Lyft's CEO isn't overly concerned about AI agents commoditizing rideshare because the service is physical. Customers need to trust the safety and reliability of who picks them up, a factor that generic AI agents can't easily replicate or guarantee.

Related Insights

The future of gig work on Lyft isn't just about replacing drivers with corporate AV fleets. CEO David Risher envisions a model where individuals can own a self-driving car and add it to the Lyft platform, trading their vehicle's time for money instead of their own.

While AI agents could shift sales away from traditional retailers, companies with extensive physical infrastructure and forward-positioned inventory have a defense. AI agents prioritizing speed and efficiency for physical goods will likely still favor these established networks, preventing full disintermediation in the new agentic commerce landscape.

CEOs of platforms like ZocDoc and TaskRabbit are not worried about AI agent disruption. They believe the immense complexity of managing their real-world networks—like integrating with chaotic healthcare systems or vetting thousands of workers—is a defensible moat that pure software agents cannot easily replicate, giving them leverage over AI companies.

AI models lack access to the rich, contextual signals from physical, real-world interactions. Humans will remain essential because their job is to participate in this world, gather unique context from experiences like customer conversations, and feed it into AI systems, which cannot glean it on their own.

Lyft's CEO argues the competition is not a binary battle with Uber for their combined 2.5 billion annual rides. Instead, the true target market is the 160 billion rides Americans take in their own cars. This reframes the opportunity from market share theft to massive market expansion and conversion.

Lyft maintains a 29-point advantage over competitors in driver preference. A key factor is their guarantee that drivers will never make less than 70% of what riders pay weekly, after insurance. This fosters loyalty and pride, acting as a competitive moat in the gig economy.

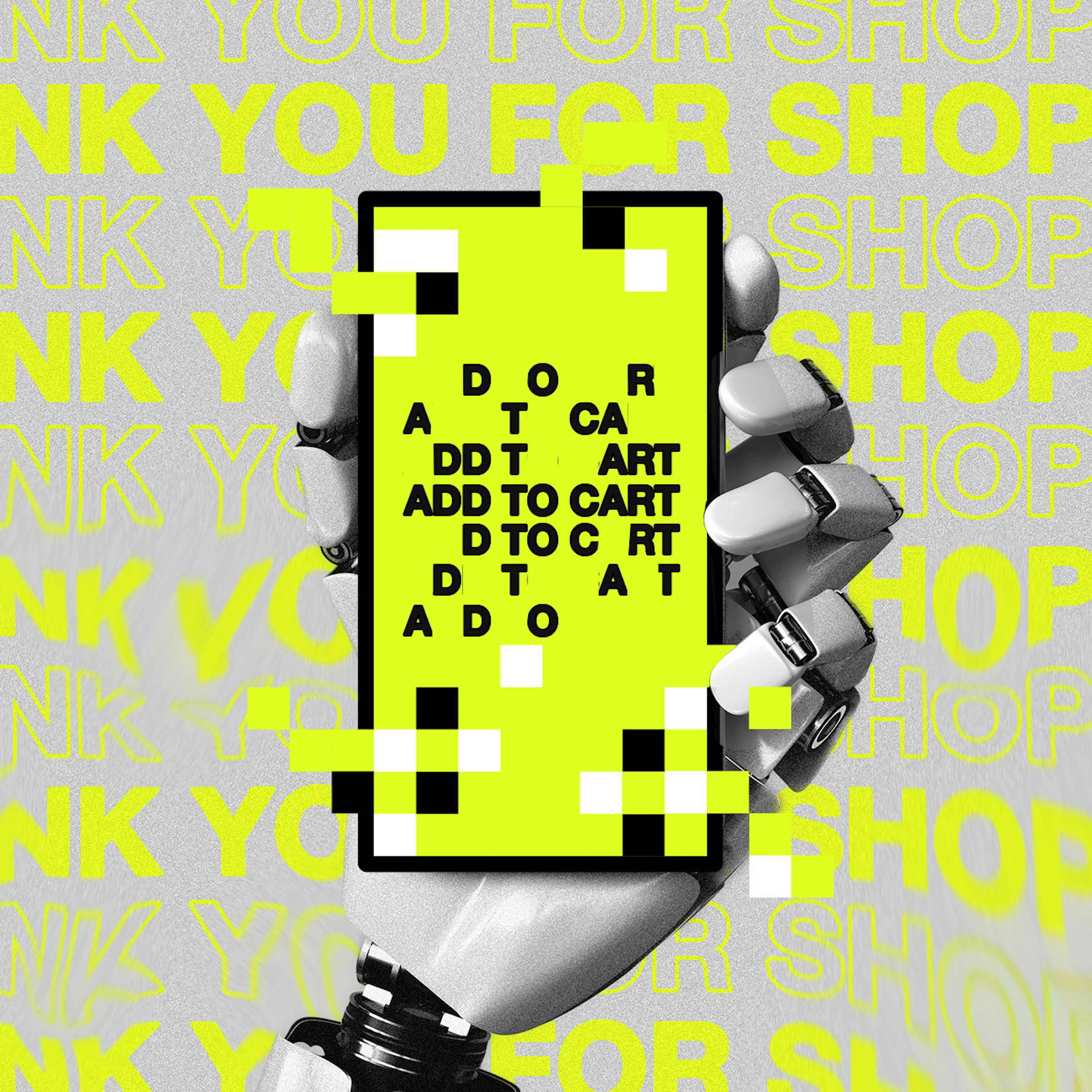

The "DoorDash Problem" posits that AI agents could reduce service platforms like Uber and Airbnb to mere commodity providers. By abstracting away the user interface, agents eliminate crucial revenue streams like ads, loyalty programs, and upsells. This shifts the customer relationship to the AI, eroding the core business model of the App Store economy's biggest winners.

Service company CEOs believe strong brand loyalty is their primary defense against the "DoorDash Problem." Lyft's CEO argues that users are more likely to ask an AI specifically for "a Lyft" rather than a generic "ride." They are investing in brand to ensure they are requested by name, preventing them from being disintermediated and reduced to the cheapest commodity option.

CEO David Risher claims data refutes the idea that AVs displace human drivers. Instead, Lyft's growth is faster in cities with AVs like San Francisco and Phoenix. He suggests AVs "oxygenate the market," expanding overall demand for ridesharing rather than just cannibalizing existing rides.

CEO David Risher describes Lyft's autonomous vehicle strategy as "polyamorous." Instead of betting on one technology partner, they are integrating with multiple AV companies like Waymo, May Mobility, and Baidu. This approach positions Lyft as the essential network for any AV provider to access riders, regardless of who builds the best car.