Beijing's expansive export controls on rare earths were not an overplay but a calculated risk to shift from a defensive to an offensive posture. They correctly bet that the U.S. administration would ultimately seek to de-escalate and preserve the diplomatic track, thereby validating China's proactive strategy.

Related Insights

By using its most powerful trade weapon—control over rare earths—early in its conflict, China incentivized the world to develop alternative supplies. This move provides short-term gains but likely diminishes China's long-term strategic leverage.

The shift to a less adversarial China policy may be a strategic maneuver to avoid supply chain disruptions. The U.S. appears to be biding its time—likely for 5+ years—to wean itself off dependence on Chinese rare earth minerals, which are critical for both industry and defense manufacturing.

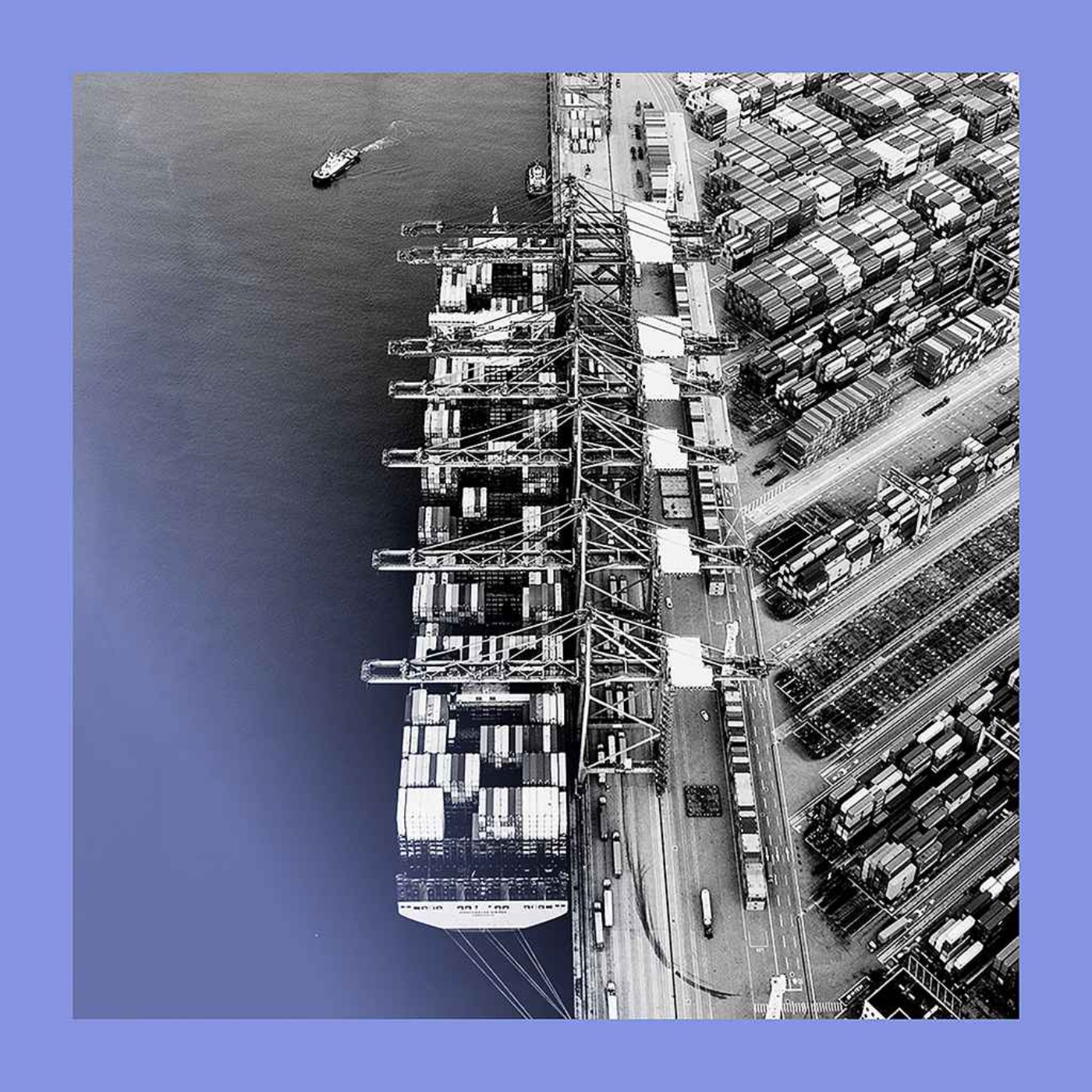

China is leveraging its 90% control over rare earth processing not just against the US, but globally. By requiring licenses from any company worldwide, it creates a chokehold on high-tech manufacturing and establishes a new template for economic coercion.

China demonstrated its significant leverage over the U.S. by quickly pressuring the Trump administration through a partial embargo on rare earth metals. This showcased a powerful non-tariff weapon rooted in its control of critical mineral supply chains, which are also vital for defense applications.

Following US policy moves, China is likely to expand its use of export controls on critical materials. Silver, essential for EVs, solar panels, and AI data centers, has been added to its list, signaling a willingness to leverage its supply chain dominance as a geopolitical tool against rivals.

While headlines focus on advanced chips, China’s real leverage comes from its strategic control over less glamorous but essential upstream inputs like rare earths and magnets. It has even banned the export of magnet-making technology, creating critical, hard-to-solve bottlenecks for Western manufacturing.

Unlike the first trade war, where Beijing was caught flat-footed, it entered the second with a prepared policy plan and emotional resolve. China developed a toolkit of retaliatory measures, such as the rare earth card, and seized the initiative rather than simply reacting to U.S. actions.

China achieved its near-monopoly on rare earths not by chance, but through a long-term state-sponsored strategy. This involved providing capital to key firms, funding overseas acquisitions, banning foreign ownership of domestic mines, and consolidating the industry to control global prices.

China is restricting exports of essential rare earth minerals and EV battery manufacturing equipment. This is a strategic move to protect its global dominance in these critical industries, leveraging the fact that other countries have outsourced environmentally harmful mining to them for decades.

The latest US-China trade talks signal a shift from unilateral US pressure to a negotiation between equals. China is now effectively using its control over critical exports, like rare earth minerals, as a bargaining chip to compel the U.S. to pause its own restrictions on items like semiconductors.