CEO David Risher claims data refutes the idea that AVs displace human drivers. Instead, Lyft's growth is faster in cities with AVs like San Francisco and Phoenix. He suggests AVs "oxygenate the market," expanding overall demand for ridesharing rather than just cannibalizing existing rides.

Related Insights

The future of gig work on Lyft isn't just about replacing drivers with corporate AV fleets. CEO David Risher envisions a model where individuals can own a self-driving car and add it to the Lyft platform, trading their vehicle's time for money instead of their own.

Lyft is competing with Waymo in cities like San Francisco but partnering with them in Nashville, where Lyft manages Waymo's fleet (cleaning, charging, maintenance). This "frenemy" approach allows Lyft to participate in the autonomous vehicle future by providing operational services to a direct competitor.

David Risher dismisses the zero-sum view of competing with Uber. He points out that the total rideshare market (2.5B annual rides) is dwarfed by the personal car market (160B rides). Lyft's true growth strategy is to convert personal car trips into rideshare, making direct competition a much smaller part of the picture.

Lyft's CEO argues the competition is not a binary battle with Uber for their combined 2.5 billion annual rides. Instead, the true target market is the 160 billion rides Americans take in their own cars. This reframes the opportunity from market share theft to massive market expansion and conversion.

The convergence of autonomous, shared, and electric mobility will drive the marginal cost of travel towards zero, resembling a utility like electricity or water. This shift will fundamentally restructure the auto industry, making personal car ownership a "nostalgic privilege" rather than a daily necessity for most people.

Lyft's CEO isn't overly concerned about AI agents commoditizing rideshare because the service is physical. Customers need to trust the safety and reliability of who picks them up, a factor that generic AI agents can't easily replicate or guarantee.

Instead of building its own AV tech or committing to one exclusive partner, Lyft is embracing a 'polyamorous' approach by working with multiple AV companies like Waymo, May Mobility, and Baidu. This de-risks their strategy, positioning them as an open platform that can integrate the best technology as it emerges, rather than betting on a single winner.

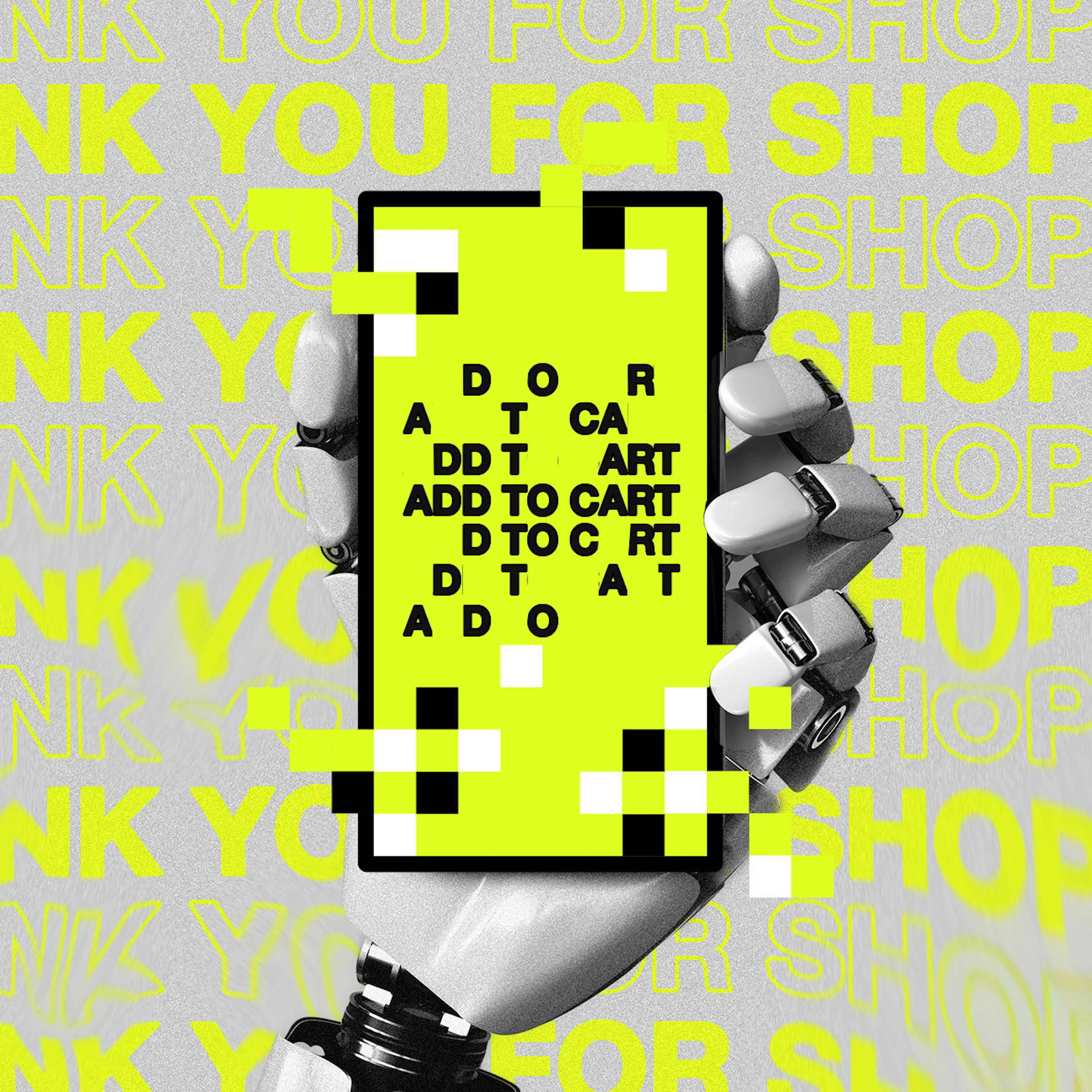

Service company CEOs believe strong brand loyalty is their primary defense against the "DoorDash Problem." Lyft's CEO argues that users are more likely to ask an AI specifically for "a Lyft" rather than a generic "ride." They are investing in brand to ensure they are requested by name, preventing them from being disintermediated and reduced to the cheapest commodity option.

CEO David Risher describes Lyft's autonomous vehicle strategy as "polyamorous." Instead of betting on one technology partner, they are integrating with multiple AV companies like Waymo, May Mobility, and Baidu. This approach positions Lyft as the essential network for any AV provider to access riders, regardless of who builds the best car.

By driving for Lyft, CEO David Risher learned firsthand that surge pricing, while economically sound, creates immense daily stress for riders. This qualitative insight, which data might miss, led Lyft to remove $50 million in surge pricing and launch a 'Price Lock' subscription feature based directly on a passenger's story.