China's global dominance isn't in owning mines, but in controlling the midstream refining and smelting processes. This creates a critical choke point for the West's supply of essential materials for defense, AI, and electrification, as they control 50-98% of processing capacity for key metals.

Related Insights

China could leverage its dominance in rare earths by requiring payment in offshore Chinese Yuan (CNY). This move would force Western defense, AI, and industrial companies to source CNY, creating significant new demand for the currency and challenging the US dollar's role in global commodity trade.

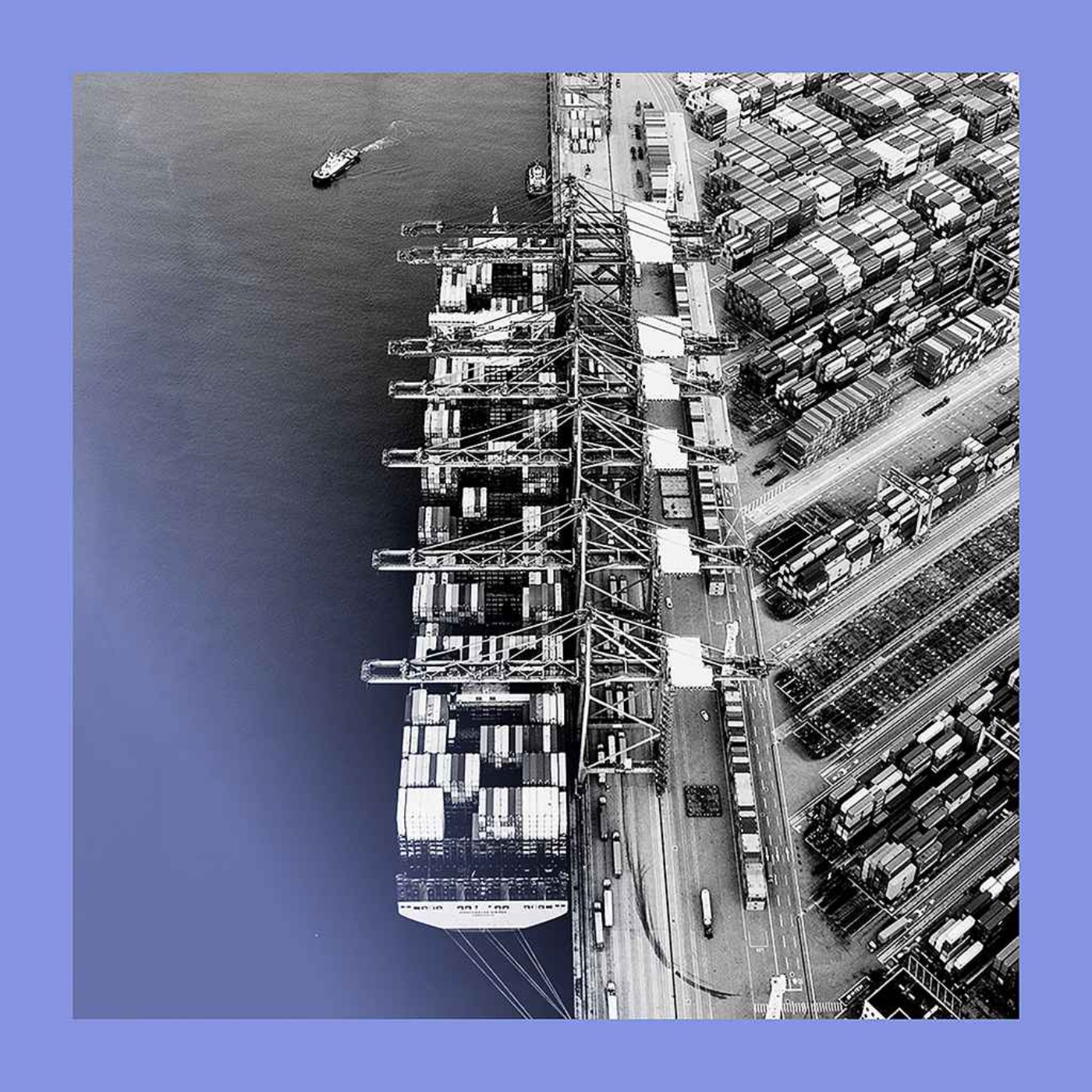

The strategic competition with China is often viewed through a high-tech military lens, but its true power lies in dominating the low-tech supply chain. China can cripple other economies by simply withholding basic components like nuts, bolts, and screws, proving that industrial basics are a key geopolitical weapon.

For 30 years, China identified rare earths as a strategic industry. By massively subsidizing its own companies and dumping product to crash prices, it methodically drove US and global competitors out of business, successfully creating a coercive dependency for the rest of the world.

Western leaders mistakenly focus on securing raw material sources ('feedstock'), believing mining rights equal supply chain control. The reality is that China's dominance in midstream processing makes the mine's location irrelevant, as they control the ability to turn ore into usable material.

China is leveraging its 90% control over rare earth processing not just against the US, but globally. By requiring licenses from any company worldwide, it creates a chokehold on high-tech manufacturing and establishes a new template for economic coercion.

China employs "weaponized pricing" by offering refining services at a negative cost, effectively paying countries to process their copper. This tactic makes it impossible for Western refiners to compete, ensuring China maintains its stranglehold on the critical midstream supply chain.

China demonstrated its significant leverage over the U.S. by quickly pressuring the Trump administration through a partial embargo on rare earth metals. This showcased a powerful non-tariff weapon rooted in its control of critical mineral supply chains, which are also vital for defense applications.

While headlines focus on advanced chips, China’s real leverage comes from its strategic control over less glamorous but essential upstream inputs like rare earths and magnets. It has even banned the export of magnet-making technology, creating critical, hard-to-solve bottlenecks for Western manufacturing.

China is restricting exports of essential rare earth minerals and EV battery manufacturing equipment. This is a strategic move to protect its global dominance in these critical industries, leveraging the fact that other countries have outsourced environmentally harmful mining to them for decades.

The AI race is a national security imperative, akin to the Cold War arms race. However, the US is critically dependent on China for the copper, rare earths, and other materials required to build and power AI data centers, creating a massive strategic vulnerability.