The competitive AI landscape has forced founders from pure research backgrounds to adopt a strong focus on financial returns. This shift from idealistic AGI pursuits to "hard capitalism" means they make rational R&D spending decisions, de-risking investor concerns.

Related Insights

The AI race has been a prisoner's dilemma where companies spend massively, fearing competitors will pull ahead. As the cost of next-gen systems like Blackwell and Rubin becomes astronomical, the sheer economics will force a shift. Decision-making will be dominated by ROI calculations rather than the existential dread of slowing down.

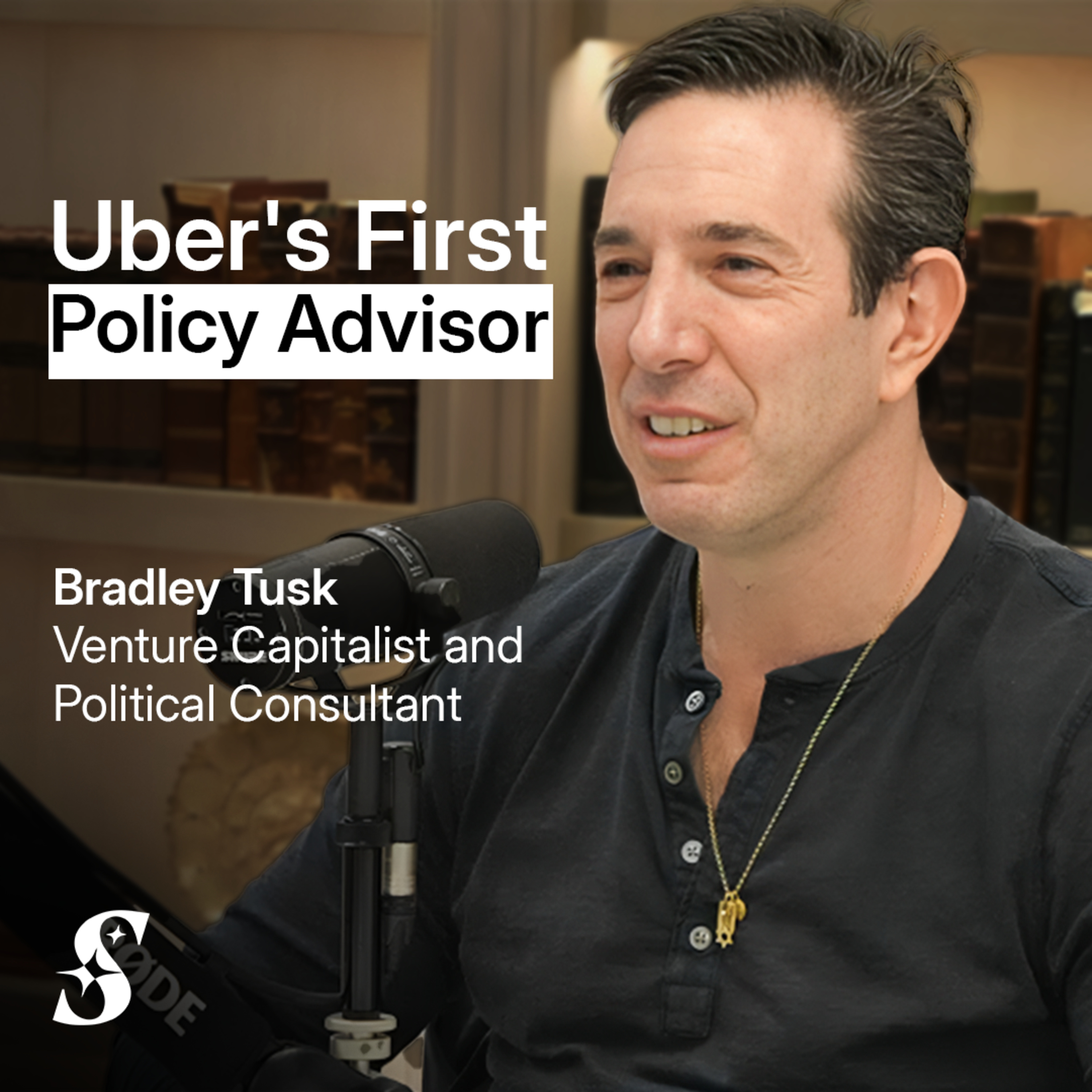

Redpoint Ventures' Erica Brescia describes a shift in their investment thesis for the AI era. They are now more likely to back young, "high-velocity" founders who "run through walls to win" over those with traditional domain expertise. Sheer speed, storytelling, and determination are becoming more critical selection criteria.

Major tech companies are locked in a massive spending war on AI infrastructure and talent. This isn't because they know how they'll achieve ROI; it's because they know the surest way to lose is to stop spending and fall behind their competitors.

Top AI labs face a difficult talent problem: if they restrict employee equity liquidity, top talent leaves for higher salaries. If they provide too much liquidity, newly-wealthy researchers leave to found their own competing startups, creating a constant churn that seeds the ecosystem with new rivals.

Small firms can outmaneuver large corporations in the AI era by embracing rapid, low-cost experimentation. While enterprises spend millions on specialized PhDs for single use cases, agile companies constantly test new models, learn from failures, and deploy what works to dominate their market.

