AWS's marketplace for publishers isn't just an AI play. It's a strategic move to compete with CDN providers like Cloudflare by innovating its CloudFront service. It also aims to build goodwill with publishers, which benefits Amazon's massive and growing advertising business.

Related Insights

Amazon is investing billions in OpenAI, which OpenAI will then use to purchase Amazon's cloud services and proprietary Trainium chips. This vendor financing model locks in a major customer for AWS while funding the AI leader's massive compute needs, creating a self-reinforcing financial loop.

To challenge Microsoft's AI dominance, AWS may need to acquire a horizontal application company like Notion or Airtable. Lacking Microsoft's built-in enterprise application footprint, this move would give AWS the application layer necessary to create a "reasoning flywheel" and capture value higher up the tech stack.

Investments in OpenAI from giants like Amazon and Microsoft are strategic moves to embed the AI leader within their ecosystems. This is evidenced by deals requiring OpenAI to use the investors' proprietary processors and cloud infrastructure, securing technological dependency.

Amazon's potential commerce partnership with OpenAI is fraught with risk. Allowing ChatGPT to become the starting point for product searches threatens Amazon's highly profitable on-site advertising revenue, even if Amazon gains referral traffic. It's a classic battle to avoid being aggregated by another platform.

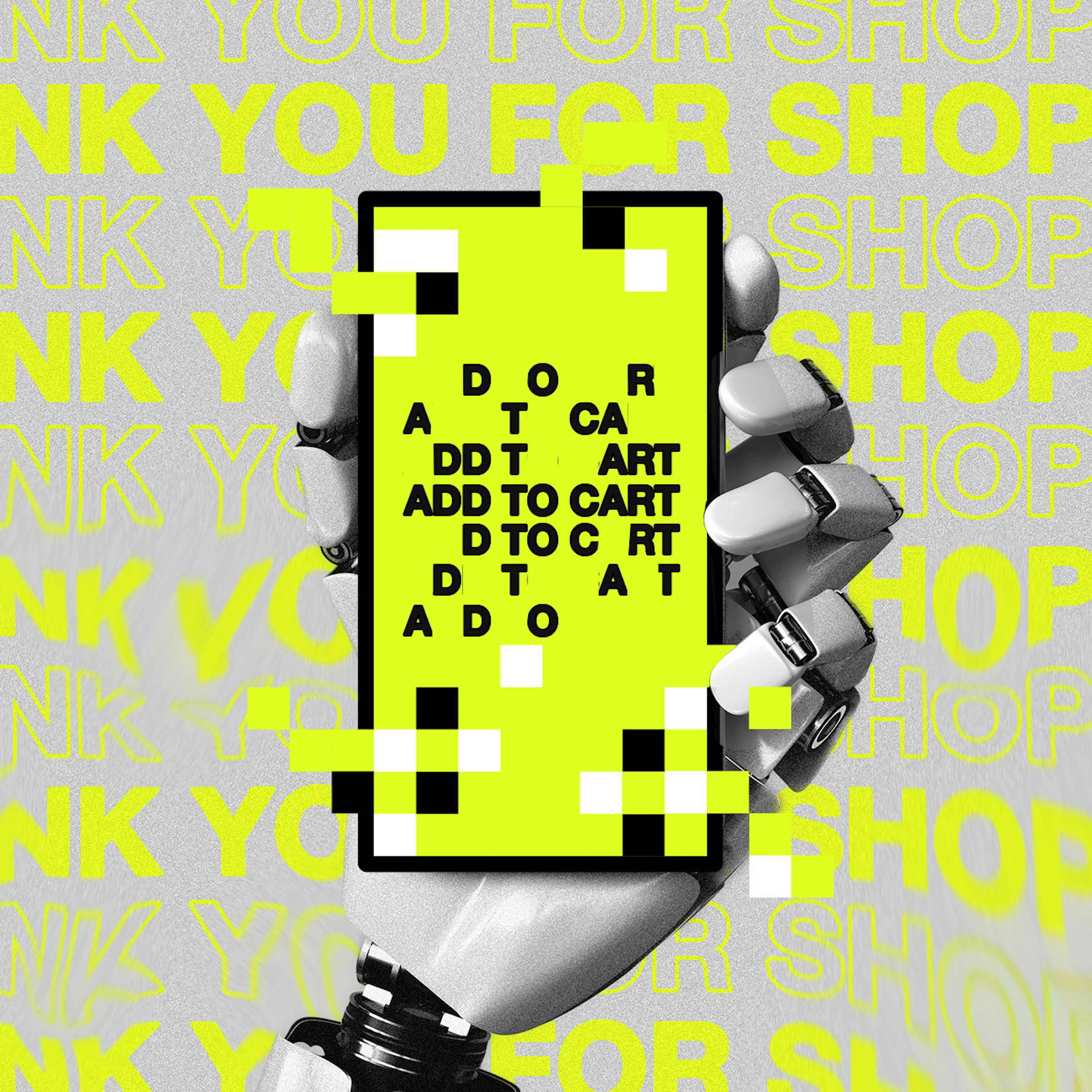

Unlike service platforms like Uber that rely on real-world networks, Amazon's high-margin ad business is existentially threatened by AI agents that bypass sponsored listings. This vulnerability explains its uniquely aggressive legal stance against Perplexity, as it stands to lose a massive, growing revenue stream if users stop interacting directly with its site.

By investing billions in both OpenAI and Anthropic, Amazon creates a scenario where it benefits if either becomes the dominant model. If both falter, it still profits immensely from selling AWS compute to the entire ecosystem. This positions AWS as the ultimate "picks and shovels" play in the AI gold rush.

Publishers are enthusiastic about marketplaces from AWS and Microsoft because they offer a path to usage-based revenue. This model is seen as more sustainable than the current one-off, flat-fee licensing deals with AI companies, potentially replicating the scalable monetization of digital advertising.

While a commerce partnership with OpenAI seems logical, Amazon is hesitant. They recognize that if consumers start product searches on ChatGPT, it could disintermediate Amazon's on-site search, cannibalizing their high-margin advertising revenue and ceding aggregator power.

AWS CEO Andy Jassy describes current AI adoption as a "barbell": AI labs on one end and enterprises using AI for productivity on the other. He believes the largest future market is the "middle"—enterprises deploying AI in their core production apps. AWS's strategy is to leverage its data gravity to win this massive, untapped segment.

The deal isn't just about cloud credits; it's a strategic play to onboard OpenAI as a major customer for Amazon's proprietary Tranium AI chips. This helps Amazon compete with Nvidia by subsidizing a top AI lab to adopt and validate its hardware.