The business model of owning Airbnb properties is highly vulnerable to regulatory changes. A single city council decision can effectively destroy a profitable operation overnight by imposing new restrictions, as seen in cities like Vancouver and San Francisco. This makes it a fundamentally fragile business.

Related Insights

Airbnb's AI-driven party prevention is a pro-host move to counterbalance recent pro-guest changes to its fee structure. This illustrates how platform businesses must continuously alternate which side of the marketplace they favor to keep both groups engaged and prevent churn on either side.

Counterintuitively, the best multifamily markets aren't high-population-growth cities like Austin. These attract too much new supply, capping rent growth. The optimal strategy is to find markets with barriers to entry and minimal new construction, as this creates a durable runway for rental increases.

The number of startups founded in China dropped from 51,000 in 2018 to just 1,200 in 2023, a 98% decrease. Roelof Botha attributes this collapse to unpredictable government regulations that stifle entrepreneurial risk-taking, serving as a warning for how policy could impact innovation elsewhere.

Brian Chesky argues that large, late-stage private companies experience the downsides of public scrutiny without the benefits. There's an "insatiable desire" from outsiders to "get to the truth," creating more speculative pressure than the regulated transparency of being a public company.

Unlike scalable digital businesses, real estate has a hard ceiling on returns. You can't innovate on a property to dramatically increase revenue without massive capital expenditure. This lack of operational leverage limits its upside compared to businesses where profits can be reinvested into growth initiatives.

Price caps can devastate small-time landlords, like retirees dependent on rental income, by setting rent below their costs for taxes and maintenance. This turns the property into a money-losing asset that is impossible to sell, effectively destroying the owner's life savings and retirement plan.

Severe rent freezes can make property maintenance and ownership financially unviable. In extreme cases where an asset becomes a liability, the only way for owners to recoup their investment may be to burn the building down and collect insurance money, a perverse outcome of a well-intentioned policy.

The housing industry is resistant to startup disruption due to immense "activation energy." This includes hyper-local regulations, fragmented distribution, cyclical capital needs, and a complex web of legacy players. Overcoming this barrier requires decades of effort, creating a powerful moat for incumbents.

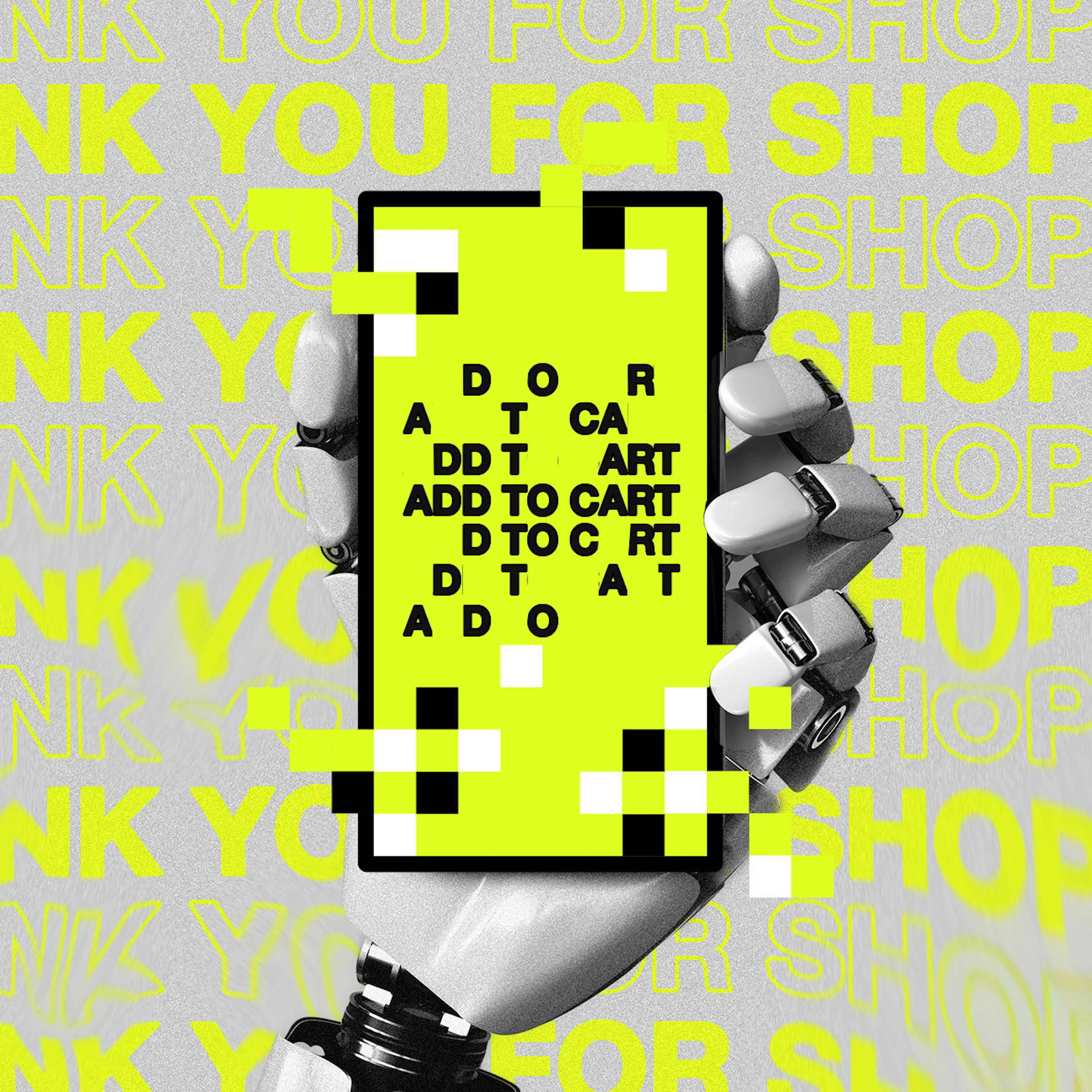

The "DoorDash Problem" posits that AI agents could reduce service platforms like Uber and Airbnb to mere commodity providers. By abstracting away the user interface, agents eliminate crucial revenue streams like ads, loyalty programs, and upsells. This shifts the customer relationship to the AI, eroding the core business model of the App Store economy's biggest winners.

New rent control laws don't just limit rent; they fundamentally cap the equity upside for real estate investors. By limiting potential cash flow growth from an asset, these policies make building or upgrading apartment buildings less attractive. This discourages the very capital investment needed to solve the housing supply crisis.