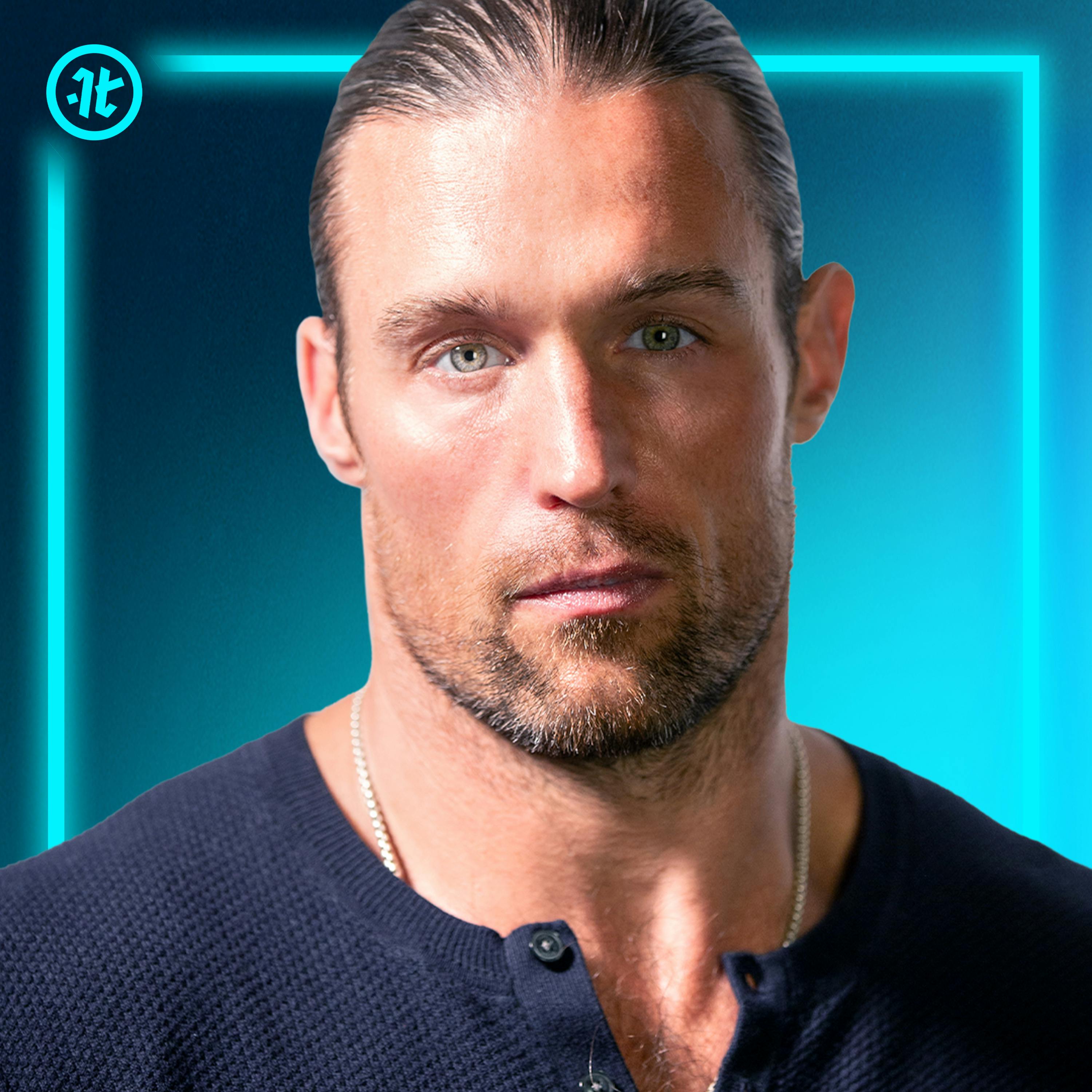

![David George - Building a16z Growth, Investing Across the AI Stack, and Why Markets Misprice Growth - [Invest Like the Best, EP.450] thumbnail](https://megaphone.imgix.net/podcasts/8da7dbd8-ceeb-11f0-941c-ef83bcdd4c9f/image/d44107bc94719f78fbe91befb141073e.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)