The widely discussed compute shortage is primarily an inference problem, not a training one. According to Mustafa Suleiman, Microsoft has enough power for training next-gen models, but is constrained by the massive demand for running existing services like Copilot.

Related Insights

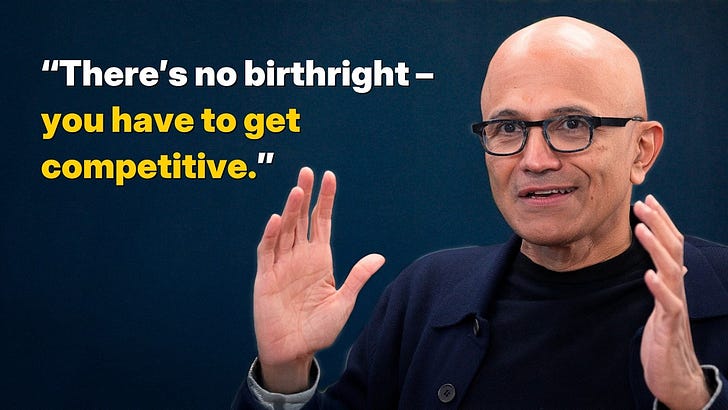

To navigate the massive capital requirements of AI, Nadella reframes the investment in cutting-edge training infrastructure. Instead of being purely reactive to customer demand, a significant portion is considered R&D, allowing for sustained, order-of-magnitude scaling necessary for breakthroughs.

Contrary to the common focus on chip manufacturing, the immediate bottleneck for building new AI data centers is energy. Factors like power availability, grid interconnects, and high-voltage equipment are the true constraints, forcing companies to explore solutions like on-site power generation.

Satya Nadella reveals that Microsoft prioritizes building a flexible, "fungible" cloud infrastructure over catering to every demand of its largest AI customer, OpenAI. This involves strategically denying requests for massive, dedicated data centers to ensure capacity remains balanced for other customers and Microsoft's own high-margin products.

Unlike the dot-com era's speculative infrastructure buildout for non-existent users, today's AI CapEx is driven by proven demand. Profitable giants like Microsoft and Google are scrambling to meet active workloads from billions of users, indicating a compute bottleneck, not a hype cycle.

Satya Nadella clarifies that the primary constraint on scaling AI compute is not the availability of GPUs, but the lack of power and physical data center infrastructure ("warm shelves") to install them. This highlights a critical, often overlooked dependency in the AI race: energy and real estate development speed.

AI's computational needs are not just from initial training. They compound exponentially due to post-training (reinforcement learning) and inference (multi-step reasoning), creating a much larger demand profile than previously understood and driving a billion-X increase in compute.

Despite appearing to lose ground to competitors, Microsoft's 2023 pause in leasing new datacenter sites was a strategic move. It aimed to prevent over-investing in hardware that would soon be outdated, ensuring it could pivot to newer, more power-dense and efficient architectures.

Microsoft's plan to train 20 million AI users in India actively fuels exponential demand for energy-intensive computing. This creates a fundamental long-term conflict with its commitment to build fully sustainable data centers. The strategy's success hinges on whether efficiency can outpace this deliberately engineered demand growth.

As hyperscalers build massive new data centers for AI, the critical constraint is shifting from semiconductor supply to energy availability. The core challenge becomes sourcing enough power, raising new geopolitical and environmental questions that will define the next phase of the AI race.

OpenAI’s pivotal partnership with Microsoft was driven more by the need for massive-scale cloud computing than just cash. To train its ambitious GPT models, OpenAI required infrastructure it could not build itself. Microsoft Azure provided this essential, non-commoditized resource, making them a perfect strategic partner beyond their balance sheet.