Silver Lake cofounder Glenn Hutchins contrasts today's AI build-out with the speculative telecom boom. Unlike fiber optic networks built on hope, today's massive data centers are financed against long-term, pre-sold contracts with creditworthy counterparties like Microsoft. This "built-to-suit" model provides a stable commercial foundation.

Related Insights

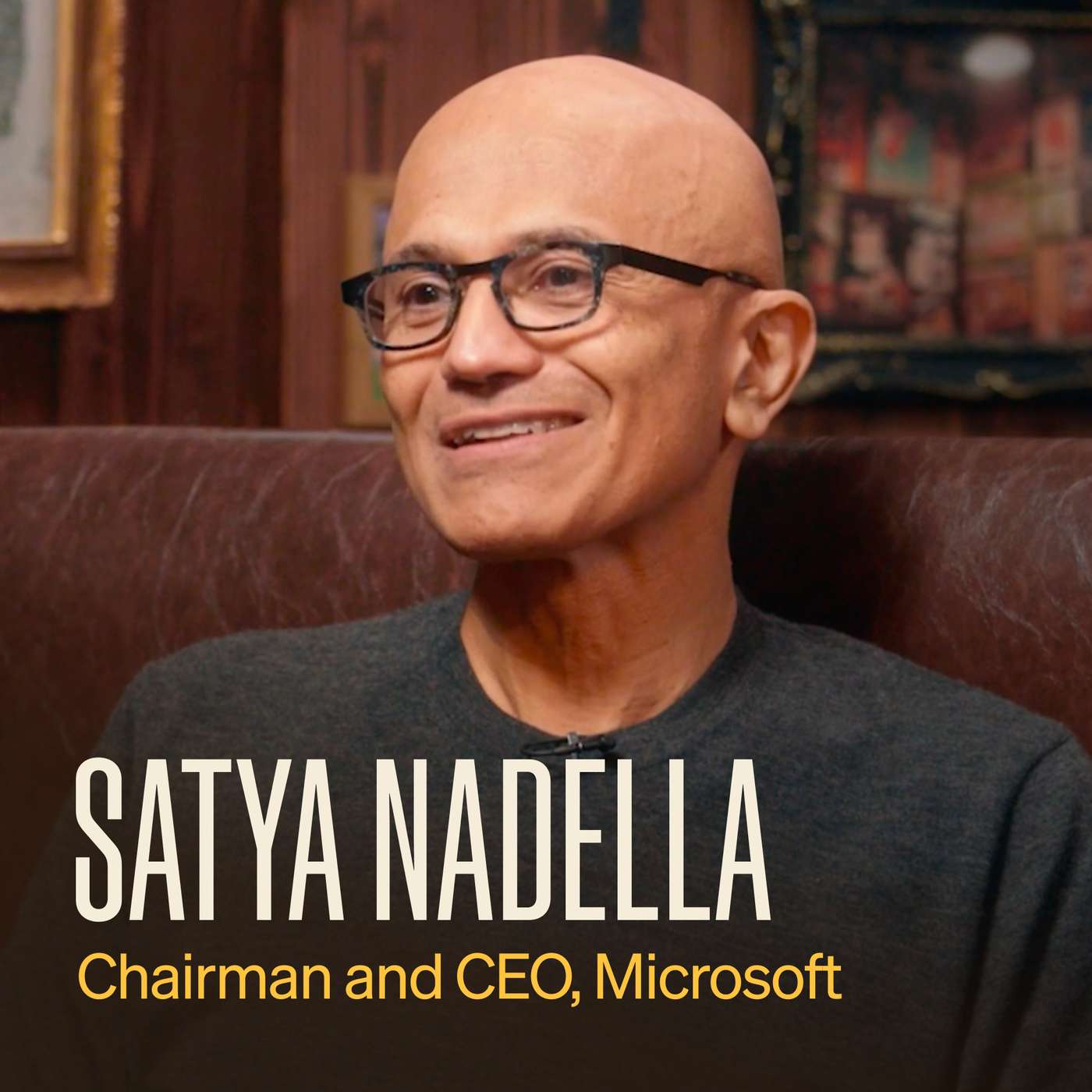

Instead of bearing the full cost and risk of building new AI data centers, large cloud providers like Microsoft use CoreWeave for 'overflow' compute. This allows them to meet surges in customer demand without committing capital to assets that depreciate quickly and may become competitors' infrastructure in the long run.

During the dot-com crash, application-layer companies like Pets.com went to zero, while infrastructure providers like Intel and Cisco survived. The lesson for AI investors is to focus on the underlying "picks and shovels"—compute, chips, and data centers—rather than consumer-facing apps that may become obsolete.

Private credit has become a key enabler of the AI boom, with firms like Blue Owl financing tens of billions in data center construction for giants like Meta and Oracle. This structure allows hyperscalers to expand off-balance-sheet, effectively transferring the immense capital risk of the AI build-out from Silicon Valley tech companies to the broader Wall Street financial system.

The current AI infrastructure build-out is structurally safer than the late-90s telecom boom. Today's spending is driven by highly-rated, cash-rich hyperscalers, whereas the telecom boom was fueled by highly leveraged, barely investment-grade companies, creating a wider and safer distribution of risk today.

Unlike the speculative "dark fiber" buildout of the dot-com bubble, today's AI infrastructure race is driven by real, immediate, and overwhelming demand. The problem isn't a lack of utilization for built capacity; it's a constant struggle to build supply fast enough to meet customer needs.

Vincap International's CIO argues the AI market isn't a classic bubble. Unlike previous tech cycles, the installation phase (building infrastructure) is happening concurrently with the deployment phase (mass user adoption). This unique paradigm shift is driving real revenue and growth that supports high valuations.

Unlike the dot-com bubble's finite need for fiber optic cables, the demand for AI is infinite because it's about solving an endless stream of problems. This suggests the current infrastructure spending cycle is fundamentally different and more sustainable than previous tech booms.

Unlike the dot-com or shale booms fueled by less stable companies, the current AI investment cycle is driven by corporations with exceptionally strong balance sheets. This financial resilience mitigates the risk of a credit crisis, even with massive capital expenditure and uncertain returns, allowing the cycle to run longer.

Unlike the speculative overcapacity of the dot-com bubble's 'dark fiber' (unused internet cables), the current AI buildout shows immediate utilization. New AI data centers reportedly run at 100% capacity upon coming online, suggesting that massive infrastructure spending is meeting real, not just anticipated, demand.

Unlike the dot-com era funded by high-risk venture capital, the current AI boom is financed by deep-pocketed, profitable hyperscalers. Their low cost of capital and ability to absorb missteps make this cycle more tolerant of setbacks, potentially prolonging the investment phase before a shakeout.