For 22 years, Leno lived solely on his stand-up comedy earnings while banking his entire Tonight Show salary. This simple, two-income strategy avoids complex investments and ensures substantial wealth accumulation through disciplined saving, not sophisticated financial maneuvering.

Related Insights

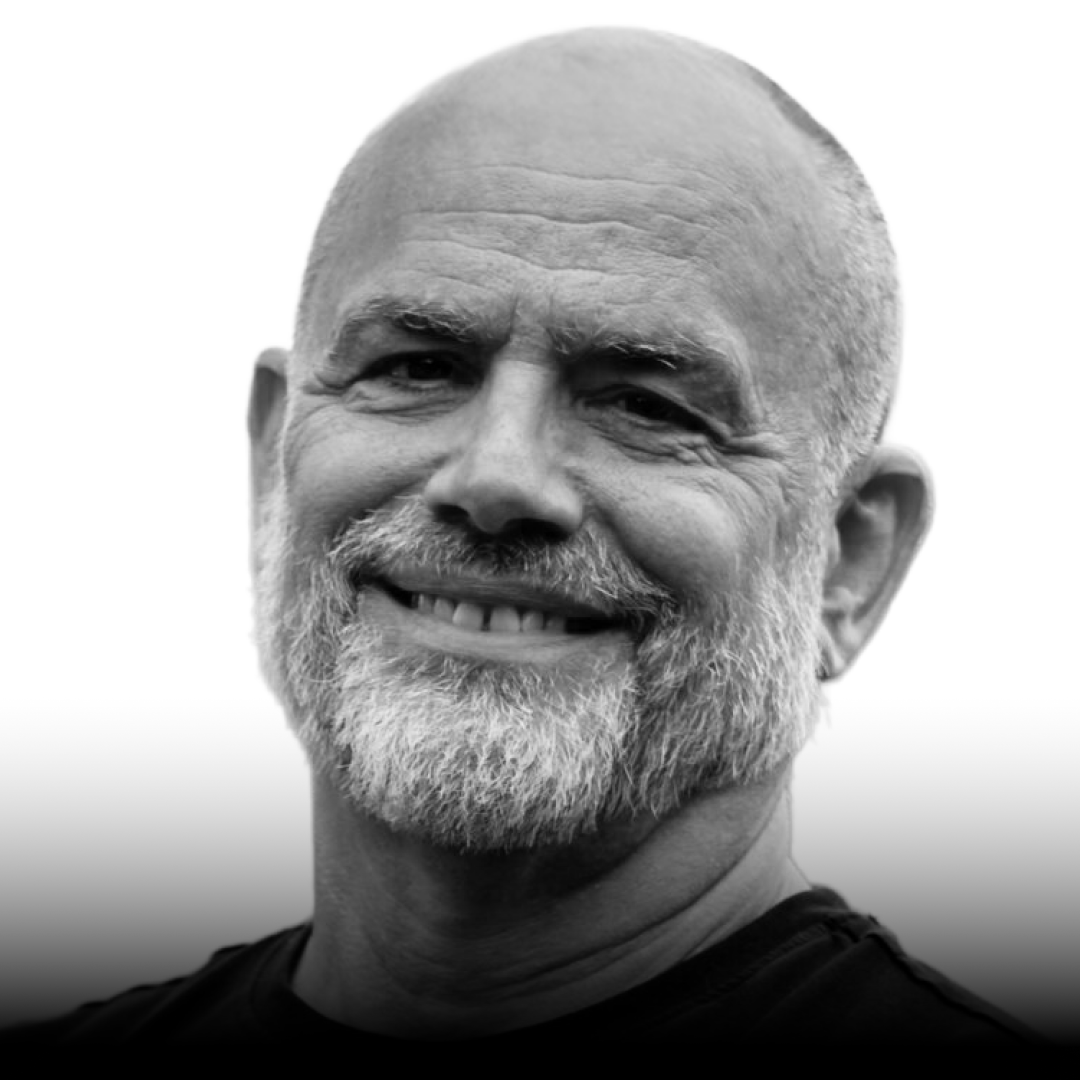

Author Mike Perry, though shy, adopted Mark Twain's strategy of using paid speaking engagements to supplement unpredictable book income. This has become one of his most reliable revenue streams, offering a practical financial model for artists and writers.

Reconcile contradictory advice by segmenting your capital. Hold years of living expenses in cash for short-term security and peace of mind. Separately, invest money you won't need for 10-25 years into assets to combat long-term inflation. The two strategies serve different, non-conflicting purposes.

Successful bootstrapping isn't just about saving money; it's a deliberate capital accumulation strategy. By consciously avoiding status-driven purchases for an extended period, entrepreneurs can build a war chest to invest in assets that generate real wealth, like a business, giving them a significant long-term advantage.

Many individuals can articulate a detailed investment strategy but have never considered their own philosophy for spending. This oversight ignores a critical half of the wealth equation, which is governed by complex emotions like envy, fear, and contentment. A spending philosophy is as crucial as an investing one.

Guided by a financial advisor, news anchor Daren Kagan saved two-thirds of her half-million-dollar salary. This aggressive savings strategy meant that when she was let go from CNN, she had enough capital to fund her next venture without financial stress, turning a crisis into an opportunity.

Relying on willpower or manual budgeting is a losing strategy because it's unsustainable and causes friction. The only proven, long-term method for building wealth is to automate savings and investments, removing daily decision-making from the equation.

Instead of budgeting, create a system where every dollar earned is allocated automatically: 75% max for spending, 15% minimum for investing, and 10% for short-term savings. This plan scales with your income, ensuring that as you earn more, you automatically invest more.

To overcome the fear of high-risk investing, bucket your money. Create a separate account with capital you can afford to lose, funded through small daily trade-offs (like making coffee at home). This reframes each dollar saved as a potential 100x investment, enabling aggressive but controlled risk-taking.

True financial well-being and happiness are not dictated by income level, but by living within your means and maintaining self-awareness. Someone earning a modest salary can be in a much better place than a high-earner who is overleveraged and lacks a sense of self.

True wealth isn't a high salary; it's freedom derived from ownership. Professionals like doctors or lawyers are well-paid laborers whose income is tied to their time. Business owners, in contrast, build systems (assets) that generate money independently of their presence.