The startup landscape now operates under two different sets of rules. Non-AI companies face intense scrutiny on traditional business fundamentals like profitability. In contrast, AI companies exist in a parallel reality of 'irrational exuberance,' where compelling narratives justify sky-high valuations.

The massive $700B capital injection into AI demands a return. The next few years will shift focus from hype to demonstrable results. Companies that can't show a quick, real, and efficient ROI will face a reckoning, even if they have grand aspirations.

A unique dynamic in the AI era is that product-led traction can be so explosive that it surpasses a startup's capacity to hire. This creates a situation of forced capital efficiency where companies generate significant revenue before they can even build out large teams to spend it.

Fundraising is easier when pitching a predictable plan like 'buy X GPUs to get Y performance.' It's much harder to raise for uncertain, long-term research, even if that's where the next true breakthrough lies. This creates a market bias towards capital expenditure over pure R&D.

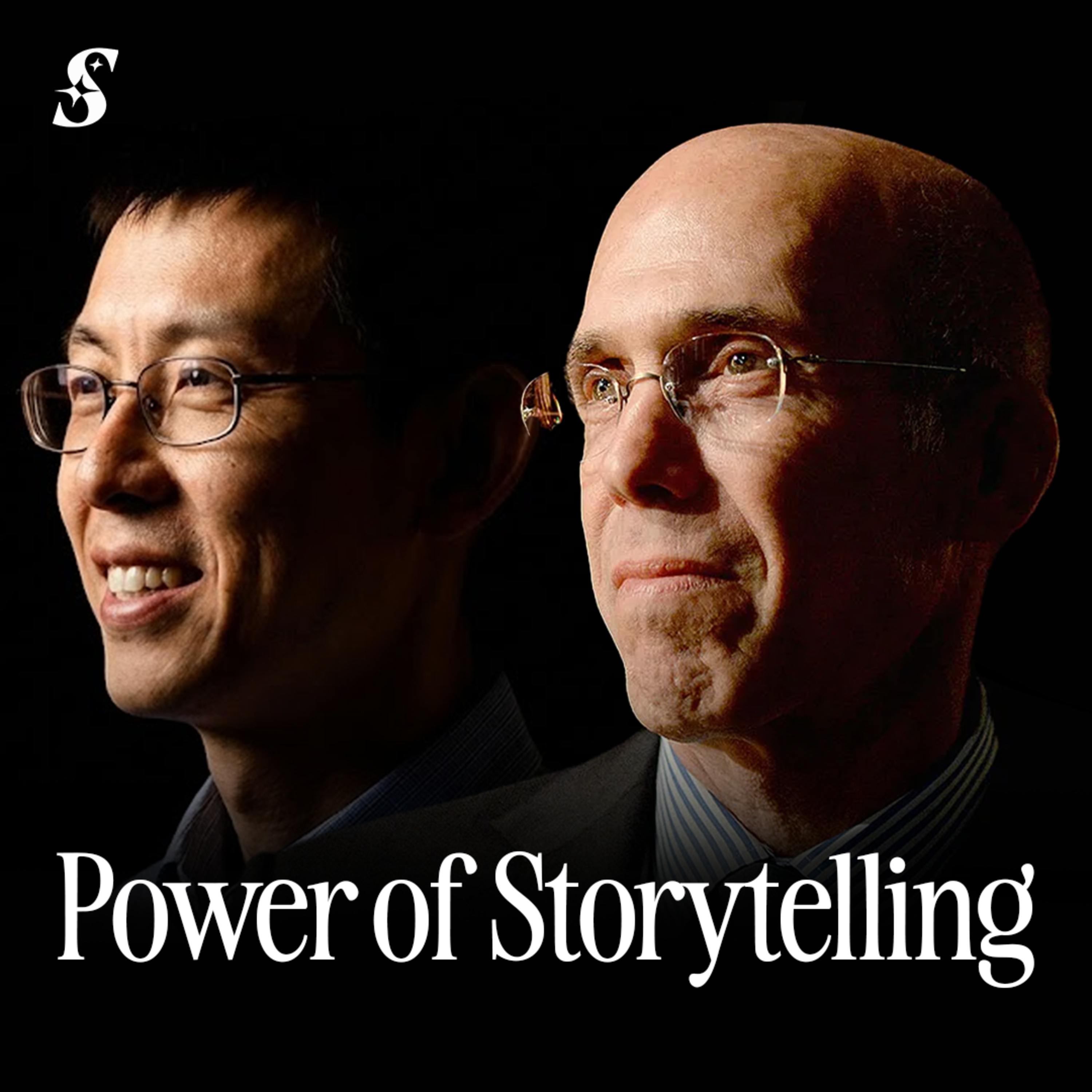

Demis Hassabis reveals his original vision was to keep AI in the lab longer to solve fundamental scientific problems, like curing cancer. The unexpected commercial success of chatbots created an intense 'race condition' that altered this 'purer' scientific path, bringing both challenges and a massive influx of resources.

![Gavin Baker - Nvidia v. Google, Scaling Laws, and the Economics of AI - [Invest Like the Best, EP.451] thumbnail](https://megaphone.imgix.net/podcasts/d97fee14-d4d7-11f0-8951-8324b640c1c1/image/d3a8b5ecbf3957de5b91f278a191c9ff.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)